GDI Integrated Facility Services (TSE:GDI) Shareholders Have Enjoyed An Impressive 116% Share Price Gain

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. To wit, the GDI Integrated Facility Services Inc. (TSE:GDI) share price has flown 116% in the last three years. Most would be happy with that. It's also good to see the share price up 34% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for GDI Integrated Facility Services

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

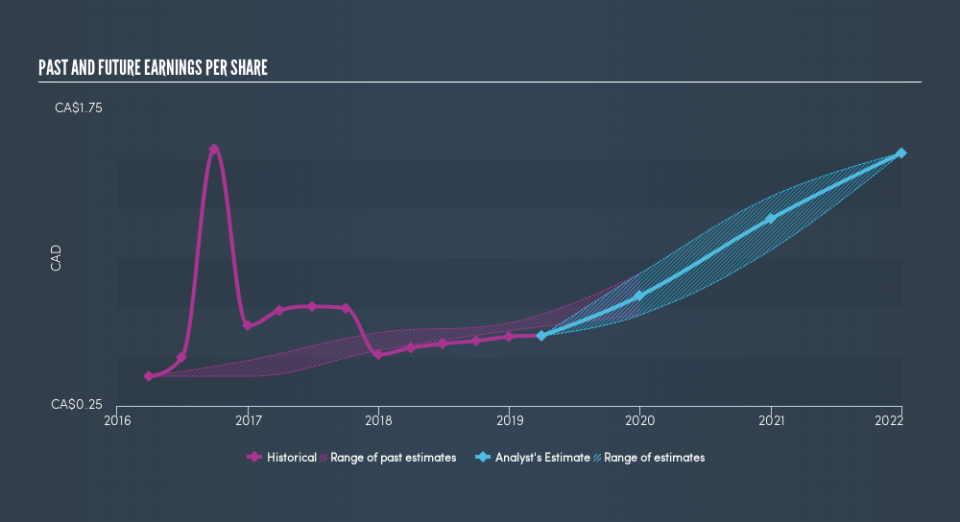

GDI Integrated Facility Services was able to grow its EPS at 15% per year over three years, sending the share price higher. In comparison, the 29% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that GDI Integrated Facility Services has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Pleasingly, GDI Integrated Facility Services's total shareholder return last year was 62%. So this year's TSR was actually better than the three-year TSR (annualized) of 29%. The improving returns to shareholders suggests the stock is becoming more popular with time. Before spending more time on GDI Integrated Facility Services it might be wise to click here to see if insiders have been buying or selling shares.

Of course GDI Integrated Facility Services may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance