Gold Likely to Shine on Demand-Supply Imbalance: 5 Top Picks

Gold prices jumped in 2024 buoyed by increased geopolitical tensions, a depreciating U.S. dollar, the potential for monetary policy easing, and continuous purchasing by central banks. Physical demand has also been strong in China due to a weaker yuan, a volatile stock market and comparatively low deposit rates. investors are thus exploring alternatives for their savings.

The World Gold Council (WGC) recently said that the gold mining industry is suffering from a scarcity of deposits of the yellow metal. WGC Chief Market Strategist John Reade said “The bigger picture, I think about mine production is that, effectively, it plateaued around 2016, 2018 and we’ve seen no growth since then.”

As gold miners have already explored prospective areas, new mines are very hard to be identified. Gold mining is a very lengthy process by its nature. Moreover, slow-moving government clearances create more hurdles for miners.

However, on the demand side, the use of gold in energy, healthcare and technology is rising. India and China account for around 50% of consumers’ gold demand. Economic strength in India is fueling wealth-driven buying.

The yellow metal has long been considered a safe-haven investment in financial or political uncertainty. Gold demand continues to be on the rise from central banks. Therefore, there will be an eventual demand-supply imbalance, which is likely to drive gold prices.

Our Top Picks

We have narrowed our search to five gold stocks with strong potential for the rest of 2024. These stocks have seen earnings estimate revisions in the last 60 days. These companies are also regular dividend payers. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

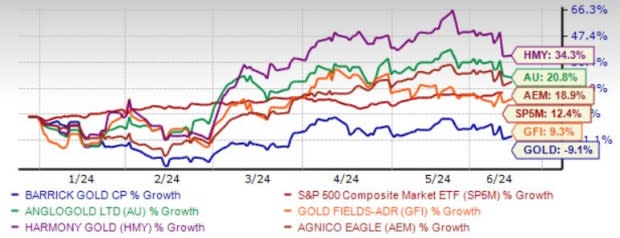

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Barrick Gold Corp. GOLD is expected to gain from the progress in key growth projects including Goldrush, the Pueblo Viejo expansion, Lumwana Super Pit and Reko Diq, which are likely to significantly contribute to its production.

GOLD continues to focus on high-return investments, particularly in Nevada, bolstered by successful exploration programs and ongoing project executions. The merger with Randgold also fortified GOLD’s position in the industry, now owning top-tier assets. The joint venture with Newmont provides additional upsides.

Zacks Rank #1 Barrick Gold has an expected revenue and earnings growth rate of 10.5% and 26.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7% over the last 30 days. GOLD has a current dividend yield of 2.5%.

AngloGold Ashanti plc AU operates as a gold mining company in Africa, Australia, and the Americas. AU primarily explores for gold, as well as produces silver and sulphuric acid as by-products. AU’s flagship property is a 100% owned Geita mine located in the Lake Victoria goldfields of the Mwanza region in north-western Tanzania.

Zacks Rank #1 AngloGold Ashanti has an expected revenue and earnings growth rate of 12.7% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 28.8% over the last 60 days. AU has a current dividend yield of 1%.

Gold Fields Ltd. GFI operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. GFI also explores for copper and silver deposits.

Zacks Rank #1 Gold Fields has an expected revenue and earnings growth rate of 28.6% and 50.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 21.7% over the last 60 days. GFI has a current dividend yield of 2.3%.

Harmony Gold Mining Co. Ltd. HMY is benefiting from a diverse portfolio of gold development projects. The Wafi-Golpu project is expected to significantly boost HMY’s production profile. The project is estimated to produce around 500,000 gold equivalent ounces per year for the company during peak production.

The low-risk Eva Copper project in Australia offers additional upside, giving HMY a significant global copper-gold footprint. HMY acquired Eva Copper in fiscal 2023, adding a tier-one mining jurisdiction to its portfolio. The acquisition is in line with HMY’s objective of transitioning into a low-cost gold and copper mining company.

Zacks Rank #1 Harmony Gold Mining has an expected revenue and earnings growth rate of 15% and 43.6%, respectively, for next year (ending June 2025). The Zacks Consensus Estimate for next-year earnings has improved 35% over the last 60 days. HMY has a current dividend yield of 1.5%.

Agnico Eagle Mines Ltd. AEM is strengthening its exploration and asset investments. With a focus on sustainability and operational efficiency, AEM seeks to increase production levels and improve cash flow generation. The Kittila expansion is likely to enhance mine efficiency and lower current operating costs.

AEM is expected to gain from the Hope Bay acquisition. The merger with Kirkland Lake Gold also solidifies AEM’s position as a leading gold producer, with greater financial resources and a stronger pipeline of projects. By strategically diversifying its operations, AEM aims to reduce risks and maintain financial resilience.

Zacks Rank #2 Agnico Eagle Mines has an expected revenue and earnings growth rate of 9.9% and 43.5%, respectively, for the current year. The Zacks Consensus Estimate for next-year earnings has improved 0.6% over the last seven days. AEM has a current dividend yield of 2.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngloGold Ashanti PLC (AU) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance