‘Weaponization’ of Reserves Is a Top Risk for Central Banks

(Bloomberg) -- Central bank reserve managers are increasingly worried about the safety of their currency assets, citing rising geopolitical risk across the world, according to a UBS Group AG survey.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Saudi Prince’s Trillion-Dollar Makeover Faces Funding Cutbacks

Modi’s Embrace of Putin Irks Biden Team Pushing Support for Kyiv

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

Stocks See Big Rotation as Yields Sink on Fed Bets: Markets Wrap

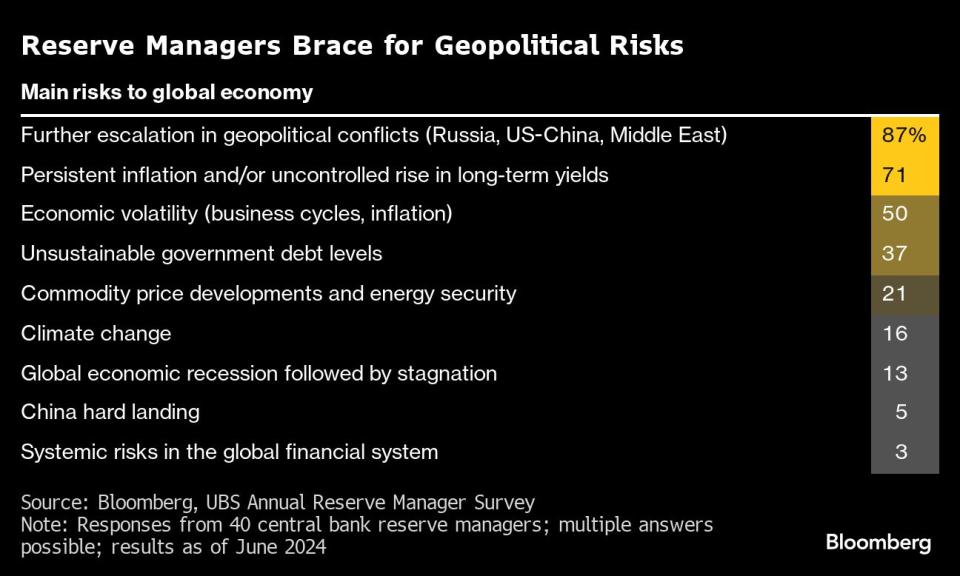

The so-called “weaponization” of FX reserves was listed as a top risk by a third of the participants, double last year’s amount. The biggest concern for 87% of 40 central banks surveyed by UBS was a further escalation in the tensions between Russia and Ukraine, China and the US, as well as the situation in the Middle East.

The worry is that central bank assets could be sanctioned, seized or tapped if conflicts escalate. A plan outlined earlier this year to use profits from Russia’s frozen foreign-currency assets to help rebuild Ukraine has set a dangerous precedent that risks undermining the status of FX reserves as a country’s most liquid and secure store of wealth.

These events “raise further the risk that FX reserves are no longer seen as a safe haven for central banks,” said Massimiliano Castelli, head of global sovereign markets at UBS Asset Management. He added gold might be “brought back to life by ongoing geopolitical trends.”

That could spur a shift out of dollar-denominated assets, further challenging the greenback’s dominance.

The average share of dollar holdings among central banks surveyed — which manage half of global FX reserves — was 55%, little changed from 56% a year ago. That share was 67% in 2021 and it has been gradually grinding lower. Meanwhile, a quarter of the respondents said they increased allocations to the euro, while 8% added to yen holdings.

“There is a view that the dollar will be damaged by the weaponization of currency reserves for geopolitical reasons,” Castelli said, adding that an escalation in US sanctions against countries including Russia were prompting them to conduct business in other currencies.

The prospect of escalating political risk was underscored at a summit of NATO leaders Wednesday, which issued the alliance’s strongest-ever language against China’s military support for Russia’s invasion of Ukraine. Half of the surveyed reserve managers believe the conflict will continue beyond 2026.

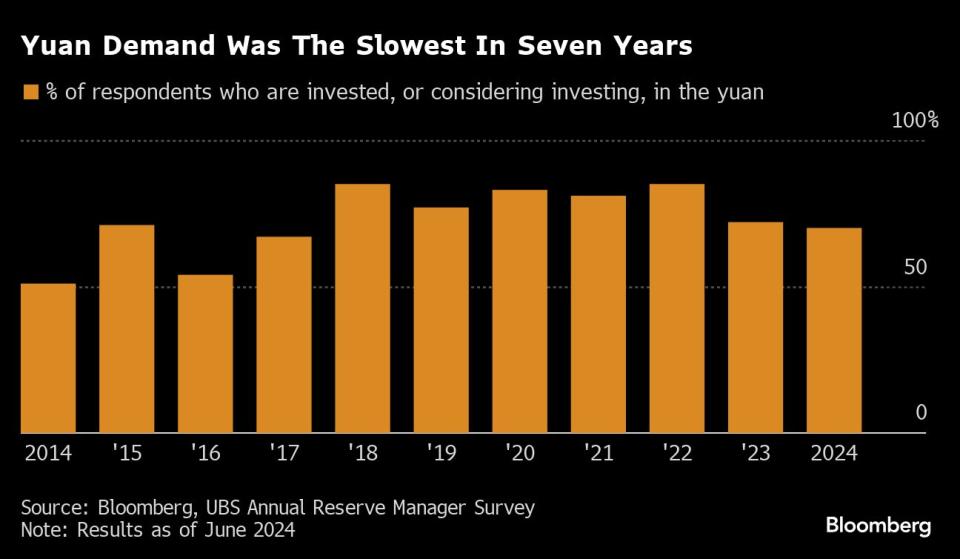

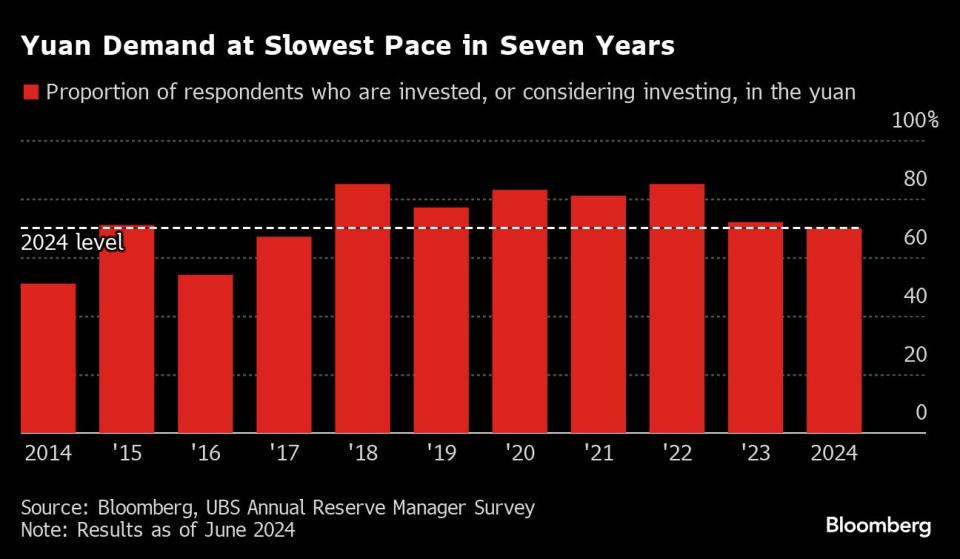

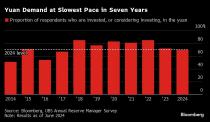

Demand for yuan-denominated assets, in the meantime, dropped on concerns about a slowing Chinese economy. The share of respondents saying they were invested or were considering investing in the yuan fell to 70% from 72% last year, hitting the lowest since 2017.

Reserves managers are also more worried about political fragmentation and bloated public accounts than they were a year ago. The share of participants citing unsustainable debt levels as a main risk to the global economy more than doubled to 37%.

On the occasion of Bretton Woods’ 80th Anniversary, this year’s UBS survey also inquired participants about global financial organizations, which most saw as becoming obsolete without reforms. Only one third believe that the current international financial architecture is resilient enough to survive current challenges that include income inequality, climate change and demographic changes.

--With assistance from Heng Xie.

(Updates with NATO summit in eighth paragraph)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance