If You Had Bought AAR (NYSE:AIR) Shares Three Years Ago You’d Have Made 56%

While AAR Corp. (NYSE:AIR) shareholders are probably generally happy, the stock hasn’t had particularly good run recently, with the share price falling 18% in the last quarter. But that shouldn’t obscure the pleasing returns achieved by shareholders over the last three years. To wit, the share price did better than an index fund, climbing 56% during that period.

See our latest analysis for AAR

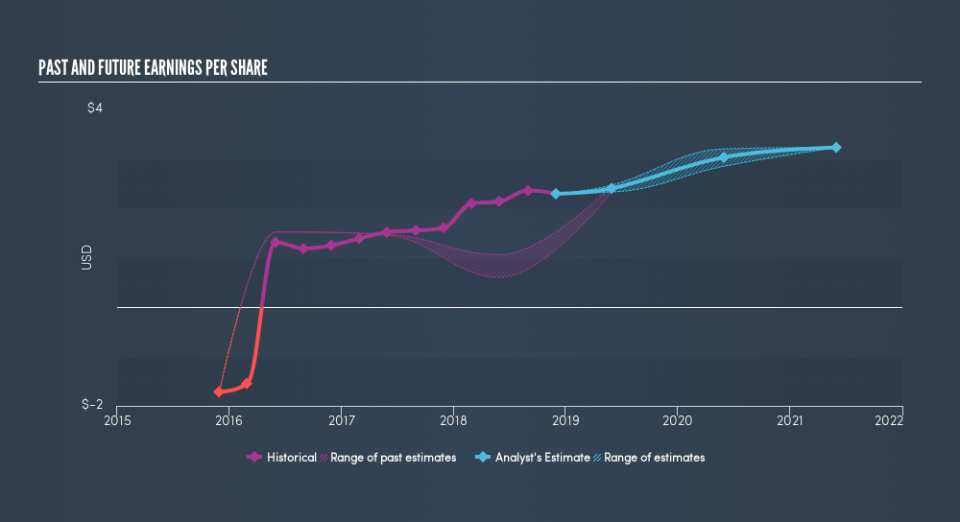

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

During three years of share price growth, AAR moved from a loss to profitability. That would generally be considered a positive, so we’d expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how AAR has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for AAR the TSR over the last 3 years was 60%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that AAR shareholders are down 24% for the year (even including dividends). Unfortunately, that’s worse than the broader market decline of 0.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there’s a good opportunity. Longer term investors wouldn’t be so upset, since they would have made 3.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on AAR it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance