Group 1 Automotive Inc (GPI) Q1 2024 Earnings: Surpasses Revenue Forecasts but Sees Dip in EPS

Diluted EPS from continuing operations: $10.76, down 3.2% year-over-year, exceeded the estimate of $9.38.

Adjusted diluted EPS from continuing operations: $9.49, a decrease of 13.2% from the prior year, surpassed the estimate of $9.38.

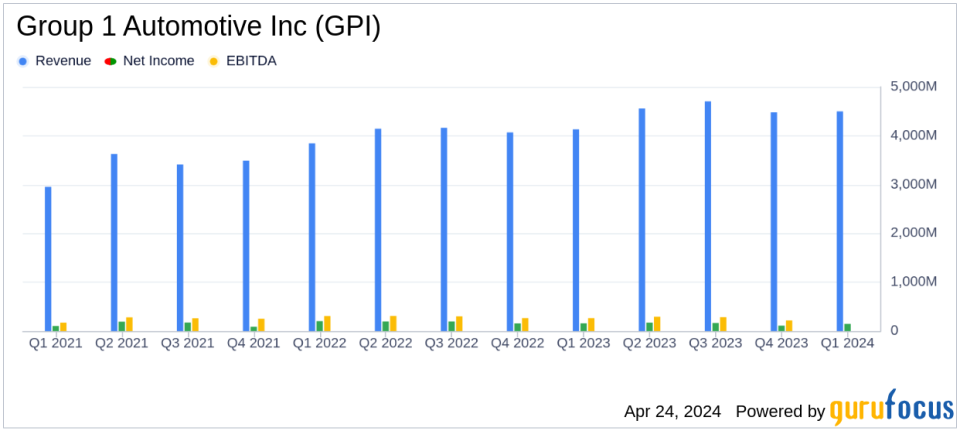

Total Revenue: $4.5 billion, an increase of 8.2% year-over-year, surpassed the estimate of $4378.54 million.

Net Income from continuing operations: $147.4 million, a decrease of 7.2% year-over-year, exceeded the estimate of $124.62 million.

Parts and Service Revenue: $576.2 million, up 5.1% from the previous year, setting a new quarterly record.

U.K. Total Revenue: $824.8 million, increased by 4.7% year-over-year, marking a quarterly record.

New and Used Vehicle Sales: Reported double-digit volume growth in the U.S., with new vehicle units sold up 11.7% and used vehicle retail units up 8.2%.

On April 24, 2024, Group 1 Automotive Inc (NYSE:GPI) disclosed its financial results for the first quarter of 2024 through an 8-K filing. The company reported a notable increase in total revenues, achieving a first quarter record of $4.5 billion, which is an 8.2% rise from the previous year, surpassing the estimated $4.378 billion. However, the diluted earnings per share (EPS) from continuing operations decreased by 3.2% to $10.76, compared to the estimated $9.38, reflecting mixed financial dynamics.

Group 1 Automotive, a prominent player in the automotive retail industry, operates 203 dealerships across the U.S. and U.K., featuring 35 automobile brands. The company's strategic focus includes expanding its U.K. operations, with a significant acquisition of Inchcapes U.K. retail automotive business expected to close in Q3 2024. This move is projected to add approximately $3 billion in revenue, enhancing GPI's market presence in the region.

Financial Highlights and Operational Challenges

The company's net income from continuing operations for Q1 2024 was $147.4 million, a decrease of 7.2% year-over-year. Adjusted net income also saw a decline, coming in at $130.0 million, down 16.7% from the previous year. This decrease in profitability metrics, including a dip in EPS, highlights the challenges faced in maintaining growth in net earnings amidst expanding operations and market volatility.

Despite these challenges, GPI achieved record quarterly revenues in parts and service, and new and used vehicle sales in the U.K., indicating robust operational execution and resilience in core business areas. The automotive retailer also successfully integrated nine new dealership acquisitions with expected annual revenues of $1.0 billion, showcasing effective corporate development strategies.

Key Financial Metrics and Industry Impact

The automotive industry faces unique challenges and opportunities, with dealership performance being a critical indicator of overall health. For GPI, new vehicle units sold increased by 11.7% to 44,302 units, and used vehicle retail units rose by 8.2% to 49,183 units. However, the gross profit per retail unit for new vehicles saw a significant decrease of 23.5%, reflecting tighter margins amidst competitive market conditions.

Finance and Insurance (F&I) revenues grew by 14.4% to $188.9 million, with a gross profit per retail unit increase of 4.1%, underscoring the importance of these services in GPI's revenue mix. The parts and service segment also continued to perform well, with a 5.1% increase in revenues, contributing to the company's diversified income streams.

Strategic Outlook and Investor Considerations

Looking ahead, GPI is focused on realizing the full benefits of its cost reduction efforts, particularly in the U.K., and is optimistic about the integration of the Inchcape acquisition. The company's proactive management of dealership performance and strategic acquisitions are pivotal in navigating the complexities of the automotive market.

For investors, GPI's ability to generate record revenues amidst challenges presents a mixed but potentially promising picture. The strategic expansions and operational efficiencies might offset the pressures on net income and EPS, making GPI a noteworthy consideration for those invested in the automotive retail sector.

As GPI continues to adapt and grow, its journey offers valuable insights into resilience and strategic planning in the ever-evolving automotive industry.

Explore the complete 8-K earnings release (here) from Group 1 Automotive Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance