Grab 3 Equity REIT Stocks Despite Challenges in the Industry

The REIT and Equity Trust - Other industry constituents are likely to be affected by the uncertain business environment. Customers are prioritizing cost management and delaying leasing decisions. The Fed is expected to maintain a cautious stance on rate cuts, keeping REITs' interest expenses high. Supply-chain constraints and high material costs could further elevate development expenses.

Amid this backdrop, investors may favor defensive asset categories within the industry characterized by resilience and strong fundamentals, which are expected to drive growth. Players like Lamar Advertising Company LAMR, Americold Realty Trust, Inc. COLD and Farmland Partners Inc. FPI are likely to prosper.

About the Industry

The Zacks REIT and Equity Trust - Other sector comprises a diverse collection of REIT stocks representing various asset categories, including industrial, office, lodging, healthcare, self-storage, data centers, infrastructures and more. Equity REITs lease out space within these properties to tenants, generating income through rental payments. Economic growth assumes a central role within the real estate sector as economic expansion directly correlates with higher demand for real estate, increased occupancy rates and greater bargaining power for landlords to command higher rental rates. Moreover, the performance of Equity REITs hinges on the specific dynamics of their underlying assets and the geographic location of their properties. Therefore, it is imperative to thoroughly explore the fundamentals of these asset categories before making any investment decisions.

What's Shaping the Future of the REIT and Equity Trust - Other Industry?

Economic Uncertainty to Hamper Near-Term Activity: An uncertain business environment affects occupier sentiment. In a volatile and persistently high interest rate environment and geopolitical concerns, customers remain focused on cost controls and delaying their decisions with respect to decision-making for leasing. Clients are exhibiting reduced urgency in making new commitments and are still waiting for further price discovery. Asset category-wise, this is affecting the demand for industrial real estate. Though continued job expansion is expected to boost demand for office space, leasing activity is likely to be affected amid hybrid work setups and ongoing uncertainty in the broader business climate. In the self-storage asset category, there is new customer price sensitivity, and this headwind from lower new customer rates is likely to affect these REITs’ performance in the near term. In the case of Tower REITs, demand is expected to mellow down in the quarters ahead amid slowing carrier capital expenditure and the churn effect, hurting profitability.

Supply-Chain Woes & High Material Costs Linger: Economic uncertainty and geopolitical unrest continue to cause supply-chain constraints at various stages. Combined with elevated interest rates, this has increased raw material costs, resulting in higher development costs. Additionally, REITs rely heavily on the debt market for their development and redevelopment activities. Also, the Federal Reserve continues adhering to the cautious approach to lowering interest rates in the short term. As a result, interest expenses are still likely to be on the higher end in the near term, affecting their ability to purchase or develop real estate with borrowed funds. Further, with high interest rates still in place, the dividend payout of REITs might seem less attractive than the yields on fixed-income and money market accounts.

Resilient Demand Across Certain Asset Classes Offers Growth Opportunities: Demand for certain asset categories, such as data centers and healthcare, are likely to remain healthy in the near term. Expected acceleration in the senior citizen population and a rise in healthcare spending by this age cohort in the upcoming period, as well as pent-up demand for medical services, augur well for healthcare REITs’ medical property demand. Further, in this digital era, there is high demand for inter-connected data center space, with enterprises and service providers continuing to integrate artificial intelligence into their strategies and offerings and advance their digital transformation agendas. This will enhance growth prospects for data center REITs.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks REIT and Equity Trust - Other industry is housed within the broader Finance sector. It carries a Zacks Industry Rank #182, which places it in the bottom 27% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the southward revision of funds from operations (FFO) per share outlook for the constituent companies in aggregate. Looking at the aggregate FFO per share estimate revisions, it appears that analysts are losing confidence in this group’s growth potential of late. For 2024, the industry’s FFO per share estimates have moved 4.8% south over the past year. The industry’s estimates for 2025 have moved 8.9% south during this time frame.

However, before we present a few stocks that you might want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

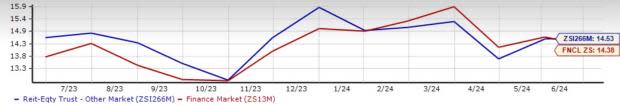

Industry Lags the Stock Market Performance

The REIT and Equity Trust - Other Industry has underperformed both the S&P 500 composite and the broader Zacks Finance sector in a year.

The industry has risen 1.9% during this period compared with the S&P 500’s increase of 25.6% and the broader Finance sector’s 20.7% jump.

One-Year Price Performance

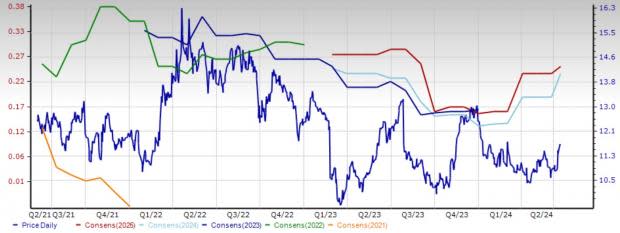

Industry's Current Valuation

On the basis of the forward 12-month price-to-FFO ratio, which is a commonly used multiple for valuing REIT - Others, we see that the industry is currently trading at 14.53X compared with the S&P 500’s forward 12-month price-to-earnings (P/E) of 21.59X. The industry is trading above the Finance sector’s forward 12-month P/E of 14.38X. This is shown in the chart below.

Forward 12 Month Price-to-FFO (P/FFO) Ratio

Over the last five years, the industry has traded as high as 22.13X and as low as 12.81X, with a median of 17.80X.

3 REIT and Equity Trust - Other Stocks to Buy

Farmland Partners Inc.: This REIT owns and seeks to acquire premium North American farmland and provides loans to farmers secured by farm real estate.

Currently, it manages around 177,400 acres across 17 states and owns land and buildings for four agriculture equipment dealerships in Ohio leased to Ag Pro under the John Deere brand.

The company cultivates approximately 26 crop types and has more than 100 tenants. As the company continues to capitalize on the demand for good farmland, investors can look forward to further profitable outcomes.

FPI currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for the company’s 2024 FFO per share has been raised 26.3% over the past two months to 24 cents, which indicates an increase of 50% year over year. The stock has risen 6% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lamar Advertising Company: This REIT is one of the largest owners and operators of outdoor advertising structures in the United States.

The impressive footprint of outdoor advertising assets, the unmatched logo sign business, a diversified tenant base across various sectors and a focus on local businesses are tailwinds for Lamar. Efforts to expand the digital platform and technological advancements in the low-cost, out-of-home advertising platform bode well for long-term growth.

Lamar currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LAMR’s 2024 FFO per share has been raised 3.7% over the past two months to $8.03.

Moreover, the Zacks Consensus Estimate for 2025 FFO per share has been moved up 5.2% over the same period. The stock has appreciated 7.8% in the past six months.

Americold Realty Trust: This Atlanta, GA-based REIT is a global leader in temperature-controlled logistics real estate and value-added services. The company operates in North America, Europe, Asia-Pacific and South America. Its facilities serve as an essential component of the supply chain, linking food producers, processors, distributors and retailers to consumers.

With a focus on temperature-controlled warehouses, COLD benefits from the rising demand for cold storage facilities. With the growing trend of e-commerce and the increasing demand for temperature-controlled supply chains, Americold Realty's specialized asset class could offer a defensive play in uncertain times.

COLD currently carries a Zacks Rank #2. The Zacks Consensus Estimate for the company’s 2024 FFO per share of $1.44 calls for a 13.4% increase year over year. The stock has also risen 1.7% in the past three months.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Farmland Partners Inc. (FPI) : Free Stock Analysis Report

Americold Realty Trust Inc. (COLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance