GBP/JPY Technical Analysis: New Trend, New Direction, Same Levels

DailyFX.com -

To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

GBP/JPY Technical Strategy: Intermediate-term: mixed, short-term: bearish.

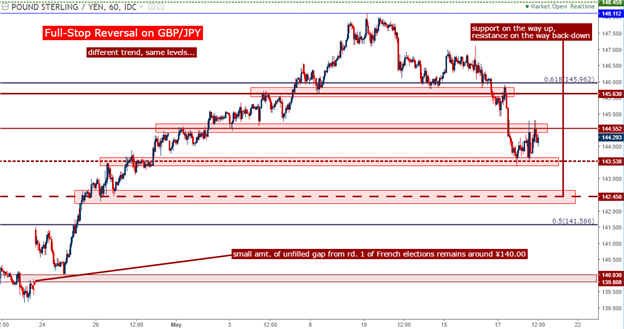

GBP/JPY has put in a major reversal, and the support points we were previously looking at are now showing as resistance.

If you’re looking for trading ideas, check out our Trading Guides. If you’re looking for shorter-term ideas, check out our IG Client Sentiment.

Just a week ago, it looked like a near-certainty that GBP/JPY would soon perch-up to a fresh post-Brexit high. With the combined forces of GBP-strength and JPY-weakness, GBP/JPY went on a robust run after the U.S. Presidential election that saw more than 2,000 pips set a high at 148.46. But as that move digested after the December rate hike from the Fed, with fears of ‘Hard Brexit’ bringing GBP-lower, GBP/JPY pulled back down to the mid-130’s again.

In mid-April, the theme of Yen weakness caught another gasp of strength that re-drove those prior bullish trends, with GBP/JPY making an aggressive move in an attempt to take out that prior-high at 148.46. The trend was strong, with very little pullback or retracement as bulls bid each minor pullback. Price action had moved within 34.7 pips of taking out that prior-high, with a top developing at 148.11.

Since then, bears have re-taken control of GBP/JPY, pushing prices-lower by as much as 450 pips over the last six trading days. This has driven price action below multiple levels of prior support, with many of those prior support levels now showing as some form of resistance.

Chart prepared by James Stanley

Given the size of this bearish retracement, those utilizing longer time-horizons will likely want to wait for matters to calm before looking to take on bullish exposure. The area around ¥141.50 could be particularly interesting for such an approach, as this is a confluent zone of potential support. At ¥141.59 we have the 50% retracement of the ‘Brexit move’ in GBP/JPY, and at ¥141.86 we have the 50% retracement of the most recent bullish ramp in the pair that started in mid-April. If support does, in fact, develop here; the door could be opened for topside swing and longer-term plays.

Chart prepared by James Stanley

Near-term, and until 141.50 comes back into play, the bearish side of the pair is likely going to look most attractive; particularly for those utilizing short-term momentum-based strategies. GBP/JPY has been showing some element of resistance off each of the support levels we looked at in our last article, and below we’ve update that with recent price action.

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance