The Gentherm (NASDAQ:THRM) Share Price Has Gained 17% And Shareholders Are Hoping For More

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Gentherm Incorporated (NASDAQ:THRM) share price is 17% higher than it was a year ago, much better than the market return of around 4.1% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Looking back further, the share price is 16% higher than it was three years ago.

See our latest analysis for Gentherm

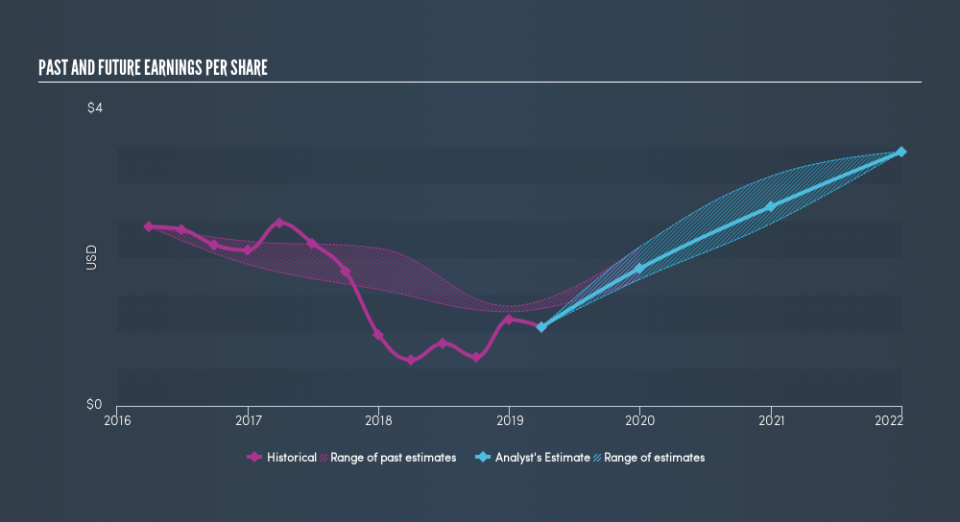

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Gentherm grew its earnings per share (EPS) by 71%. It's fair to say that the share price gain of 17% did not keep pace with the EPS growth. So it seems like the market has cooled on Gentherm, despite the growth. Interesting.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Gentherm has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

It's nice to see that Gentherm shareholders have received a total shareholder return of 17% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.9% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course Gentherm may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance