Green Thumb Industries Leads Three Value Stocks On TSX For Your Consideration

Amidst a landscape of moderating inflation and shifting interest rate expectations in Canada, investors are closely watching market movements for opportunities. In such an environment, identifying undervalued stocks on the TSX can offer potential avenues for those looking to diversify their portfolios in alignment with current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

Calian Group (TSX:CGY) | CA$56.01 | CA$110.60 | 49.4% |

Calibre Mining (TSX:CXB) | CA$1.86 | CA$3.17 | 41.3% |

goeasy (TSX:GSY) | CA$186.99 | CA$313.71 | 40.4% |

Trisura Group (TSX:TSU) | CA$41.35 | CA$80.18 | 48.4% |

Kinaxis (TSX:KXS) | CA$148.71 | CA$249.67 | 40.4% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Endeavour Mining (TSX:EDV) | CA$29.64 | CA$54.00 | 45.1% |

Green Thumb Industries (CNSX:GTII) | CA$16.00 | CA$27.13 | 41% |

Kits Eyecare (TSX:KITS) | CA$8.41 | CA$14.23 | 40.9% |

Capstone Copper (TSX:CS) | CA$9.62 | CA$16.43 | 41.5% |

Let's dive into some prime choices out of from the screener

Green Thumb Industries

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use, with a market capitalization of approximately CA$3.79 billion.

Operations: The company generates revenue primarily through its Retail and Consumer Packaged Goods segments, with figures reported at $806.38 million and $583.78 million respectively.

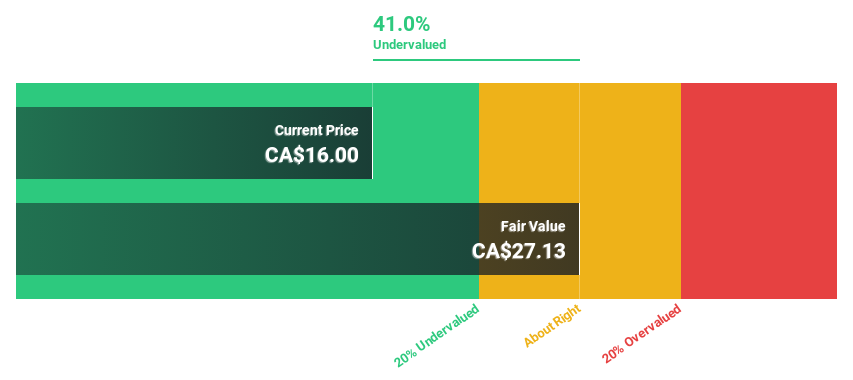

Estimated Discount To Fair Value: 41%

Green Thumb Industries, trading at CA$16, significantly below the estimated fair value of CA$27.13, appears undervalued based on discounted cash flows. Recent expansion into new markets and potential strategic mergers indicate proactive management despite a forecasted modest return on equity of 7.5% in three years. With earnings expected to grow by 23% annually—outpacing the Canadian market's 14.6%—and revenue growth also above market trends at 10.3%, Green Thumb's financial health seems poised for improvement, aligning with its strategic initiatives and market expansions.

Alamos Gold

Overview: Alamos Gold Inc. is a company involved in acquiring, exploring, developing, and extracting precious metals primarily in Canada and Mexico, with a market capitalization of approximately CA$8.51 billion.

Operations: The company generates revenue from three main segments: Mulatos (CA$442.80 million), Island Gold (CA$254.90 million), and Young-Davidson (CA$351.70 million).

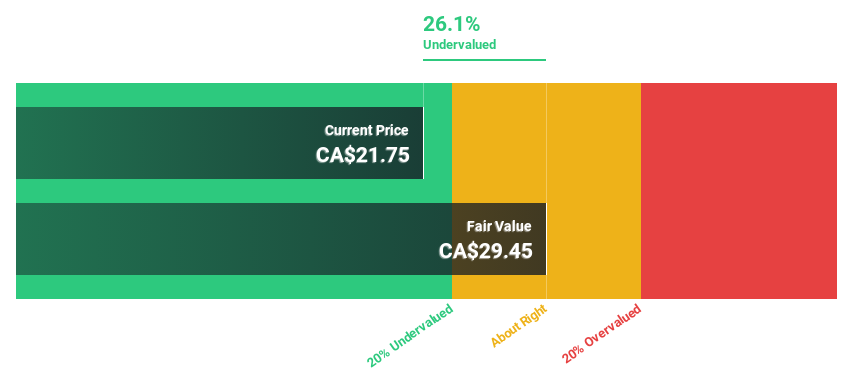

Estimated Discount To Fair Value: 26.1%

Alamos Gold, priced at CA$21.75, trades 26.1% below its assessed fair value of CA$29.45, suggesting significant undervaluation based on cash flows. With a robust earnings growth forecast of 24.69% annually and revenue growth anticipated to exceed the Canadian market average at 16.4%, the company's financial prospects appear strong despite a relatively low expected return on equity of 15%. Recent exploration results indicate potential for further resource expansion, reinforcing its growth trajectory amidst ongoing dividend payments and shareholder returns.

Docebo

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market capitalization of approximately CA$1.53 billion.

Operations: The company's revenue is primarily generated from its educational software segment, totaling CA$190.78 million.

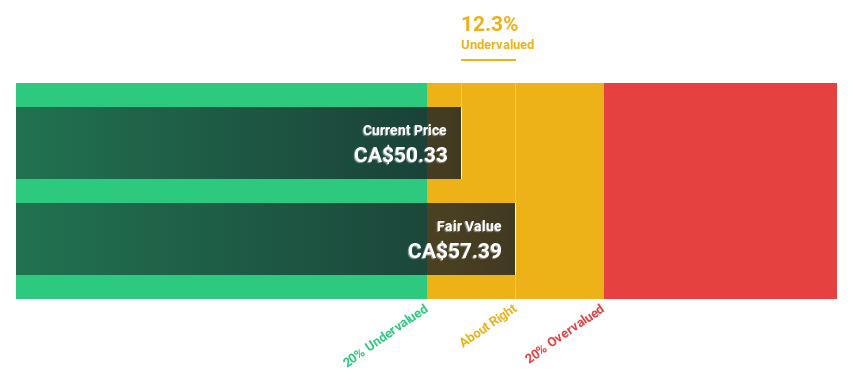

Estimated Discount To Fair Value: 12.3%

Docebo, priced at CA$50.33, is considered undervalued against a fair value of CA$57.39, reflecting a modest discount based on cash flow analysis. The company's recent financial performance shows robust growth with Q1 sales rising from US$41.46 million to US$51.4 million year-over-year and net income increasing significantly to US$5.17 million. Forecasted annual earnings growth of 50.63% and revenue growth at 16.2% per year outpace the Canadian market averages, despite current profit margins being lower than the previous year at 3.5%.

Turning Ideas Into Actions

Dive into all 25 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include CNSX:GTII TSX:AGI and TSX:DCBO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance