GSK's New Drugs and Pipeline Hold the Key to Growth in 2023

GSK GSK boasts a diversified base and presence in different geographical areas. The company has made significant progress in expanding its presence in emerging markets by acquiring product portfolios from companies like Bristol-Myers and UCB.

The company changed its name to GSK plc from GlaxoSmithKline plc in mid-May 2022. In July 2022, GSK de-merged its Consumer Healthcare (CHC) segment into a standalone company. The independent Consumer Healthcare company has been named Haleon HLN. GSK shareholders own a 54.5% stake in Haleon, while 6% is held by GSK. Certain Scottish limited partnerships (SLPs) hold a 7.5% stake in Haleon. GSK’s CHC joint venture partner, Pfizer, holds a 32% stake in Haleon but plans to sell it soon.

GSK’s relatively newer specialty products like Nucala (severe eosinophilic asthma), Bexsero (meningitis vaccine), Shingrix (shingles vaccines), Trelegy Ellipta (three medicines in a single inhaler to treat COPD) and Juluca (dolutegravir+ rilpivirine once-daily, single pill for HIV) have witnessed considerable success and have become key drivers of top-line growth with the trend expected to continue in 2023. Sales of these products are making up for a decline in Established Pharmaceuticals due to generic erosion. GSK expects its new medicines and vaccines (approved between 2017 and 2021) to contribute around 60% of the new GSK’s (after CHC demerger) sales growth for the period 2022-2026. The spin-off of the Consumer unit has also allowed it to focus on drug development.

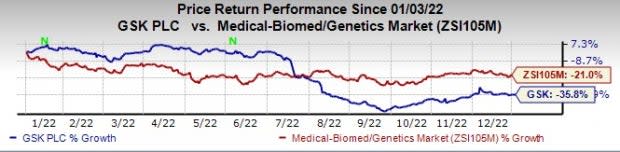

GSK’s stock has declined 35.8% in the past year compared with a decline of 21% for the industry.

Image Source: Zacks Investment Research

2023 is expected to be a pivotal year as far as GSK’s pipeline is concerned. Several pipeline readouts and regulatory events are expected in 2023. GSK expects FDA decisions on regulatory applications filed for three key pipeline candidates, Duvroq/daprodustat for anemia associated with chronic renal disease in February, RSV vaccines for older adults in May and momelotinib for myelofibrosis with anemia in June. Regulatory applications seeking approvals for all three candidates are also under review in Europe and some other countries. GSK also expects to file a new drug application for gepotidacin for uncomplicated urinary tract infection, while another candidate, bepirovirsen for chronic hepatitis B, is expected to enter late-stage development in the first half of the year. GSK plans to launch more than 20 new products/line extensions by 2026 with more than 10 having blockbuster potential.

Key new drug approvals in the past couple of years were Rukobia/fostemsavir for heavily pre-treated HIV, Blenrep/belantamab mafatotin for fourth-line multiple myeloma; Cabenuva, a long-acting injectable HIV treatment; Jemperli (dostarlimab) for second-line endometrial cancer and mismatch repair-deficient (dMMR) recurrent or advanced solid tumors and Apretude, a long-acting injectable form of cabotegravir drug for the prevention of HIV infection, also called pre-exposure prophylaxis or PrEP. These new products should contribute meaningfully to revenue growth in 2023 and thereafter.

GSK’s vaccine sales recovered in 2022 after being hurt by COVID-related disruptions in several markets in 2021.Importantly sales of its shingles vaccine, Shingrix, recovered due to strong commercial execution in Europe and International markets, post-pandemic rebound and the growing impact of new launches. Presently, the vaccine is available across 25 countries. Sales of Shingrix and the overall vaccine segment are expected to continue the positive trend in 2023.

GSK has its share of problems. Generic competition for key drug, Advair is hampering sales of GSK’s respiratory products, which we believe may not be compensated by new respiratory drugs. Competitive pressure on HIV drugs has risen.

Nonetheless, strong sales of specialty medicines, regular pipeline success and accretive M&A deals should keep the stock afloat going forward.

Zacks Rank & Stocks to Consider

GSK has a Zacks Rank #3 (Hold) currently. Some better-ranked stocks worth considering are Syndax Pharmaceuticals SNDX and Anika Therapeutics ANIK, both with a Zacks Rank #1 (Strong Buy).

Syndax Pharmaceuticals’ loss per share estimates for 2022 have narrowed from $2.68 per share to $2.52, while that for 2023 has improved from $3.10 per share to $2.65 per share in the past 60 days. Syndax’s stock is up 14.9% in the past year.

Syndax beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 95.39%, on average.

In the past 60 days, estimates for Anika Therapeutics’ 2022 loss per share have narrowed from 76 cents to 69 cents. During the same period, loss estimates per share for 2023 have narrowed from 70 cents to 47 cents. Shares of Anika Therapeutics have declined 19% in the past year.

Earnings of Anika Therapeutics beat estimates in two of the last three quarters and missed the mark once, delivering a three-quarter earnings surprise of 12.58%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Anika Therapeutics Inc. (ANIK) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Haleon PLC Sponsored ADR (HLN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance