Garbage is this week's champ, Les Moonves is the chump

This week’s champ is garbage. After Tuesday’s stock market selloff that pulled the Dow 800 points lower, a lot of investors were looking for ways to protect themselves from what’s looking like a Grinch rally in December and a lot more uncertainty in 2019. Goldman Sachs suggests they go to trash.

Goldman gave a rare double upgrade to Waste Management (WM), the U.S. company that takes out Americans’ trash. The company was moved from “underperform” to “outperform” as analysts expect WM to compound earnings growth at a higher rate than the overall market.

Goldman said of its call on Waste Management, “Given the age of the current business cycle and expectations for slowing economic growth, we believe now is the right time to own waste stocks.”

Waste Management is up about 7-and-a-half percent year to date, while the broader market fell into negative territory after Tuesday’s stock market rout. The VanEck Environmental Services ETF (EVX), which tracks companies that benefit from increased demand for waste management, has risen more than 7 percent this year and more than 8 percent in the last 12 months.

Investors are starting to think less about how to get booming returns and more about how to protect themselves cause it’s getting ugly out there. That makes Goldman’s call that much more beneficial for waste management.

Garbage. This week’s champ.

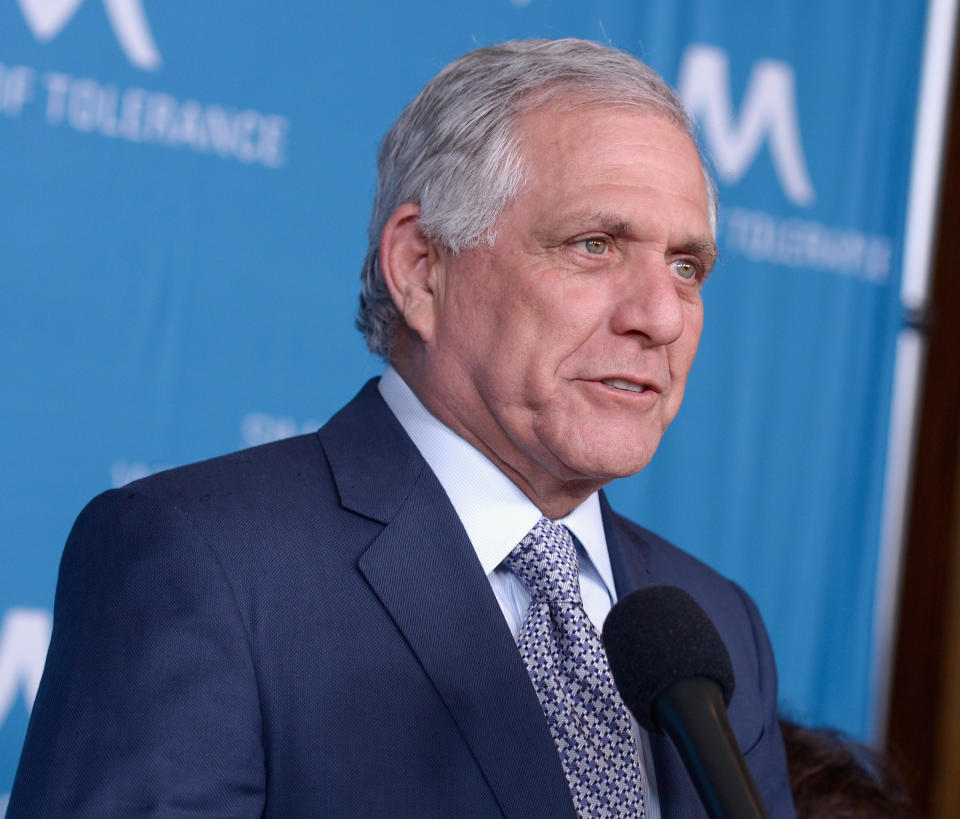

This week’s chump is former CBS (CBS) CEO Les Moonves. Moonves stepped down in September and was set to get a $120 million payout from the Columbia Broadcasting System — unless he lied to the folks investigating the long list of “sexual misconduct” cases against him.

And it turns out, according to a report released last week, that Moonves destroyed evidence and misled investigators about his behavior while he was CEO. The legal team says he engaged in multiple acts of “serious nonconsensual sexual misconduct in and outside of the workplace, both before and after he came to CBS in 1995.”

Moonves said he was trying to protect his good reputation, but it turns out that good reputation was not at all deserved.

There’s a lesson in all this about powerful men who abuse their power and mistreat women in and outside the workplace. Even if it looked like they had previously won, karma and investigation can come back around and settle the score to turn their previously close associates against them and build a case to bring them down.

Les Moonves. This week’s chump.

—

Dion Rabouin is a global markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.

See also:

Wall Street managers have cost Americans more than $600 billion over the past decade

It’s the end of the world as we know it, and investors feel bullish

The dollar’s status as the world’s funding currency is in question

The stock market is at ‘a crossroads’ and on course for a ‘reckoning’ in 2019, investors say

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance