Goldman (GS) Might Pay $2B to Resolve State Fund 1MDB Scandal

Engulfed in the heightened scandal related to the multibillion-dollar 1Malaysia Development Bhd (1MDB), U.S. investment bank Goldman Sachs GS might get some respite with the settlement of the same.

Recently, per a Reuters article, Goldman might enter into a settlement with the U.S. government and a state regulator by paying around $2 billion. The payment will follow the admittance of guilt by the bank and resolve the ongoing investigations in the 1MDB Malaysian corruption scandal.

Per latest talks with the U.S. officials, a Goldman subsidiary in Asia would plead guilty for the violation of U.S. bribery laws. Following the discussions, Goldman is also likely to appoint an independent monitor for supervision and proposition of changes for its compliance procedures. Notably, three federal regulators — the U.S. Department of Justice (DoJ), Securities and Exchange Commission (SEC) and the Federal Reserve — and New York's Department of Financial Services are involved in the discussions.

Per the bank’s statement, Goldman is acting in full co-operation with the regulators. However, the SEC and the Justice Department have refrained from commenting on the matter. Also, no immediate response was received from other regulators’ representatives.

Background

Goldman has been scrutinized for playing role in raising funds through bond offerings for 1MDB, the fund entangled in corruption and money-laundering probes in roughly six countries. Per the DoJ, misappropriation of funds, worth nearly $4.5 billion, from 1MDB by top officials of the fund and their colleagues from 2009 through 2014, also included funds which were raised through Goldman.

Therefore, regulators of around 14 countries, including the United States, Malaysia, Singapore and others, have probed Goldman for its role as an underwriter and doings during the transactions.

Further, in November 2018, criminal charges were levied against two former bankers — Tim Leissner and Roger Ng of Goldman by the U.S. prosecutors, as well as on Low — a Malaysian financier who effectively had the control of the state-owned investment 1MDB. Low has been accused for routing the money out of 1MBD, and paying bribes and purchasing real estate, art, and jewelry. Nevertheless, the bond proceeds were meant for strategic investments for the state.

Per DoJ, nearly $600 million were earned by the bank, including three bond offerings in 2012 and 2013, which raised $6.5 billion. Further, huge bonuses were earned by Leissner, Ng and others. However, Goldman claimed Leissner and Ng were working to hide criminal activities from bank management.

Last year, Leissner accepted the act of conspiracy for laundering money and plotting the violation of the Foreign Corrupt Practices Act. Nonetheless, the other employee has not come with a plea and is facing a case in Brooklyn’s federal court.

However, spokesperson for Malaysian prime minister Mahathir Mohamad and the attorney general of Malaysia have not come up with any comment on the matter.

Bottom Line

Although Goldman has resolved quite a few litigation issues, it still faces probes and queries from several federal agencies, and a few foreign governments for its businesses conducted during the pre-crisis period. As a result, the company’s legal expenses are expected to remain elevated, which might partially impede its bottom-line growth in the near term.

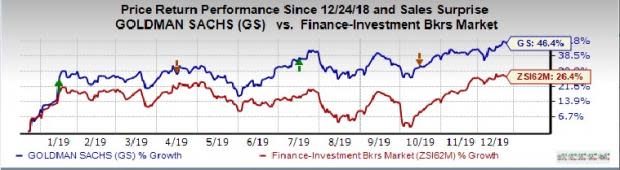

Shares of the company have gained around 46.4% in the past year compared with 26.4% growth registered by the industry.

Goldman currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Morgan Stanley MS has been witnessing upward estimate revisions for the past 60 days. Moreover, this Zacks #2 Ranked (Buy) stock has rallied more than 17% over the last six months. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Piper Jaffray Companies PJC has been witnessing upward estimate revisions for the past 60 days. Also, the company’s shares have gained nearly 12.5%, in the last six months. It carries a Zacks Rank of 2, at present.

Federated Investors, Inc. FII has been witnessing upward estimate revisions for the past 60 days. Additionally, the company’s shares have gained nearly 3.5%, in the last six months. It carries a Zacks Rank of 2, at present.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.6% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Piper Jaffray Companies (PJC) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Federated Investors, Inc. (FII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance