Gig Economy Stocks Q1 Teardown: Uber (NYSE:UBER) Vs The Rest

Looking back on gig economy stocks' Q1 earnings, we examine this quarter's best and worst performers, including Uber (NYSE:UBER) and its peers.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 5 gig economy stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 3.3%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and gig economy stocks have had a rough stretch, with share prices down 5% on average since the previous earnings results.

Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

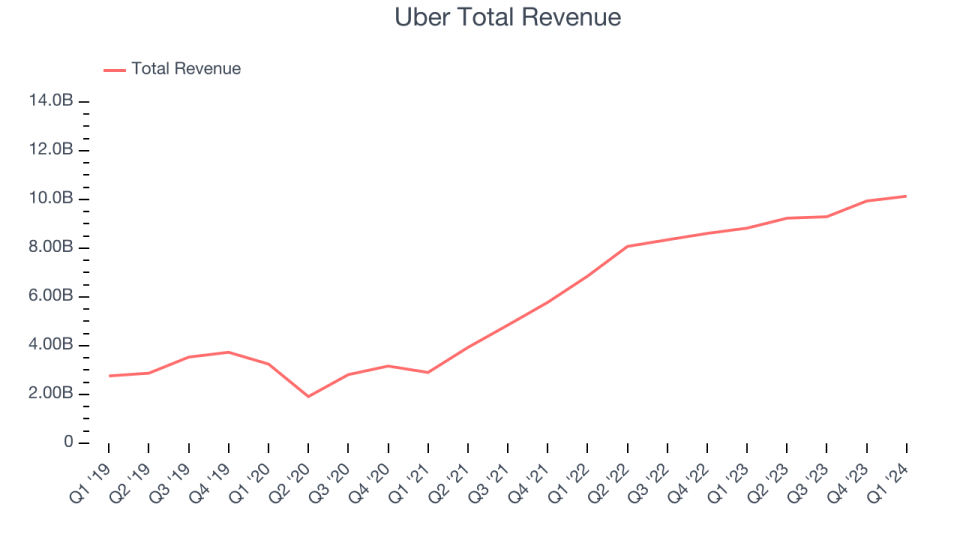

Uber reported revenues of $10.13 billion, up 14.8% year on year, in line with analysts' expectations. It was an ok quarter for the company, with strong growth in its users but slow revenue growth.

“Our results this quarter once again demonstrate our ability to deliver consistent, profitable growth at scale,” said Dara Khosrowshahi, CEO.

Uber delivered the weakest performance against analyst estimates of the whole group. The company reported 149 million users, up 14.6% year on year. The stock is down 9.8% since the results and currently trades at $63.49.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Best Q1: Lyft (NASDAQ:LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

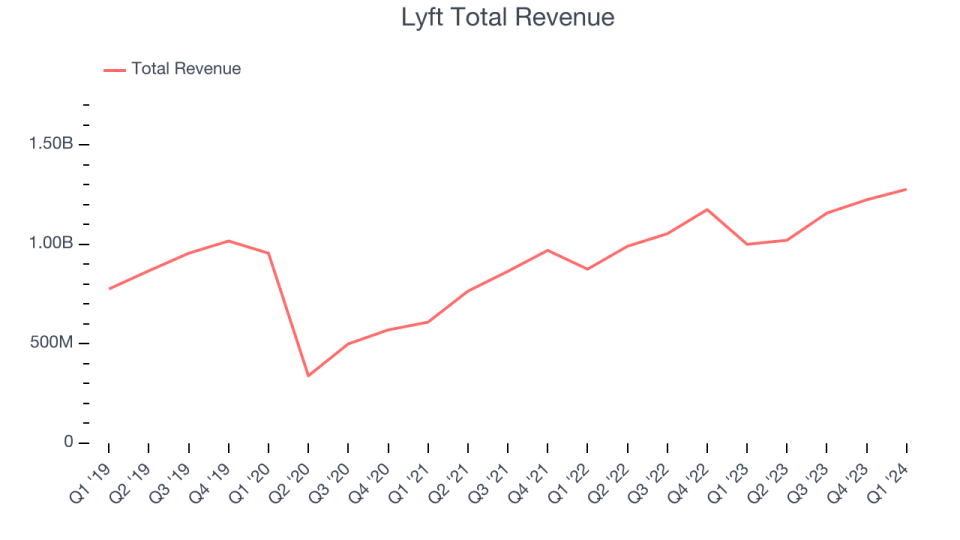

Lyft reported revenues of $1.28 billion, up 27.7% year on year, outperforming analysts' expectations by 10.2%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue estimates and strong top-line growth.

Lyft achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 21.9 million users, up 12% year on year. The stock is down 5.8% since the results and currently trades at $15.63.

Is now the time to buy Lyft? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $305.4 million, down 14.1% year on year, exceeding analysts' expectations by 2.5%. It was a weak quarter for the company, with a decline in its requests and slow revenue growth.

Angi had the slowest revenue growth in the group. The company reported 4.13 million service requests, down 31.3% year on year. The stock is down 14.5% since the results and currently trades at $2.24.

Read our full analysis of Angi's results here.

DoorDash (NYSE:DASH)

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE:DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $2.51 billion, up 23.5% year on year, surpassing analysts' expectations by 2.5%. It was a strong quarter for the company, with a decent beat of analysts' revenue estimates and solid revenue growth.

The stock is down 12% since the results and currently trades at $112.1.

Read our full, actionable report on DoorDash here, it's free.

Fiverr (NYSE:FVRR)

Based in Tel Aviv, Fiverr (NYSE:FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $93.52 million, up 6.3% year on year, surpassing analysts' expectations by 1.1%. It was a weaker quarter for the company, with a decline in its buyers and slow revenue growth.

The company reported 4 million active buyers, down 7% year on year. The stock is up 22.5% since the results and currently trades at $24.9.

Read our full, actionable report on Fiverr here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance