GBP/USD Daily Forecast – Sterling Rallies to 5-Month High on Brexit Optimism

Sterling Rally Unfazed by Negative Headlines

The British pound to dollar exchange rate has been surging higher for a week despite news headlines consistently pointing to hurdles in getting a deal done.

Early in the week, the headlines cautioned that there is still a lot to be done in getting a deal done. More recent headlines are suggesting a deal won’t get ratified in parliament as the DUP is not on board with the latest deal.

Price action in GBP/USD signals that the markets are optimistic as ever that a deal will materialize with the exchange rate rallying to levels not seen since the middle of May. Further, dips have been shallow relative to the upward momentum.

The two-day EU summit has started and so far it looks like Johnson might get his deal approved. The British PM will continue to try and talk to other party members to ease concerns and lift his chances of getting the deal approved in parliament.

Technical Analysis

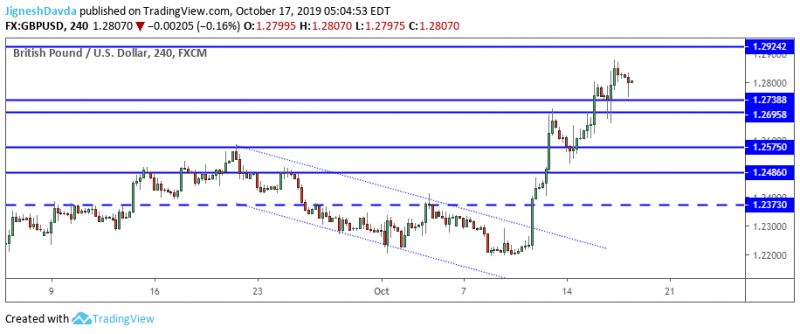

GBP/USD is nearing a level I highlighted in prior daily forecasts at 1.2924. At this stage, I think the rally is getting a bit stretched.

The current price action reminds me of how the exchange rate traded around the referendum. The markets priced in that the UK would stay in the EU ahead of the vote. In the end, the markets got completely caught off guard during the vote as it started to become clear it might go the other way.

Further, I think there is still a fair amount of downside risk at this point. This is despite the pair not being all that sensitive to negative headlines.

More importantly, parliament will meet on Saturday, when the markets are closed. This means that there is a good chance Sterling will gap at the open on Monday. The direction will obviously depend on how things went on Saturday.

With this in mind, I wouldn’t be surprised to see some profit-taking ahead of the weekend. The pair has seen a nice surge and I think bulls will be reluctant to hold positions over the weekend.

In such a scenario, we may see the pair ease lower over the next day or two. At the same time, I do still think we can get one last push higher towards 1.2924.

Bottom Line

GBP/USD shows strong upward momentum despite negative headlines

We may see a turn lower in the pair ahead of the weekend on profit-taking.

There is a significant risk in holding positions over the weekend considering that parliament meets on Saturday.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance