General Motors (GM) Q3 Earnings Top, Sales Miss Mark, '21 View Up

General Motors GM reported adjusted earnings of $1.52 per share for third-quarter 2021, topping the Zacks Consensus Estimate of $1.07. Higher-than-anticipated profits from its Financial segment drove this outperformance. The bottom line, however, compares unfavorably with year-ago quarter’s earnings of $2.83 per share.

Revenues of $26,779 million missed the Zacks Consensus Estimate of $31,167 million. The top-line figure also compares unfavorably with the year-ago figure of $35,480 million. The company recorded adjusted earnings before interest and taxes (EBIT) of $2,922 million, significantly lower than the $5,284 million seen in the prior-year quarter. This downside resulted from the semiconductor headwinds faced by General Motors, slightly offset by the company’s recall cost-settlement contract with LG Electronics and $270 million in equity income from its joint ventures in China.

The automaker’s market share in the GM market was 8.4% for the reported quarter, down from the year-ago period’s 10.4%.

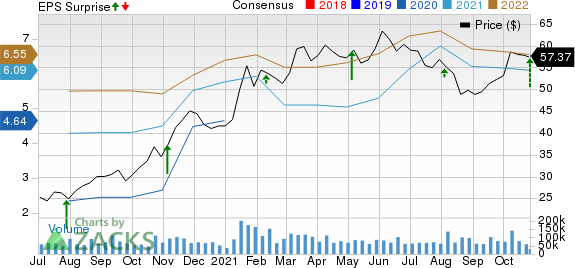

General Motors Company Price, Consensus and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

Segmental Performance

GM North America (GMNA) generated third-quarter net revenues of $20,554 million, down from the $29,128 million recorded in the corresponding period of 2020. Nonetheless, revenues from the unit outpaced the Zacks Consensus Estimate of $19,923 million. The region’s wholesale vehicle sales of 423,000 units declined from the 799,000 units reported in the year-ago quarter and also missed the consensus mark of 454,000 units. The segment’s operating profit came in at $2,125 million, lower than the $4,366 million witnessed in the year-earlier period. The segmental profit also lagged the consensus mark of $2,608 million.

GM International’s (GMI) net revenues for the reported quarter came in at $2,843 million, up from the year-ago quarter’s $2,735 million. The reported metric also beat the consensus mark of $2,441 million. The unit reported an operating profit of $229 million, significantly higher than the year-ago profit of $10 million.

GM Financial generated net revenues of $3,354 million for the September-end quarter, down from the $3,421 million recorded in the year-ago period and missing the consensus mark of $3,448 million. Also, the segment recorded an operating profit of $1,093 million, down from the $1,207 million witnessed in the prior-year quarter but beating the consensus mark of $988 million.

GM Cruise witnessed net revenues of $26 million for the third quarter, at par with the figure reported in the year-earlier period but topping the consensus mark of $25 million. The segment posted an operating loss of $286 million compared with the $204 million loss reported in the prior-year quarter. The reported loss is narrower than the consensus mark of a loss of $313 million.

Financial Position

General Motors — which shares space with other auto biggies including Ford F, Tesla TSLA and Volkswagen VWAGY — had cash and cash equivalents of $17.4 billion as of Sep 30, 2021 compared with $19.9 billion at the end of 2020. The long-term automotive debt at the end of the quarter was $16.4 billion compared with $16.2 billion as of Dec 31, 2020.

General Motors’ automotive cash used in operating activities amounted to $2,602 million at the end of the July-September quarter. The company recorded negative adjusted automotive free cash flow (FCF) of $4,385 million for third-quarter 2021 comparing unfavorably with the positive FCF of $9,122 million in the prior-year period.

2021 View Up

For 2021, this Zacks Rank #3 (Hold) company expects adjusted EPS in the band of $5.70-$6.70, up from the previous forecast of $5.40-$6.40. The full-year net income is anticipated in the range of $8.1-$9.6 billion, higher than the earlier estimate of $7.7-$9.2 billion. The adjusted EBIT forecast remains intact within the range of $11.5-$13.5 billion. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Volkswagen AG (VWAGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance