GSK Plunges as Drugmaker Must Face Zantac Cases in Delaware

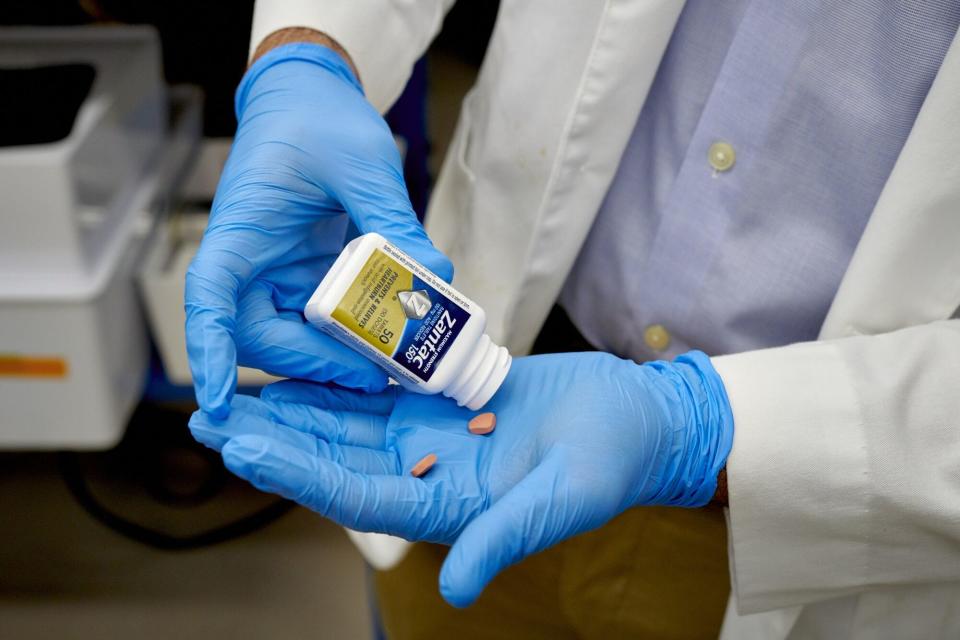

(Bloomberg) -- GSK Plc shares plunged in the wake of a court ruling that the UK drugmaker, alongside others including Sanofi, must face trials over whether the former heartburn treatment Zantac causes cancer.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

GameStop Shares Surge as Gill’s Reddit Return Shows Huge Bet

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

The stock fell as much as 10% in London trading, wiping about £7 billion ($8.9 billion) from GSK’s market value. The drop is the worst since another Zantac-related rout in August 2022.

The selloff erased roughly half of the stock’s gains this year, just as the company was finally showing signs of progress.

The ruling is “a big, fat fly in the ointment of an otherwise improving story,” Wolfe Research’s Tim Anderson said in a note to clients.

Investors were alarmed by the prospect of an overhang from drawn-out litigation, which has weighed on pharmaceutical companies including Bayer AG. The German company has been fighting cases relating to the weedkiller Roundup, and its shares have slumped roughly 70% since it acquired the herbicide’s maker, Monsanto, in 2018.

However, GSK has already settled several lawsuits relating to Zantac, raising the expectation that it would do the same before significant cases went to trial.

Read More: GSK Turned Feared Investor Into Ally With Timely Vaccine Success

The ruling paves the way for multiple trials in Delaware state court. Zantac, a once-popular antacid, has drawn a flurry of US personal-injury lawsuits.

Sanofi has said it faces about 25,000 cases in Delaware — significantly fewer than the roughly 69,000 in which GSK is named as a defendant. The French drugmaker’s shares fell about 1% in Paris trading.

Unlike a federal judge in Florida who rejected the cancer evidence as unreliable in 2022, Superior Court Judge Vivian Medinilla on Friday concluded that consumers weren’t relying on flawed science to support allegations that Zantac caused a variety of cancers.

A settlement would cost around $3 billion, Citi analyst Peter Verdult wrote in a note. Bloomberg Intelligence’s Holly Froum put the total settlement value at $5 billion to $7.5 billion, with GSK bearing about 40-50% of the risk.

Read More: GSK, Pfizer, Peers Zantac Legal Risk Rises by Billions on Ruling

GSK is set to appeal the ruling, it said. The drugmaker emphasized that the decision “does not mean that the court agrees with plaintiffs’ experts’ scientific conclusions, and it does not determine liability.” GSK has consistently denied that Zantac causes cancer.

The decision was a “considerable surprise,” said Redburn Atlantic’s Simon Baker. However the analyst believes that GSK’s appeal will be successful as it runs “against clear legal precedent.”

Another Rout

Under Chief Executive Officer Emma Walmsley, GSK has successfully rolled out of the first vaccine for a common respiratory virus and fended off activist investor Elliott Investment Management, but Zantac litigation has posed a continued threat.

Since Walmsley took the helm in 2017, the stock has dropped around 3%. Much of that poor performance can be attributed to initial concerns around Zantac in August 2022 that sparked a selloff that wiped out gains made since Walmsley took charge. It took the stock more than a year to recover.

Plaintiffs have argued drugmakers knew ranitidine — Zantac’s active ingredient — turned into the potential carcinogen NDMA under certain conditions. In 2020, the US Food and Drug Administration asked companies to remove all ranitidine-based drugs from the US market. Medinilla cited the FDA recall in her decision to allow consumers’ experts to testify.

The companies and consumers will get a chance for their experts to present to juries, who will make the final call on Zantac’s cancer risks, the judge noted. “This dispute presents a classic battle of the experts,” Medinilla wrote. The companies “can take up their challenges” to plaintiffs’ scientific evidence on cross-examination at trial, she added.

Zantac hit the US market as a prescription drug in 1983 before transforming into an over-the-counter heartburn treatment in 1995. GSK and Warner Lambert developed it as part of a joint venture, and the drug was owned by several companies through the years before Sanofi acquired it in 2017.

--With assistance from Lisa Pham and Paul Jarvis.

(Updates with more detail from paragraph 5)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance