German rise in unemployment three times worse than expected

German unemployment has risen by more than expected in a blow to hopes that it is recovering from a downturn.

There were another 25,000 people out of work in May, data from the Federal Labor Agency show, which was well ahead of Bloomberg expectations of a gain of 7,000.

The unemployment rate held at 5.9pc.

The Federal Labor Agency’s head Andrea Nahles said: “The spring recovery hasn’t really taken off this year.”

There were 702,000 job openings in Germany in May, 65,000 fewer than a year ago.

According to a labour office analysis, the number of professions with a pronounced shortage of skilled workers has fallen slightly, to 183 affected occupations from 200.

The shortage has eased for skilled labour in structural engineering and facade construction, as well as engineers in aerospace technology, the office said.

However, this is not indicative of a long-term trend, according to Ms Nahles. She said: “Due to demographic developments, many well-qualified and experienced skilled workers will continue to leave the labour market in the coming years.”

Germany is recovering from an economic contraction at the end of 2023.

The Ifo Institute said in March that Germany will be the worst-performing rich economy in the world for the second year in a row as chancellor Olaf Scholz battles a property downturn and uncertainty over net zero targets.

Its economic recovery hit the buffers last month as business confidence stopped growing.

The Ifo Business Climate Index held steady in May, ending a three-month run of increases that had boosted expectations of a solid economic recovery.

Germany’s Dax stock market fell as much as 1.3pc on Tuesday amid concerns that the US economy is also not as strong as thought.

In a separate development, the European Central Bank is expected to soon push several German banks to build up higher reserves to protect themselves against property defaults, according to Bloomberg News.

German banks with large real estate portfolios have seen their profitability hit as they increased their reserves in case of loan losses amid a housing downturn, where falling property prices have forced developers to cancel projects.

Eleven of Germany’s biggest banks set aside €2.5bn (£2.1bn) last year to offset loan defaults on commercial real estate.

06:06 PM BST

Signing off

That’s all from us today. Here are the latest headlines:

George Osborne’s support of Standard Chartered in question after Hamas financing claims

The tragedy for Sunak is that things really are getting better

MailOnline chief warns AI tie-ups are not enough to ‘save the industry’

Labour risks breaking debt rule with net zero borrowing binge

05:34 PM BST

M&S to make meals for food banks as part of King’s anti-waste scheme

Marks & Spencer is to make special pizzas, curries and soups for food banks and homeless shelters in a boost to the King’s anti-waste scheme.

Retail editor Hannah Boland has the story:

The retailer has developed a range of meals that can be made using surplus ingredients from its food factories that it will then deliver to food waste charity Fareshare.

M&S is making a £1m investment in the project, under which it will produce more than 1.5m freshly prepared meals for Fareshare to distribute among charities and community groups across the UK.

The three different meals - vegetable curry, carrot and coriander soup and family-sized pizza - will be freshly made at M&S’s supplier factories and will have a guarantee of four days’ life from when they are donated.

M&S said they were designed to feed between two and four people, and were nutritionally balanced.

Alex Freudmann, M&S’s head of food, said: “By utilising ingredients, capacity and time available within our supply chain, we’re able to donate so much more product and ultimately help more people.”

The retailer has unveiled the investment as part of the Coronation Food Project, which was launched by the King last November to help reduce food waste.

The legacy project, first revealed by The Telegraph, was prompted by the King’s “increasing concern” over the cost of living crisis. Its launch coincided with His Majesty’s birthday, with the King wanting to use the milestone to “shine a light” on a cause close to his heart.

It followed fears that pressures on households were making it more difficult for people to donate food, while demand at food banks was surging.

The King’s scheme is aiming to help increase the proportion of meals circulating to charities by joining the dots between the food waste generated by supermarkets and food producers, and the organisations that can help get meals out to people in need.

It said it would be establishing up to eight new food hubs where it could store food and package it before distributing to food banks and community kitchens.

The Coronation Food Project is aiming to circulate 200m meals a year in the long-term. It would mark a significant increase on the 125m currently distributed by the charity FareShare.

M&S donated more than 25.3m meals through its supply chain over the last year, distributing them through FareShare and Neighbourly, another food charity.

04:51 PM BST

FTSE 100 closes in the red

The FTSE 100 has closed down 0.35pc at 8,233.46. The blue-chip index was weighed down by laggards Fresnillo, Ocado and Standard Chartered.

03:56 PM BST

Language app Duolingo removes LGBT references in Russia

Duolingo has deleted LGBT references in Russia amid pressure from the country’s communications watchdog.

The language learning app has reportedly removed what Moscow calls “non-traditional sexual relations”.

It comes after Roskomnadzor, Russia’s communications regulator, reportedly warned Duolingo against publishing material promoting non-traditional sexual relations and LGBT content.

“The company Duolingo sent Roskomnadzor a letter in response, in which it confirmed that it had deleted materials promoting non-traditional sexual relations from its training app,” Russian news agencies quoted Roskomnadzor as saying on Tuesday.

Russia has described the “LGBT movement” as extremist and those supporting it as terrorists, opening the door for serious criminal cases against LGBT people and their advocates.

Russian courts have handed fines for those which violate its “LGBT propaganda” law, including online film distributors and executives.

Duolingo was contacted for comment.

03:31 PM BST

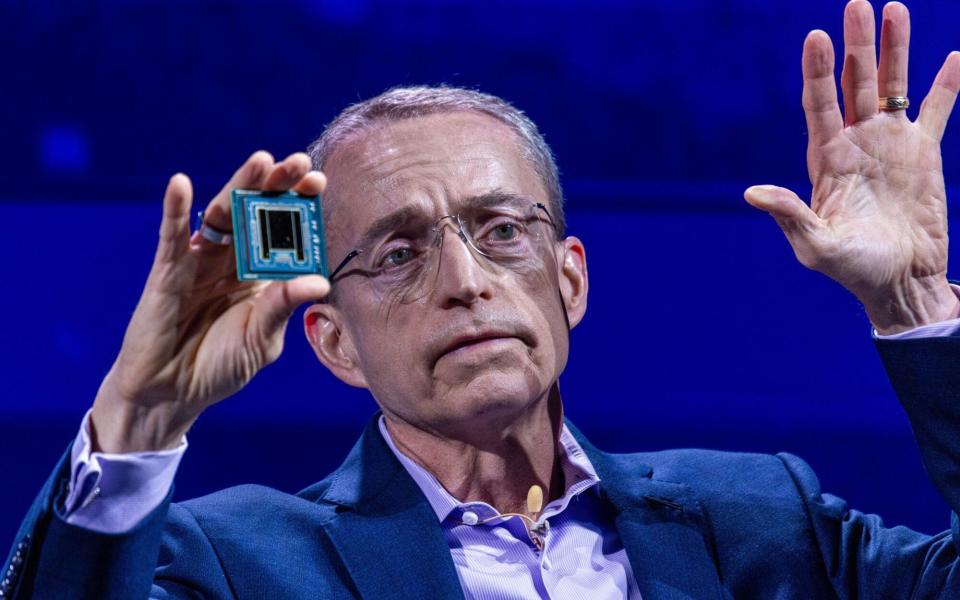

Pictured: Intel boss shows off chip designed to take on Nvidia

The boss of Intel has showed off his company’s new processor designed to put it back on track in the fight for dominance of the computing market after the rise of semiconductor giant Nvidia.

Pat Gelsinger showed off the new Xeon 6 data centre chip at the Computex show in Taiwan.

Talking about the AI race, he said:

I think of it like the internet 25 years ago, it’s that big.

We see this as the fuel that’s driving the semiconductor industry to reach $1 trillion by the end of the decade.

Shares of Intel fell 0.4pc in early trading in New York.

With that I will head off for the day and leave you in the ever-capable hands of Adam Mawardi.

03:21 PM BST

Brazilian economy gathers pace as shoppers spend more

Brazil’s economy grew 0.8pc in the first quarter, the government said, as it was boosted by consumer spending which analysts say could put the central bank on guard over inflation.

The result was slightly better than analysts’ forecasts of 0.7pc in Latin America’s biggest economy, whose President Luiz Inacio Lula da Silva has vowed to deliver “solid” growth.

Lula said the result was “more proof we are on the right track,” in a post on Twitter.

Brazil’s GDP was up 2.5pc compared to the first quarter of 2023, said the Brazilian Institute of Statistics (IBGE).

Independent analyst Andre Perfeito noted a 1.5pc increase in household consumption was a key factor in the first quarter growth, with more Brazilians working after a fall in unemployment.

William Jackson, chief emerging markets economist at Capital Economics, said the pace of growth and consumer spending “will raise (even more) concerns about inflation at the central bank.”

The central bank has slowly made tiny adjustments downwards of the interest rate, now at 10.5pc, under pressure from Lula who has said high lending costs are hurting economic growth.

03:05 PM BST

US job vacancies fall to lowest level in three years

US job openings fell in April to the lowest level since 2021 but they remained at historically strong levels despite high interest rates and signs the economy is slowing.

The Labor Department reported that employers posted 8.1m vacancies in April, down from a revised 8.4m in March.

Layoffs also fell, and the number of Americans quitting their jobs — a sign of confidence in their prospects — rose in April.

Monthly job openings have come down steadily a peak of 12.2m in March 2022 — as the economy’s recovery from Covid lockdowns left companies desperate for workers — but they remain at a high level.

Before 2021, they never topped 8m — a threshold they have now reached for 38 straight months.

The high level of job openings reflects a surprisingly strong US jobs market. When the Federal Reserve began raising interest rates in March 2022 to combat a resurgence in inflation, the higher borrowing costs were expected to tip the economy into recession and push up unemployment.

JOLTS charts:

1/ "The Great Stay" continued in April, with hires unchanged at levels historically consistent with an unemployment rate of about 5%.

It's a good time to have a job, but a not-great time to be looking for one. pic.twitter.com/0PdtfL2k2x— Guy Berger (@EconBerger) June 4, 2024

02:36 PM BST

US stocks fall at the open

Wall Street’s main indexes inched down as concern grew about the health of the world’s largest economy.

The Dow Jones Industrial Average fell 52.17 points, or 0.1pc, at the open to 38,518.86.

The S&P 500 opened lower by 5.16 points, or 0.1pc, at 5,278.24, while the Nasdaq Composite dropped 4.79 points, meaning it was essentially little changed at 16,823.88 at the opening bell.

02:12 PM BST

Next hits record high amid improving outlook for economy

Shares in high street retailer Next have hit a record high amid the improving outlook for the UK economy.

The clothing and homeware seller, which is considered a bellwether for the retail sector, climbed 1.6pc to hit £94.68, putting it 17pc higher so far this year.

It comes amid hopes that the Bank of England could cut interest rates in August, potentially giving consumers more money to spend.

02:01 PM BST

Toyota’s headquarters inspected amid testing scandal

Japanese transport officials inspected Toyota’s headquarters after the carmaker and four others including Honda and Mazda admitted failure to fully comply with national vehicle inspection standards.

Five representatives visited the offices in central Aichi region to probe breaches declared by the company related to domestic shipment certifications.

The transport ministry on Monday told five Japanese car giants - Toyota, Honda, Mazda, Suzuki and Yamaha - to stop delivering the affected vehicle models within Japan.

Toyota and others have stressed that the vehicles in question are safe and in some cases passed internal tests that were stricter than the standardised requirements.

“We will carry out on-site inspections” at each of the companies, transport minister Tetsuo Saito told reporters.

“These acts erode the trust of vehicle users and shake the very foundation of the vehicle certification system. It is extremely regrettable,” he said on Tuesday.

The sprawling scandal has sparked soul-searching within the country’s huge auto industry, following safety test irregularities at Toyota subsidiary Daihatsu.

01:32 PM BST

Museum workers end strikes after pay deal

Museum workers have voted to accept an improved pay offer, bringing an end to a long-running dispute.

Members of the Public and Commercial Services union (PCS) at National Museums Liverpool (NML) have taken more than 60 days of action, complaining that their employer was withholding a cost-of-living payment.

The action affected the Museum of Liverpool, the World Museum, the International Slavery Museum and the Maritime Museum.

The workers have voted to accept an offer of a one-off £1,200 cost-of-living payment, two extra days’ holiday a year and a 35pc discount in museum cafes, said the PCS.

General secretary Fran Heathcote said:

Congratulations to our members at NML who through their strength and determination have won this dispute.

They stood firm through many months of strike action and have now been rewarded with a significant sum and extra benefits.

01:10 PM BST

Russia welcomes Turkey’s desire to join Brics economic bloc

Russia welcomes Turkey’s reported desire to become part of the Brics group of nations, a Kremlin spokesman has said.

Dmitry Peskov said there was heightened interest in the group - comprising Brazil, Russia, India, China, South Africa, Ethiopia, Iran, Egypt, and the United Arab Emirates - from various states.

However, he said it was unlikely the grouping could completely satisfy all interested nations.

On Monday, Turkish Foreign Minister Hakan Fidan began a visit to Beijing, the highest-level visit by a Turkish official to Brics member China since 2012. Fidan held talks with Chinese counterpart Wang Yi and other officials during the visit.

Asked whether Turkey would want to join Brics during a talk at the Center for China and Globalisation on Monday, Fidan said “we would like to of course, why would we not?”. However, he did not elaborate further.

12:37 PM BST

Weight loss drug poised to be offered to UK patients

A type 2 diabetes drug has been recommended to help obese people lose weight on the NHS.

Mounjaro - also known as tirzepatide - is made by US drugs giant Eli Lilly and is part of a family of medications that help manage blood sugar, known as glucagon-like peptide-1 (GLP-1) agonist.

Other drugs from this family include semaglutide - sold under the brand names Wegovy, Ozempic and Rybelsus, which are made by Eli Lilly’s Danish rival Novo Nordisk.

In September, the National Institute for Health and Care Excellence (Nice) recommended Mounjaro as an option for type 2 diabetics who could not tolerate metformin.

It has now issued draft guidance saying the drug should also be an option to help people manage obesity.

It comes after the Medicines and Healthcare products Regulatory Agency (MHRA) authorised Mounjaro to be used to help obese adults with weight loss in November.

12:22 PM BST

Kremlin accuses Microsoft of ‘absolute slander’ over Paris Olympics warning

The Kremlin has accused Microsoft of “absolute slander” over allegations that Russia has unleashed a wave of online disinformation against France and the upcoming Paris Olympics.

Microsoft said in a blog post published on Sunday that the campaign was specifically designed to denigrate the reputation of the International Olympic Committee (IOC) and create the impression that the summer games will be marred by violence.

The US tech giant said the disinformation included falsified news websites and a feature-length documentary film.

Kremlin spokesman Dmitry Peskov said the criticism had no substance behind it.

12:00 PM BST

US stocks on track to fall at the opening bell

Stock markets on Wall Street are expected to slump at the opening bell amid concerns about the strength of the US economy.

Megacap stocks including Nvidia, Apple, Alphabet and Meta were down between 0.3pc and 0.9pc in premarket trading.

It comes after stocks slipped on Monday after survey data showed US factory activity had slowed more than expected in May and construction spending slipped in April.

However, a string of recent data points to the economy slowing more than expected, causing investors to fret even as markets expect an earlier start to interest rate cuts.

Traders are now pricing in a nearly 62pc chance of the Fed cutting rates in September, up from about 53pc before the ISM data were released and under 50pc last week, according to the CME’s FedWatch tool.

In premarket trading, the Dow Jones Industrial Average, S&P 500 and Nasdaq 100 were all down about 0.5pc.

11:41 AM BST

Germany hit by unemployment blow as recovery fails to take off

German unemployment has risen by more than expected in a blow to hopes that it is recovering from a downturn.

There were another 25,000 people out of work in May, which was well ahead of Bloomberg expectations of a gain of 7,000.

The unemployment rate held at 5.9pc, the Federal Labor Agency said.

Its head Andrea Nahles added: “The spring recovery hasn’t really taken off this year.”

Germany is recovering from an economic contraction at the end of 2023.

The Ifo Institute said in March that Germany will be the worst-performing rich economy in the world for the second year in a row as Olaf Scholz battles a property downturn and uncertainty over net zero targets.

Its economic recovery hit the buffers last month as business confidence stopped growing.

The Ifo Business Climate Index held steady in May, ending a three-month run of increases which had boosted expectations of a solid economic recovery.

Good Morning from Germany where the spring upturn in the labor market is timid. Although the number of unemployed fell further in May, it was far lower than usual at this time of year. The corresponding unadjusted unemployment rate dropped to 5.8%. But adjusted for seasonal… pic.twitter.com/t1JQQYfon7

— Holger Zschaepitz (@Schuldensuehner) June 4, 2024

11:24 AM BST

Netflix algorithm is not flawless, insists boss

The boss of Netflix has admitted that its algorithm for deciding which shows to make is not flawless.

Greg Peters, co-chief executive of the streaming site, was speaking at the Media And Telecoms 2024 And Beyond Conference on Tuesday.

He cited crime drama Top Boy, which was originally broadcast on Channel 4, teenage comedy Sex Education and war film All Quiet On The Western Front as part of the company’s offering which were given the go-ahead due to being “unique” and did not rely on data.

Mr Peters said: “If it was just as simple as great algorithms then we would have no flops.”

He also said viewers of historical drama The Crown were two times more likely to enjoy legal documentary Pepsi, Where’s My Jet?, citing this as evidence that the algorithm does not always give “obvious” suggestions for viewers.

11:14 AM BST

Shipping giant warns Red Sea crisis could run until the end of the year

Maersk has warned that global shipping routes could be impacted until the end of the year amid attacks on vessels by Iran-backed rebels in the Red Sea.

The Danish container operator revealed that its pre-tax profits plunge by 85pc in the first quarter of the year to $328m (£257m) compared to the same period last year as a result of the attacks.

However, it said a strong container market and the continued disruption meant that was raising its profit outlook for the year as the disruptions effectively remove capacity from the global fleet and thereby boost freight rates.

It is the second time in about a month Maersk has boosted its forecast as Houthi militant attacks in the Red Sea have forced it and other shipping companies to sail south of Africa.

10:41 AM BST

Gas prices fall amid ‘solid’ Norway repair plans

Natural gas prices have fallen after the operator of a pipeline from Norway said it has a “solid plan” to fix the issue which has limited supplies to Britain.

Gassco said it would be making repairs to the cracked pipeline at the Sleipner Riser platform in the North Sea, which had caused flows to a terminal in East Yorkshire to fall to zero on Monday.

Europe’s benchmark gas contract fell as much as 4.6pc after operator Gassco said the outage would likely come to an end on Friday.

10:28 AM BST

ChatGPT down: AI tool has major outage leaving users unable to access website or app

ChatGPT, the chatbot which helped fuel the excitement around artificial intelligence, has gone down for users around the world.

More than 1,000 users in Britain reported that the app developed by OpenAI was not working, according to the outage tracking website Downdetector.

OpenAI has been contacted for comment.

In case you were wondering, #ChatGPT is down for many users worldwide.

> https://t.co/yLpXPoi2zS pic.twitter.com/c54sI1TPL8— DataChazGPT (not a bot) (@DataChaz) June 4, 2024

#ChatGPT is down. What if it never comes back and we have to use our own brains to write stuff again?

— tokyo_todd (@tokyo_todd) June 4, 2024

10:13 AM BST

Foreign takeovers of UK companies hit four-year low

The number of foreign takeovers of British companies slumped to a four year low in the first three months of the year, official figures show, tempering suggestions of a recovery in interest in UK businesses.

The total value of inward merger deals, where overseas businesses buy British firms, declined 39pc to £6.1bn in the three months to March 31, the lowest figure since 2020, according to the Office for National Statistics (ONS).

Just 144 UK firms were snapped up by a foreign buyer, 15.7pc on the previous quarter, which saw 171 deals.

Among the biggest inward acquisitions of the first quarter was the buyout of British oil and gas company Neptune Energy by Italy’s Eni for £3.9bn.

The sparse figures appear to be a hangover from 2023, which saw a collapse in mergers and acquisitions (M&A) in the UK, following a period of steep rises in inflation and interest rate increases by the Bank of England.

The data preceded a flurry of renewed interest in British companies from foreign suitors in recent months, with a number of high-profile approaches in May alone.

London-listed firms including Royal Mail and mining group Anglo American are being pursued, with the former subject to a £3.5bn bid by Czech billionaire Daniel Kretinsky last week.

Meanwhile, Australian mining giant BHP is attempting to seal a £39bn takeover of Anglo American.

Acquisitions of UK companies by other UK companies were valued at £3.0 billion in Quarter 1 (Jan to Mar) 2024, similar to Quarter 4 (Oct to Dec) 2023 (£3.0 billion).

Read more ➡️ https://t.co/jHc2846Syf pic.twitter.com/qnXVBMkx2J— Office for National Statistics (ONS) (@ONS) June 4, 2024

09:53 AM BST

Steelworkers back strike action at Port Talbot

More workers have backed industrial action in protest at plans by Tata to change the way it produces steel, which will mean the loss of jobs.

The GMB union said its members at the steel giant voted by 72pc in favour of strikes.

Members of Unite are going to ban overtime and begin a work to rule later this month in protest at the closure of blast furnaces at Port Talbot in South Wales.

The company is moving to a greener form of production, using an electric arc furnace, which needs fewer workers.

Charlotte Brumpton-Childs, GMB national officer, said:

These brave workers have said clearly - they won’t go down quietly.

We will now be discussing next steps with our members, reps and sister unions.

Whilst Tata seem determined to douse the heat of our blast furnaces, the fire burns within our members’ hearts. They’ll fight to the last to protect their industry.

A Tata Steel spokesman said the strikes were “disappointing”, adding that the company is considering its “legal options regarding the legality of their ballot”.

09:39 AM BST

Oil prices fall amid oversupply fears

Oil has slumped to its lowest level in four months amid concerns about oversupply in the market.

International benchmark Brent crude fell 1.4pc towards $77 a barrel after tumbling 3.4pc on Monday. West Texas Intermediate was down 1.6pc to $73.

The fall comes after the Opec cartel and its allies revealed plans to return barrels to the market earlier than expected.

The alliance is scheduled to start unwinding output cuts as early as October, despite persistent concerns around the demand outlook and robust supply from outside of the group.

Some market watchers had expected Opec+ to extend cuts to the end of the year.

Warren Patterson, head of commodities strategy for ING, said the unwinding of cuts “will leave the market in a small surplus next year”.

09:16 AM BST

Gas prices swing after fault hits Norwegian flows to UK

Natural gas prices remain near their highest level this year after the outage at a plant in Norway disrupted supplies.

Europe’s benchmark contract has fallen as much as 1.8pc having earlier risen by 1.3pc following the fault at Norway’s Sleipner Riser platform, which led to unplanned works at its Nyhamna gas processing plant.

The outage reduced gas flows to Britain’s Easington terminal in East Yorkshire, which is an entry point for a third of Britain’s total supply.

The gas restrictions are set to last until at least Wednesday, but the duration of the outages and the broader impact on supply remains uncertain.

Norway’s Equinor said it is mapping out the repairs for a segment of pipeline at the Sleipner gas field in the North Sea, with operator Gassco looking at ways to redirect the gas if the damage leads to a prolonged outage.

Dutch front-month futures, Europe’s gas benchmark, were last down 1.3pc to about €35 per megawatt hour.

08:55 AM BST

FTSE 100 falls amid doubts about US economy

UK stocks slipped amid signs of weakness in the US economy, even as the data boosted hopes for an interest rate cut.

The blue-chip FTSE 100 index and the midcap FTSE 250 were both down 0.5pc.

Energy stocks BP and Shell fell 2.7pc and 1.9pc, respectively, after ratings agency S&P Global revised lower BP’s credit outlook while the latter fell as oil prices slipped 1.2pc.

On Monday, the Institute for Supply Management (ISM) released its manufacturing index showing US activity contracted for a second successive month in May.

The figures indicated that businesses were struggling with elevated interest rates and weak consumer spending, among other things.

However, investors increased bets on a September rate cut by the Federal Reserve.

Among other stocks, Tritax Eurobox was one of the top gainers on the FTSE 250 with a 2.7pc jump after Brookfield Asset Management said it is in early stages of a possible offer for the company.

08:41 AM BST

Mission Group considers fresh £32.3m takeover bid from rival

Digital marketing company Mission Group has said it is considering a higher £32.3m takeover approach from rival Brave Bison but revealed its initial view is that the proposal is still unlikely to get its backing.

Brave Bison, which owns the Social Chain agency founded by Dragons’ Den star Steven Bartlett, said on Monday that it had put forward an increased possible bid worth around 35.1p per Mission share on May 25 after its first approach was rejected.

The new proposal suggests giving Mission shareholders about a 50pc holding in the newly formed company and would offer a partial cash alternative of up to 50pc of the offer price.

It is an increase on the initial potential all-stock offer put forward by Brave Bison, which was worth around 29p a share, valuing fellow Aim-listed rival Mission Group at about £27m.

But Mission Group said the latest takeover tilt may still be inadequate. Its shares rose 1.2pc in early trading.

Mission Group said: “The board’s preliminary view is the revised possible offer does not reflect Mission’s contribution to the proposed combined group.”

It added that the group and its advisers are “evaluating the revised possible offer and a further announcement will be made in due course”.

Mission’s board unanimously rebuffed the first approach, which it said was “opportunistic and significantly undervalues the group and its prospects”.

08:27 AM BST

Modi ally suffers £9.7bn stock slump as Indian elections closer than expected

More than 1 trillion rupees (£9.7bn) has been wiped off the value of industrial conglomerate Adani Enterprises as the result of the Indian general election appears to be closer than expected.

Shares in the main listed unit of Indian billionaire Gautam Adani’s company fell 25pc as the ongoing vote count in the national elections suggested a reduced majority for Prime Minister Narendra Modi’s party.

Mr Adani, the multinational group’s billionaire chairman, is a close ally of the Indian leader and his Right-wing Bharatiya Janata party.

Since Mr Modi took office a decade ago, Mr Adani’s fortune has ballooned as his sprawling empire won state contracts to build infrastructure projects across the country, making him one of the world’s richest men with a net worth of $134bn (£110bn) at the end of 2022.

However, opposition parties and other critics have accused Mr Adani of benefitting from their relationship to unfairly win business and avoid proper oversight.

Adani Enterprises was trading at $32.72 (2,733 rupees) per share after midday, down $9.05 from Tuesday’s open.

It was the biggest negative mover on the Mumbai stock exchange, with the benchmark Sensex index falling more than 7pc by afternoon trading.

Exit polls had predicted a landslide victory for Mr Modi’s Bharatiya Janata Party (BJP) and its allies in this year’s election.

With nearly half of the vote counted, election commission figures on Tuesday afternoon still showed Mr Modi on course to win a third term but with a reduced majority.

08:03 AM BST

UK markets open lower

The FTSE 100 has fallen at the open amid concerns about the health of the US economy.

The UK’s blue chip index was down 0.4pc to 8,240.90 after figures showing American factory output shrank at a faster pace in May.

The midcap FTSE 250 fell 0.7pc to 20,762.46.

07:59 AM BST

British American Tobacco expects hit from ‘illicit’ single-use vapes

British American Tobacco (BAT) has cautioned that a cost-of-living squeeze on consumers affected cigarette spending and the rise of illicit disposable vapes in the US will impact its financial performance this year.

The tobacco giant said it expects its revenues and adjusted profit over the first half of the year to be down by about 1pc to 5pc versus 2023, on a constant currency basis.

It is predicting its performance to improve over the second half of the financial year.

BAT’s chief executive Tadeu Marroco said: “Our guidance also reflects ongoing macro-economic pressures, particularly in the US market and continued lack of effective enforcement against the growing illicit vapour segment.”

07:44 AM BST

US private equity snaps up UK homes for rent

US private equity giant Blackstone and shared office space company Regis have agreed a £580m deal to buy a series of new-build buy-to-let properties.

The duo will buy about 1,750 new-build homes from house builder Vistry on 36 sites across the South East of England.

The properties will be managed by private rented housing provider Leaf Living, which is backed by Blackstone and Regis.

The first completions under the agreement are expected by the end of June, with the majority of homes expected to complete within the next two years.

James Seppala, head of European real estate at Blackstone, said:

Institutional private capital can play an important role in providing high quality housing stock across the UK, particularly in the private rented sector which is significantly undersupplied today.

Partnerships such as these can meaningfully accelerate the delivery of new homes and help alleviate structural undersupply across the sector.

Vistry Group chief executive Greg Fitzgerald added: “By working in partnership with organisations like Leaf Living we can maximise the number of high-quality homes we deliver every year.”

07:23 AM BST

Spending on takeaway falls for first time in four years as household bills rise

Spending on takeaways has dropped for the first time in four years after rising bills prompted people to rein in spending on luxuries.

Our senior economics reporter Eir Nolsøe has the details:

Card spending grew at the slowest pace in more than two years in May, according to Barclaycard, with shoppers spending only 1pc more compared with a year earlier. The sluggish spending came as the cost of some household bills and essentials increased in April, which Barclays said dealt a blow to consumer confidence.

Households reduce their use of platforms like JustEast and Deliveroo, triggering the first decline in spending on takeaways since May 2020.

More than two in five people said they were tightening their belts. Cutting back on takeaways was the most commonly cited money saver.

Airlines also had the worst month since July 2021, with spending on flights increasing by just 5.6pc.

Overall, non-essential spending grew at the slowest pace in more than two years, Barclaycard said, at 0.7pc.

The British Retail Consortium, an industry body, separately reported a 0.7pc rise in shop sales in May.

Shoppers cut spending on all items, excluding groceries, by 2.4pc in the three months to May compared with a year earlier.

07:21 AM BST

British bank accused of handling payments to Hamas

A British bank has been accused of carrying out billions of dollars of transactions for funders of terrorist groups such as Hamas and al-Qaeda in US court papers.

Standard Chartered, one of the UK’s largest banks, is alleged to have carried out the deals worth more than $100bn from 2008 to 2013 in breach of sanctions against Iran, newly filed documents show.

The lender had avoided prosecution for money laundering by the US Department of Justice in 2012 when Lord Cameron’s government intervened on its behalf.

An independent expert has identified $9.6bn of foreign exchange transactions with individuals and companies designated by the US government as funding “terror groups”, including Hezbollah, Hamas, al-Qaeda and the Taliban, according to the BBC.

The bank disputed the claims put forward by whistleblowers, saying their previous allegations had been “thoroughly discredited” in the US.

07:18 AM BST

Good morning

Thanks for joining me. Today we begin with allegations made against Standard Chartered, which are detailed in new US court papers.

The British bank is accused of carrying out billions of dollars of transactions for funders of terrorist groups such as Hamas and al-Qaeda, in documents filed to a New York court.

5 things to start your day

1) Royal Mail warns Czech takeover risks sparking debt crunch | Parent company IDS admits nearly £2.4bn of loans could be called in as a result of the deal

2) Channel 5 owner Paramount agrees $8bn merger deal with billionaire tech heir | David Ellison’s Skydance awaits final sign off for takeover of TV and film studio

3) Labour warned of ‘unintended consequences’ of zero-hours ban | Hospitality bosses fear clampdown will harm investment and scare off workers

4) British universities should be pushed to develop military tech, says Labour draft policy | Secret document calls for coordinated approach to defence amid concerns over China

5) Andrew Orlowski: There’s a very good reason Dominic Cummings didn’t last long in Whitehall | The Civil Service preference for ‘generalists’ has led to a dearth of hard skills needed to run the country

What happened overnight

Asian shares retreated after a report showed that US manufacturing contracted in May, in the latest sign the economy is slowing.

India’s Sensex led the region’s losses, plunging 4.1pc to 73496.24 as the vote count for the country’s six-week-long national election appeared to show a lower than expected seat count for incumbent Prime Minister Narendra Modi’s party, although his National Democratic Alliance was comfortably leading its closest rival.

Japan’s Nikkei 225 index lost 0.2pc to 38,837.46 and the Kospi in Seoul was down 0.8pc at 2,660.69.

Hong Kong’s Hang Seng was the outlier, gaining 0.5pc to 18,494.28, while the Shanghai Composite index edged 0.1pc lower to 3,076.96.

Australia’s S&P/ASX 200 shed 0.3pc to 7,740.80. Taiwan’s Taiex lost 0.8pc.

On Monday, US stocks drifted to a mixed finish.

The S&P 500 edged 0.1pc higher, to 5,283.40, even though the majority of stocks within the index fell. The Dow Jones Industrial Average dropped 0.3pc to 38,571.03, and the Nasdaq Composite rose 0.6pc to 16,828.67.

Australian and New Zealand bonds rallied, tracking gains in Treasuries after the weak US data bolstered bets for the Federal Reserve to cut interest rates.

Treasuries rose across the curve Monday after data showed factory activity shrank at a faster pace as output came close to stagnating, with 10-year yields sinking 11 basis points to 4.39pc. Australia’s equivalent yield fell six basis points in early Tuesday trading, while New Zealand’s slipped seven basis points.

Asian currencies such as the Malaysian ringgit and South Korean won strengthened.

Yahoo Finance

Yahoo Finance