If You Had Bought ACI Worldwide (NASDAQ:ACIW) Shares Three Years Ago You'd Have Made 76%

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the ACI Worldwide, Inc. (NASDAQ:ACIW) share price is up 76% in the last three years, clearly besting the market return of around 41% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 27% in the last year.

Check out our latest analysis for ACI Worldwide

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, ACI Worldwide failed to grow earnings per share, which fell 14% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Therefore, we think it's worth considering other metrics as well.

We severely doubt anyone is particularly impressed with the modest 1.2% three-year revenue growth rate. So truth be told we can't see an easy explanation for the share price action, but perhaps you can...

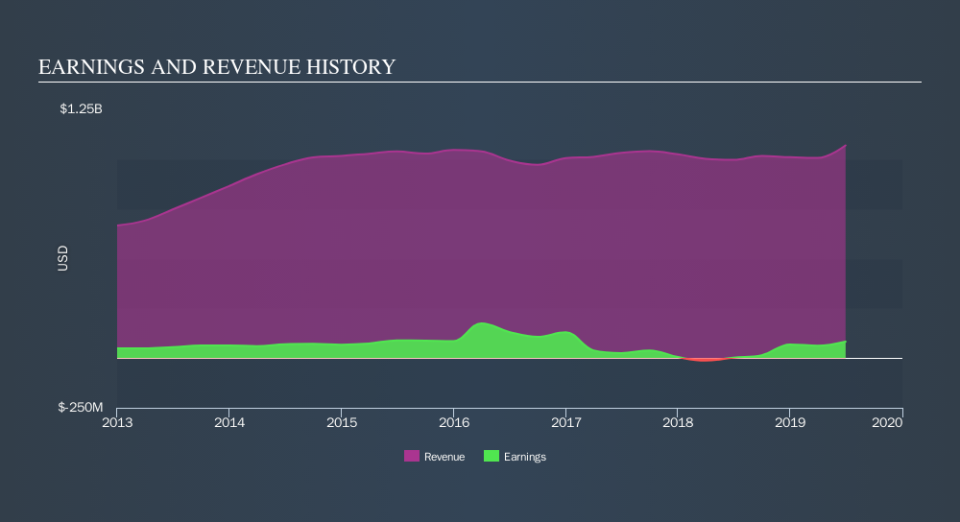

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that ACI Worldwide has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling ACI Worldwide stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that ACI Worldwide has rewarded shareholders with a total shareholder return of 27% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Is ACI Worldwide cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance