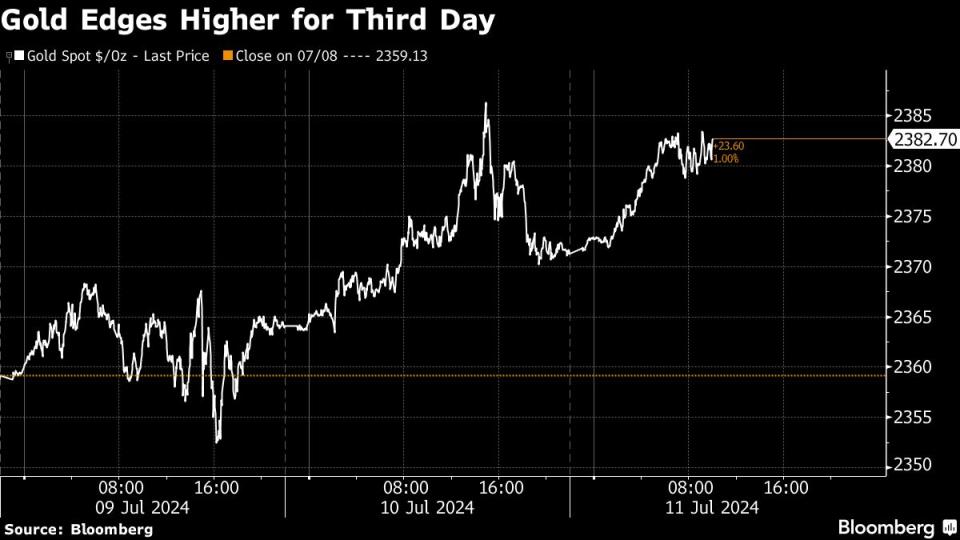

Gold Edges Higher Ahead of Key US Inflation Data Release

(Bloomberg) -- Gold edged higher for a third day as traders look ahead to the release of key US inflation figures later on Thursday.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Stocks See Big Rotation as Yields Sink on Fed Bets: Markets Wrap

The core consumer price index, which excludes food and energy, is expected to show a small increase of 0.2% in June. That might bolster the case for monetary easing.

On Wednesday, Federal Reserve Chair Jerome Powell wrapped up a second day of testimony in Washington, where he said the central bank doesn’t need inflation below 2% before cutting interest rates. Swaps traders now see two reductions in 2024, bolstering bullion which doesn’t pay interest.

Central-bank buying remains a support for the precious metal.

The Bank of Uganda said it plans to initiate a domestic gold-purchasing program to build its foreign reserves and minimize risks on reserve investments, according to its latest quarterly State of the Economy Report.

Spot gold was up 0.5% to $2,383.52 an ounce as of 10:09 a.m. in London, while the Bloomberg Dollar Spot Index fell 0.1%. Silver edged up toward $31 an ounce, while platinum and palladium both fell.

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance