Gold Bull encounters coarse gold in samples at Sandman, improved laboratory assay analysis underway – higher grades expected

Figure 1

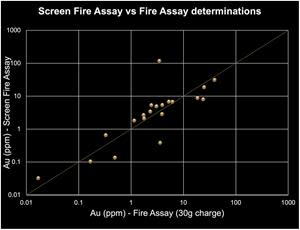

Cross-plot on logarithmic axes of metallic screen fire assay versus fire assay determinations on selected samples from SA-0001 and SA-0004

VANCOUVER, British Columbia, June 01, 2021 (GLOBE NEWSWIRE) -- Gold Bull Resources Corp. (TSX-V: GBRC) (“Gold Bull” or the “Company”) is pleased to report re-assay results of RC drill samples from the high-grade gold intersections at North Hill and Abel Knoll using the metallic screen fire assay method (with ICP or gravimetric finish as appropriate). This variation, caused by the presence of coarse gold, highlights the need for a change in the Company’s assay protocols to ensure that samples likely to contain coarse gold will return repeatable assay results suitable for inclusion in a mineral resource estimate and, that all mineralization with gold above the cut-off grade is identified.

HIGHLIGHTS & UPDATE:

Intersection in SA-0004 with assays determined by metallic screen fire averages 19.76 g/t Au from 41.1 m to 54.9 m, versus 10.95 g/t Au previously reported from conventional 30 g fire assay

Substantial variation in gold values between metallic screen fire and conventional fire assay observed in other samples from high grade zone in SA-0001 raises strong possibility of under-reporting gold values

Changes to sample preparation and assay method protocols currently being implemented, along with re-assaying to identify zones where gold grade may be under-estimated and under-reported

Gold Bull CEO, Cherie Leeden commented:

After observing visible gold in RC chips, and reviewing the repeatability of some field duplicate samples, it became apparent that the Company needed to investigate our laboratory technique. By improving the quality of our laboratory technique to suit our coarse gold geology at Sandman, we have an opportunity to include mineralization in the mineral resource estimate that might otherwise have be excluded, while also improving the accuracy of data used in the mineral resource estimate. The re-analysis with this different lab technique is indicating a significant increase in gold values in most samples which leads me to believe, some of the coarse-grained gold may have been getting missed in our original laboratory technique. Additional re-assaying is currently underway to rectify this, and we will report the new results to the market as we receive them.

Background

Drilling conducted since February 2021 at Sandman has returned several high-grade gold intercepts that have been reported in previous press releases. Hole SA-0001 at Abel Knoll intersected high-grade gold mineralization from 143.25 m to 149.35 m down-hole (refer to press release dated March 21, 2021). The average grade of this interval, based on conventional fire assay (30 g charge), with ICP-OES and gravimetric finish as appropriate, was reported as 10.75 g/t Au, using a 5 g/t cut-off.

High grade gold mineralization was also drilled at North Hill, including an interval from 41.1 m to 54.9 m with average grade 10.95 g/t Au, based on conventional 30 g fire assay and 5 g/t cut-off grade (refer to press release dated March 29, 2021).

Subsequent review of QAQC data (field duplicate samples) from a range of holes and the recent observation of visible gold in RC chips drilled at North Hill (refer to press release dated May 3, 2021) aroused concern that the conventional fire assay analytical technique may not produce repeatable assay results for samples at Sandman, where coarse gold is frequently present in the mineralization. Therefore, coarse rejects from initial crushing of selected samples from SA-0001 and SA-0004 were re-assayed using the metallic screen fire assay method, with ICP-OES or gravimetric finish as appropriate. Screen fire assaying addresses the coarse gold issue by sieving out the coarse fraction and assaying it separately and involves assaying a larger mass (1 kg) of material, with a greater probability of being representative of the drill sample.

The results of re-assaying the SA-0001 and SA-0004 samples using conventional fire assay (30 g charge) versus metallic screen fire assay are compared in graphical form (Figure 1) and tabulated (Table 1 and Table 2) below. Results from some samples are increased and others decreased. This is a consequence of the conventional fire assay determination being made on a small sample randomly selected from material where coarse grains of gold are distributed throughout, not necessarily uniformly. Efforts to fully homogenize coarse gold throughout samples by pulverization are not fully effective. Metallic screen fire assay utilizes a 1 kg pulp that is more representative of the drill sample.

The interval in SA-0004 from 41.1 m to 54.9 m returned an average grade of 19.76 g/t Au using metallic screen fire assay, versus 10.88 g/t Au using conventional fire assay with 30 g charge. The substantial increase in average grade in this interval is mainly due to the sample taken at 42.7 m to 44.2 m down-hole, where the metallic screen fire assay returned 116.738 g/t Au. It is not possible to recalculate the average grade of the 143.25 m to 149.35 m interval in SA-0001 because insufficient coarse reject material remained from the sample from 146.3 m to 147.8 m to conduct a metallic screen fire assay. However, substantial variation in grade between the two assay methods can be seen in the tabulated results (Table 1).

In future, Gold Bull will be submitting all samples within geologically identified mineralized zones that return greater than 0.1 g/t Au in conventional 30 g fire assay for re-assay using metallic screen fire assay, where sufficient sample material has been collected.

Next steps:

Submit coarse reject samples from the recent drilling program, including those recently reported as containing visible gold (refer to press release dated May 3, 2021), for metallic screen fire assay

Modify sample preparation and analysis technique moving forward

Continue drilling program to test exploration targets and extend known resources at North Hill, Silica Ridge, SE Pediment and Abel Knoll, commencing first week in June

Figure 1 Cross-plot on logarithmic axes of metallic screen fire assay versus fire assay determinations on selected samples from SA-0001 and SA-0004

https://www.globenewswire.com/NewsRoom/AttachmentNg/f6cd0d73-9849-4c61-ab8b-d2c301694b0d

Table 1 Comparison of Metallic Screen Fire versus conventional Fire Assay results from selected samples in hole SA-0001 at Abel Knoll

Hole No. | From | To | From | To | Au | Au | Change |

SA-0001 | 135.6 | 137.2 | 445 | 450 | 1.795 | 1.15 | 0.645 |

SA-0001 | 137.2 | 138.7 | 450 | 455 | 3.379 | 2.33 | 1.049 |

SA-0001 | 138.7 | 140.2 | 455 | 460 | 4.888 | 3.05 | 1.838 |

SA-0001 | 140.2 | 141.7 | 460 | 465 | 5.372 | 3.95 | 1.422 |

SA-0001 | 141.7 | 143.3 | 465 | 470 | 5.317 | 2.44 | 2.877 |

SA-0001 | 143.3 | 144.8 | 470 | 475 | 8.691 | 18.6 | -9.909 |

SA-0001 | 144.8 | 146.3 | 475 | 480 | 6.727 | 6.18 | 0.547 |

SA-0001 | 146.3 | 147.8 | 480 | 485 | Insufficient sample for SCRFA | ||

SA-0001 | 147.8 | 149.4 | 485 | 490 | 6.76 | 5.29 | 1.47 |

SA-0001 | 149.4 | 150.9 | 490 | 495 | 2.839 | 3.92 | -1.081 |

SA-0001 | 150.9 | 152.4 | 495 | 500 | 2.67 | 1.74 | 0.93 |

Table 2 Comparison of Metallic Screen Fire versus conventional Fire Assay results from selected samples in hole SA-0004 at North Hill

Hole No. | From | To | From | To | Au | Au | Change |

SA-0004 | 39.6 | 41.1 | 130 | 135 | 0.032 | 0.017 | 0.015 |

SA-0004 | 41.1 | 42.7 | 135 | 140 | 18.629 | 24.9 | -6.271 |

SA-0004 | 42.7 | 44.2 | 140 | 145 | 116.738 | 3.47 | 113.268 |

SA-0004 | 44.2 | 45.7 | 145 | 150 | 31.095 | 39.3 | -8.205 |

SA-0004 | 45.7 | 47.2 | 150 | 155 | 8.021 | 23.9 | -15.879 |

SA-0004 | 47.2 | 48.8 | 155 | 160 | 2.079 | 1.78 | 0.299 |

SA-0004 | 48.8 | 50.3 | 160 | 165 | 0.383 | 3.6 | -3.217 |

SA-0004 | 50.3 | 51.8 | 165 | 170 | 0.652 | 0.33 | 0.322 |

SA-0004 | 51.8 | 53.3 | 170 | 175 | 0.103 | 0.168 | -0.065 |

SA-0004 | 53.3 | 54.9 | 175 | 180 | 0.135 | 0.492 | -0.357 |

About Sandman

In December 2020, Gold Bull purchased the Sandman Project from Newmont. Gold mineralization was first discovered at Sandman in 1987 by Kennecott and the project has been intermittently explored since then. There are four known pit constrained gold resources located within the Sandman Project, consisting of 21.8Mt @ 0.7g/t gold for 494,000 ounces of gold; comprising of an Indicated Resource of 18,550kt @ 0.73g/t gold for 433kozs of gold plus an Inferred Resource of 3,246kt @ 0.58g/t gold for 61kozs of gold. Several of the resources remain open in multiple directions and the bulk of the historical drilling has been conducted to a depth of less than 100m. Sandman is conveniently located circa 25-30 km northwest of the mining town of Winnemucca, Nevada.

Qualified Person

Cherie Leeden, B.Sc Applied Geology (Honours), MAIG, a “Qualified Person” as defined by National Instrument 43-101, has read and approved all technical and scientific information contained in this news release. Ms. Leeden is the Company’s Chief Executive Officer. Cherie Leeden relied on resource information contained within the Technical Report on the Sandman Gold Project, prepared by Steven Olsen, a Qualified Person under NI 43-101, who is a Qualified Persons as defined by the National Instrument NI 43-101. Mr Olsen is an independent consultant and has no affiliations with Gold Bull except that of an independent consultant/client relationship. Mr Olsen is a member of the Australian Institute of Geoscientists (AIG) and is the Qualified Person under NI 43-101, Standards of Disclosure for Mineral Projects.

Quality Assurance – Quality Control

Drilling was completed using Reverse Circulation (RC) drilling utilizing double wall drill pipe, interchange hammer and 4¾ inch hammer bits to drill and sample the rock formation. Samples were taken over 5 foot intervals (1.52m) and were collected after separation of the sample using a rotary splitter situated at the base of the cyclone. A small portion of the rock chips for each 5 foot interval was placed into chip trays for record keeping and geological logging. The samples bagged at the rig were taken to American Assay Laboratories in Sparks NV by a Company employee. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program is overseen by the Company’s Qualified Person, Cherie Leeden, Chief Executive Officer.

Samples are submitted to American Assay Laboratories’ analytical facility in Sparks, Nevada for preparation and analysis. The AAL facility is ISO-17025 accredited by IAS. Where samples are re-submitted for metallic screen fire assay, the coarse reject material remaining from initial crushing is pulverized so that 85% of material passes -150 mesh. Three separate 50 g fire assays are completed on different fractions—one at the +150 mesh and two at the -150 mesh with a resulting calculated grade completed using the weights of the corresponding fractions and fire assay results. Analysis for gold is by 50 g fire assay lead collection with Inductively Coupled Plasma Optical Emission Spectroscopy (ICP-OES) finish with a lower limit of 0.003 ppm. Samples with gold assays above 10 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish, which has a lower detection limit of 0.1029 ppm. A standard fire assay with 50 g charge is also completed for use by the lab to determine the type of finish (ICP or gravimetric) that will be required for the screen fire assays.

About Gold Bull Resources Corp.

Gold Bull’s mission is to grow into a US focused mid-tier gold development Company via rapidly discovering and acquiring additional ounces. The company’s exploration hub is based in Nevada, USA, a top-tier mineral district that contains significant historical production, existing mining infrastructure and an established mining culture. Gold Bull is led by a Board and Management team with a track record of exploration and acquisition success.

Gold Bull’s core asset is the Sandman Project, located in Nevada which has a 494,000 oz gold resource as per 2021 43-101 Resource Estimate. Sandman is located 23 km south of the Sleeper Mine and boasts excellent large-scale exploration potential. Drilling at Sandman is currently underway.

Gold Bull is driven by its core values and purpose which includes a commitment to safety, communication & transparency, environmental responsibility, community, and integrity.

Cherie Leeden

President and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull Resources Corp., please visit our website at www.goldbull.ca or email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed “forward-looking statements” with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential”, “indicates”, “opportunity”, “possible” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although Gold Bull believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company’s ability to raise sufficient capital to fund its obligations under its property agreements going forward, to maintain its mineral tenures and concessions in good standing, to explore and develop its projects, to repay its debt and for general working capital purposes; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations, future prices of copper and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the potential for new discoveries, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company’s plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Yahoo Finance

Yahoo Finance