Goldman Sachs Q1 Earnings Soar, Crushing Analyst Estimates

Earnings Per Share (EPS): Reported $11.58, significantly exceeding the estimated $8.56.

Net Income: Reported $4.13 billion, surpassing the estimated $2.95 billion.

Revenue: Reported $14.21 billion, outperforming the estimated $12.92 billion.

Annualized Return on Equity (ROE): A strong 14.8%, showcasing efficient equity utilization.

Segment Growth: Notable revenue increase across all business segments compared to the previous year.

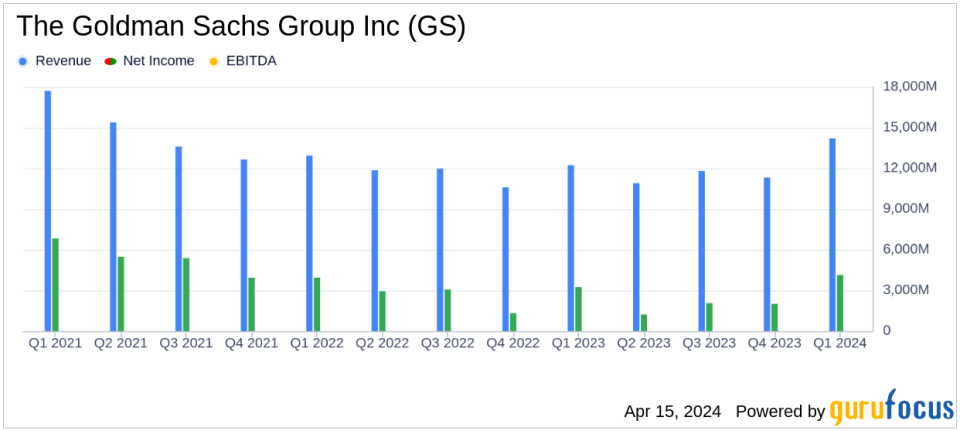

The Goldman Sachs Group Inc (NYSE:GS) released its first-quarter earnings for 2024 with a remarkable performance that significantly outpaced analyst expectations. The company reported a substantial increase in earnings per share (EPS) at $11.58, which is a striking surge from the estimated $8.56. Net income for the quarter reached $4.13 billion, eclipsing the forecasted $2.95 billion. Total revenue for the quarter stood at $14.21 billion, again surpassing the analyst projections of $12.92 billion. The firm's annualized return on equity (ROE) was a robust 14.8%, indicating a strong utilization of shareholder equity. These results were announced in the company's 8-K filing on April 15, 2024.

Goldman Sachs, a leading global investment banking and asset management firm, has once again demonstrated its financial prowess. With approximately 20% of its revenue stemming from investment banking, 45% from trading, 20% from asset management, and the remaining 15% from wealth management and retail financial services, the company has shown a well-diversified and resilient business model. The Americas contribute around 60% of the company's net revenue, with Asia and Europe, the Middle East, and Africa accounting for 15% and 25%, respectively.

The first quarter results reflect the strength of Goldman Sachs' interconnected franchises and its ability to generate substantial earnings. Chairman and Chief Executive Officer, David Solomon, emphasized the company's focus on executing its strategy and leveraging core strengths to serve clients and deliver for shareholders.

Financial Highlights and Challenges

The reported net revenues of $14.21 billion for the first quarter of 2024 represent a 16% increase compared to the same quarter in the previous year, with growth observed across all segments. This performance is particularly noteworthy as it demonstrates the company's ability to thrive despite various market challenges. The strong revenue growth is a testament to the firm's diversified business model and its capacity to adapt to changing market conditions.

Goldman Sachs' financial achievements are significant within the capital markets industry, as they reflect the company's competitive edge and operational efficiency. The impressive earnings and revenue figures not only highlight the firm's financial health but also its potential to continue delivering value to shareholders.

Analysis of Financial Statements

The company's balance sheet and cash flow statements, while not detailed in this summary, are expected to reflect the solid financial position indicated by the net revenue and net earnings figures. Key metrics such as the annualized ROE and the book value per share, which stands at $321.10, are important indicators of the company's profitability and value, respectively.

Goldman Sachs' performance in the first quarter of 2024 sets a positive tone for the year ahead. The firm's ability to significantly outperform analyst estimates on key financial metrics is indicative of its strong market position and strategic execution. As investors and analysts digest these results, the focus will likely be on the sustainability of this growth and the firm's ability to navigate potential future challenges in the global financial landscape.

For a comprehensive analysis of The Goldman Sachs Group Inc's (NYSE:GS) financial results and outlook, interested parties are encouraged to join the conference call or access the audio webcast through the Investor Relations section of the firm's website.

It is important to note that while the company's forward-looking statements provide insight into management's expectations, they are subject to various uncertainties and changes in circumstances, which may cause actual results to differ materially from projections.

For further details on The Goldman Sachs Group Inc's (NYSE:GS) financial performance, please refer to the full earnings report and listen to the conference call scheduled to discuss these results in depth.

Explore the complete 8-K earnings release (here) from The Goldman Sachs Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance