General Industrial Machinery Stocks Q1 Highlights: Otis (NYSE:OTIS)

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how general industrial machinery stocks fared in Q1, starting with Otis (NYSE:OTIS).

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 general industrial machinery stocks we track reported a mixed Q1; on average, revenues missed analyst consensus estimates by 2.5%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the general industrial machinery stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.3% on average since the previous earnings results.

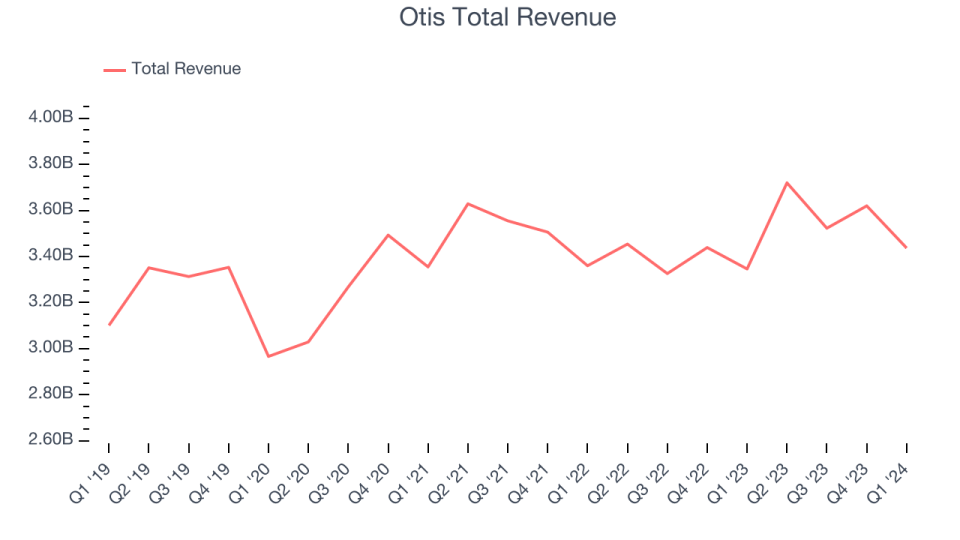

Otis (NYSE:OTIS)

Founded in 1853 by the inventor of the safety elevator, Otis (NYSE:OTIS) is an elevator manufacturer and provider of supplementary equipment and services.

Otis reported revenues of $3.44 billion, up 2.7% year on year, falling short of analysts' expectations by 0.7%. It was a weaker quarter for the company, with underwhelming earnings guidance for the full year and full-year revenue guidance missing analysts' expectations.

"Otis continues to demonstrate the strength of our Service-driven business model with maintenance portfolio growth above 4% and both year over year and quarter over quarter Service margin expansion," said Judy Marks, Chair, CEO & President.

The stock is down 1.5% since the results and currently trades at $96.

Read our full report on Otis here, it's free.

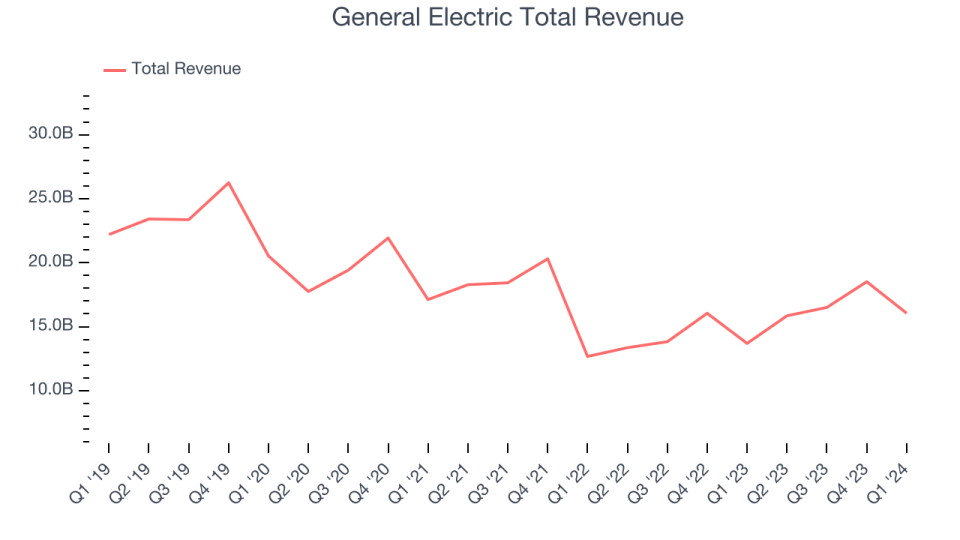

Best Q1: General Electric (NYSE:GE)

Tracing its roots back to the work of Thomas Edison, General Electric (NYSE:GE) is a provider of components and solutions for the aerospace, renewable energy, and power sectors.

General Electric reported revenues of $16.05 billion, up 17.2% year on year, outperforming analysts' expectations by 2.2%. It was an impressive quarter for the company, with revenue and EPS exceeding analysts' estimates.

General Electric pulled off the fastest revenue growth among its peers. The stock is up 8.4% since the results and currently trades at $162.57.

Is now the time to buy General Electric? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Icahn Enterprises (NASDAQ:IEP)

Founded and mainly owned by renowned investor Carl Icahn, Icahn (NYSE:IEP) is a holding company that has investments in the energy, automotive, food packaging, and metal industries.

Icahn Enterprises reported revenues of $2.47 billion, down 7.7% year on year, falling short of analysts' expectations by 11.6%. It was a weak quarter for the company, with revenue and EPS falling below Wall Street's expectations.

The stock is down 1.5% since the results and currently trades at $16.91.

Read our full analysis of Icahn Enterprises's results here.

3M (NYSE:MMM)

With its original mining venture failing due to anorthosite having no commercial value, 3M (NYSE:MMM) is a provider of products used in the industrial, safety and graphics, healthcare, electronics and energy, and consumer sectors.

3M reported revenues of $5.72 billion, down 28.8% year on year, falling short of analysts' expectations by 25.4%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

3M had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 9.6% since the results and currently trades at $100.98.

Read our full, actionable report on 3M here, it's free.

Illinois Tool Works (NYSE:ITW)

Founded by Byron Smith, an investor who held over 100 patents, Illinois Tool Works (NYSE:ITW) manufactures engineered components and specialized equipment for numerous industries.

Illinois Tool Works reported revenues of $3.97 billion, down 1.1% year on year, falling short of analysts' expectations by 1.4%. It was a mixed quarter for the company, with a miss of analysts' organic revenue estimates.

The stock is down 5.3% since the results and currently trades at $235.99.

Read our full, actionable report on Illinois Tool Works here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance