H.B. Fuller Co (FUL) Reports Q1 2024 Earnings: Aligns with EPS Projections, Marginal Revenue ...

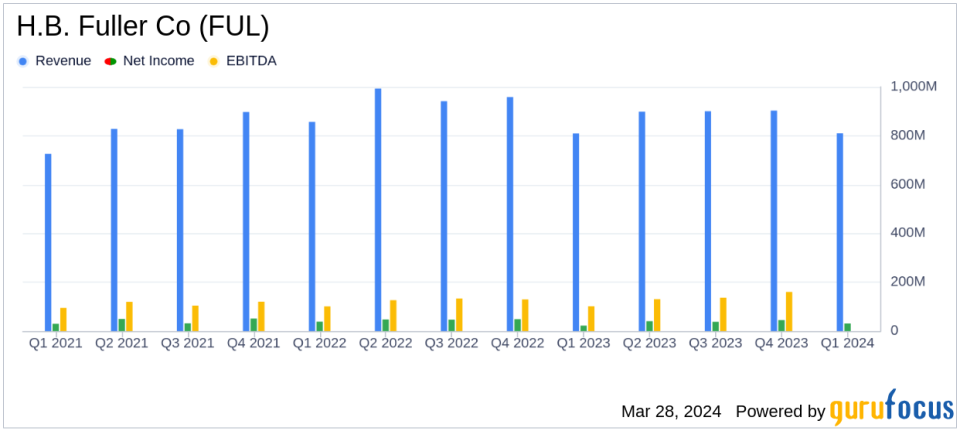

Revenue: Reported at $810 million, a slight increase from $809.2 million in the same quarter last year.

Net Income: $31 million, with adjusted EPS of $0.67, aligning with analyst estimates and marking a 22% increase year-on-year.

Adjusted EBITDA: Rose by 12% to $123 million with a margin improvement of 160 basis points to 15.2%.

Cash Flow: Operating cash flow saw a significant year-on-year increase of $42 million.

Debt Management: Net debt remained flat sequentially and decreased by $82 million year-on-year, with net debt-to-adjusted EBITDA ratio improving from 2.9X to 2.8X.

Working Capital: Decreased by $87 million compared to the previous year, reflecting improved efficiency.

H.B. Fuller Co (NYSE:FUL) released its 8-K filing on March 27, 2024, disclosing its financial performance for the first quarter of fiscal year 2024. The company, a leading manufacturer of adhesives, sealants, and other chemical-based products, reported a marginal increase in net revenue to $810 million, up 0.2% from the same period last year. This figure is just shy of the estimated $825 million projected by analysts.

H.B. Fuller Co operates through three segments, with Hygiene, Health and Consumable Adhesives being the largest, contributing significantly to the company's revenue, primarily in the United States. Despite the modest increase in revenue, the company's adjusted earnings per share (EPS) of $0.67 met the estimates and represented a 22% increase compared to the first quarter of the previous year.

Performance and Challenges

The report indicated that organic revenue declined by 4.2% year-on-year, with pricing adjustments and volume decreases contributing to the reduction. However, the company's strategic acquisitions contributed to a 5.0% increase in net revenue. The adjusted gross profit margin saw a notable improvement, rising 320 basis points to 30.1%, thanks to favorable net pricing, raw material cost actions, and restructuring benefits.

Challenges faced by the company included increased selling, general and administrative (SG&A) expenses, which rose to $172 million due to the impact of acquisitions, inflation in wages and services, and higher variable compensation expense. However, these were partially offset by restructuring savings.

Financial Achievements

H.B. Fuller's financial achievements in the first quarter are significant for the company and the broader chemicals industry. The robust growth in adjusted EBITDA, up 12% to $123 million, and the expansion of the adjusted EBITDA margin to 15.2%, are indicative of the company's ability to manage costs and improve profitability amid market fluctuations. The company's disciplined approach to pricing and cost management, along with the realization of synergies from acquisitions, has contributed to these positive outcomes.

Key Financial Metrics

Key financial metrics from the income statement include a net income of $31 million and a diluted EPS of $0.55. The balance sheet shows a net debt of $1,665.5 million, with a slight reduction in the net debt-to-adjusted EBITDA ratio. The cash flow statement highlights an increase in cash flow from operations of $42 million year-on-year, signaling strong cash generation capabilities.

Celeste Mastin, H.B. Fuller's president and CEO, commented on the results, stating, "We are off to a good start to the year, with first quarter financial results largely consistent with our expectations. Our team is maintaining commercial discipline, proactively innovating to create win-win opportunities for our customers and pricing to that value, while also driving synergy realization and restructuring savings."

Looking Forward

Looking ahead, H.B. Fuller remains confident in achieving its financial goals for fiscal 2024, with expectations of continued profit growth, margin expansion, and improved volume trends. The company's strategic focus on organic investments and synergistic acquisitions positions it well for long-term growth and profitability.

Investors and stakeholders can access more detailed financial information and participate in the upcoming conference call scheduled for March 28, 2024, to discuss the quarter's results and outlook for the remainder of the fiscal year.

For value investors and those interested in the chemical industry's financial dynamics, H.B. Fuller's latest earnings report provides a comprehensive overview of the company's current standing and future prospects. The balance between meeting analyst expectations and driving significant improvements in profitability metrics underscores the company's operational efficiency and strategic planning.

Explore the complete 8-K earnings release (here) from H.B. Fuller Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance