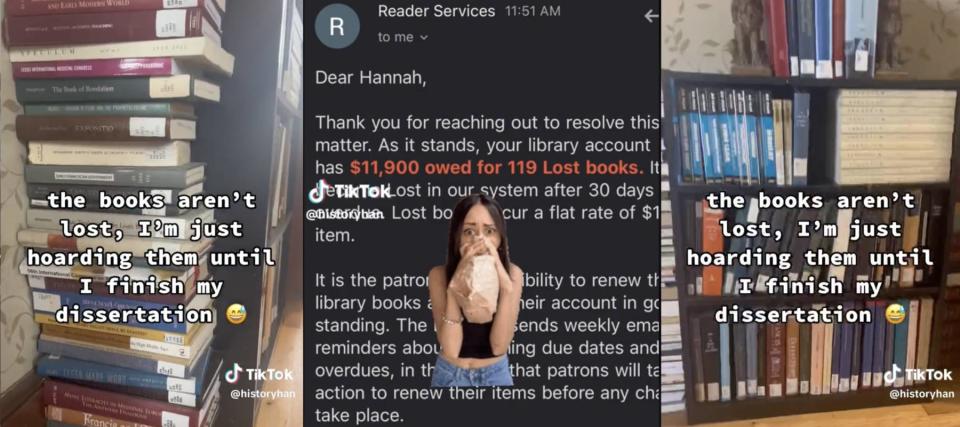

This grad student was horrified after learning she owed $11,900 in library fines — says she was just 'hoarding' books for her dissertation. 3 more 'stealthy' fees you need to watch out for

Graduate student Hannah Jones says she recently received an email from her school library about owing $11,900 for “119 lost books” she’d apparently held onto for years.

Don't miss

This janitor in Vermont built an $8M fortune without anyone around him knowing. Here are the 2 simple techniques that made Ronald Read rich — and can do the same for you

Here's how much money the average middle-class American household makes — how do you stack up?

'Hold onto your money': Jeff Bezos says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

“The books aren’t lost, I’m just hoarding them until I finish my dissertation,” says the caption on the TikTok video — which has gained around 450,000 views since being posted in late April.

Jones, who attends Binghamton University in New York, told The Daily Dot she first checked the books out three years ago when preparing for exams. In March, she received four email reminders to renew or return the books but “kept putting it off.” However, once she received the email about the amount owing, she immediately notified the library she hadn’t lost the books and still had them with her, and the majority of her fees were waived.

Despite only paying $20 for her mistake, Jones says she’s learned her lesson when it comes to small fees sneaking up on you. Many institutions quietly levy penalties against customers, similar to library late fees. It’s a problem many of us can experience if we’re not careful. Here are three types of fines to look out for.

1. Banking fines

There are several ways a bank can charge you fees, so it’s important to read the fine print before engaging in any business.

For example, if you miss a credit card payment, issuers can charge you as much as $41, according to the Consumer Financial Protection Bureau.

Some banks may also charge you maintenance fees — fines you have to pay just to keep your account open — although these fees can be waived if you maintain a certain minimum balance.

And if you use your debit card to spend more money than you have in your account, you can be hit with an overdraft fee.

Read more: You could be the landlord of Walmart, Whole Foods and CVS (and collect fat grocery store-anchored income on a quarterly basis)

2. Subscriptions you forgot to cancel

We’ve all been there. You don’t have time to binge watch on Netflix anymore, or you’ve passed your free trial on Kindle Unlimited and forgot to cancel before the next billing date.

But these forgotten payments can add up over time. One survey from marketing insights agency C+R Research found that 42% of consumers have forgotten about a subscription service they were paying for but were no longer using. And while respondents initially estimated they spent $86 a month on average on their subscriptions, their actual monthly spend came to $219.

An easy way to avoid paying for unwanted subscriptions is to create a budget to track your spending. You could manually record everything in a spreadsheet or download an app that gives you a breakdown of your purchases.

3. Junk fees

Junk fees are extra fees that get tacked onto your purchases but aren’t disclosed upfront. You’ve probably seen them get added onto things like concert tickets or airline fares at checkout.

They may seem pretty small — sometimes just a couple of dollars — but junk fees inflate the cost of your purchases.

There are a few ways you can avoid these surprise expenses. For example, when scheduling your next flight, book through an aggregate site that will give you the actual price upfront. And before going to a fancy restaurant, check their website or call in advance to see if they include any extra charges, such as mandatory gratuity.

What to read next

'We were broke in six months': Ben Affleck says he and Matt Damon blew through the $110K they made from Good Will Hunting on jeeps, 'party house' — 4 tips to make your money last

Chad ‘Ochocinco’ saved 83% of his NFL salary by buying fake jewelry and sleeping in the stadium — here are 5 ways to preserve your wealth at an all-star level

If you owe $25K+ in student loans, there are ways to pay them off faster

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance