Good Samaritan pays off predatory loan debt of Arizona man featured in USA TODAY

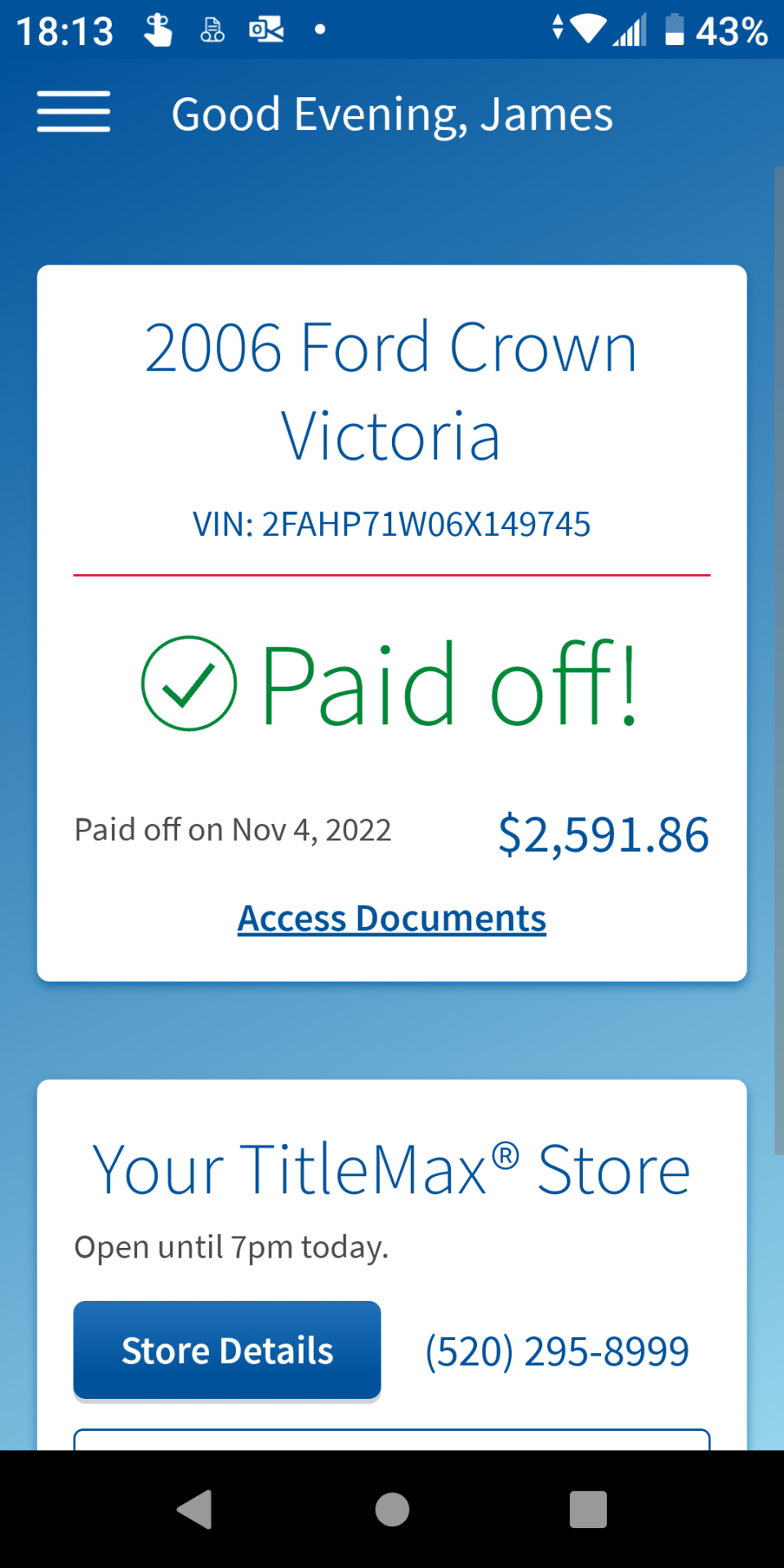

James Hollis can say goodbye to a pair of predatory loans with triple-digit interest rates.

A half-dozen good Samaritans from around the country offered to pay off the debt after USA TODAY on Nov. 3, wrote about Hollis, who lives on Social Security disability and $23 in monthly food stamps, and his $3,050 in car title loans he obtained to fix a faulty transmission.

Hollis said Monday he was blown away with the generous offers, and Lorne Lavine, a dentist from Encino, California, who owns a dental technology company, covered the tab.

"I feel a great sense of relief," Hollis said. "I didn't know how I was going to make it. I was strapped."

Hollis had started parking his 2006 Ford Crown Victoria, a converted former police cruiser, sideways in his Tucson, Arizona, carport because he feared it would get repossessed after falling behind in his payments in July.

Lavine, who said he's provided free dental care overseas on humanitarian trips, said he wanted to help Hollis and was stunned about the interest rates of nearly 155% and 202% on the car title loans.

The interest on those loans totaled $10,741, resulting in a total bill of nearly $14,000 if Hollis had paid it off over several years, records show.

"I felt horrible," Lavine told USA TODAY. "The people who need these loans the most are the most challenged to pay it back, and these rates are crazy. I understand there is an increased risk for these loan companies, but over 200%?… How can people get their heads above water when they have 200% interest on loans?"

USA TODAY wrote about Hollis as it examines high-interest loans that critics and supporters agree are becoming common across the country. Driving the trend is the staggering level of inflation gripping low-wage earners who need help paying for purchases over several installments.

Layaway for the holidays: Should you use 'buy now, pay later' for 2022 holiday purchases?

To the point: What are payday loans and other types of predatory lending?

The story also reported about a small bipartisan group in Congress that wants to cut the cost of those loans by passing national legislation that would limit interest rates to 36%. That's the maximum charged on any loans made to active service members and their families after a law was enacted 16 years ago.

Hollis said he received offers from five other strangers including a woman who wanted to take a collection at her church. He said he kindly told those five that another person, Lavine, paid the debt.

Predatory loans on the rise: How a $3,000 repair ballooned into a $14,000 debt

Rent-a-banks replacing payday loans: Consumer watchdogs raise alarms as more consumers rely on high-interest 'rent-a-bank' loans

Lavine said he was able to directly pay off the larger loan of nearly $2,600 but the company holding the smaller loan would only take payment from Hollis. So, Lavine said he mailed him a check.

Lavine said the USA TODAY story "struck a nerve" with him, and he initially was going to pay for just part of the loan. But after Hollis sent him all of the loan documents, he was "floored" seeing the high-interest rates and decided to pay it all off.

Lavine said another reason he wanted to help was to be a good role model to his 16-year-old son, Jake.

"I get pleasure and joy in helping others out," Lavine said. "I want him (Jake) to be a good person and be helpful and kind and respectful."

A good portion of Hollis's limited income was earmarked for the $427 monthly payment on the loans. Now, he said he will have enough money to pay his bills and buy Christmas gifts for his family.

And his days of taking out car title loans are over.

"I won't do that again," Hollis said. "Not at all."

Have a tip on business or investigative stories? Reach the reporter at craig.harris@usatoday.com or 602-509-3613 or on Twitter @CraigHarrisUSAT or linkedin.com/in/craig-harris-70024030/

This article originally appeared on USA TODAY: Good Samaritan pays off predatory loan debt after USA TODAY article

Yahoo Finance

Yahoo Finance