G-III (NASDAQ:GIII) Misses Q1 Revenue Estimates

Fashion conglomerate G-III (NASDAQ:GIII) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $609.7 million. The company also expects next quarter's revenue to be around $659.8 million, slightly below analysts' estimates. It made a non-GAAP profit of $0.12 per share, down from its profit of $0.13 per share in the same quarter last year.

Is now the time to buy G-III? Find out in our full research report.

G-III (GIII) Q1 CY2024 Highlights:

Revenue: $609.7 million vs analyst estimates of $616.7 million (1.1% miss)

EPS (non-GAAP): $0.12 vs analyst estimates of -$0.03 ($0.15 beat)

Revenue Guidance for Q2 CY2024 is $659.8 million at the midpoint, below analyst estimates of $664.6 million

The company reconfirmed its revenue guidance for the full year of $3.2 billion at the midpoint

EPS (non-GAAP) Guidance for Q2 CY2024 is $0.27 at the midpoint, below analyst estimates of $0.33

Gross Margin (GAAP): 42.5%, up from 41.2% in the same quarter last year

Market Capitalization: $1.41 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “We had a strong start to fiscal 2025, delivering first quarter earnings per diluted share well ahead of our expectations. Our performance was driven by double-digit increases in DKNY and Karl Lagerfeld along with a successful relaunch of Donna Karan, reflecting our commitment to investing in our owned brands and our ability to meet the ever-changing needs of our consumers. I am also excited to announce our partnership and investment in AWWG, a global fashion group and premier platform for iconic international brands, which furthers a number of our strategic priorities. Looking ahead, we remain cautiously optimistic and are reaffirming our fiscal year 2025 net sales and raising our guidance for net income per diluted share.”

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

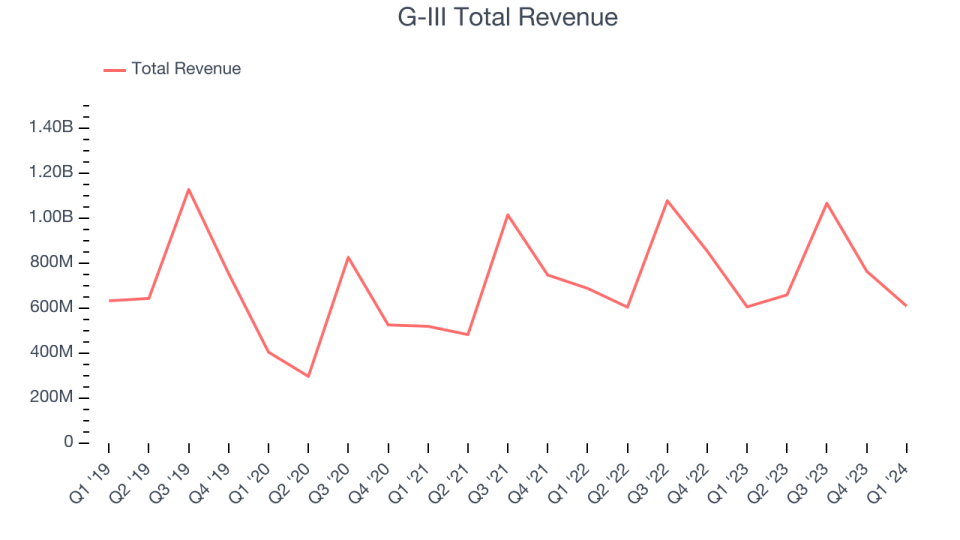

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. G-III had weak demand over the last five years as its sales were flat, a poor baseline for our evaluation of quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. G-III's annualized revenue growth of 2.8% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, G-III's $609.7 million of revenue was flat year on year, falling short of Wall Street's estimates. For next quarter, the company is guiding for flat year on year revenue of $659.8 million, slowing from the 9% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 3.7% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

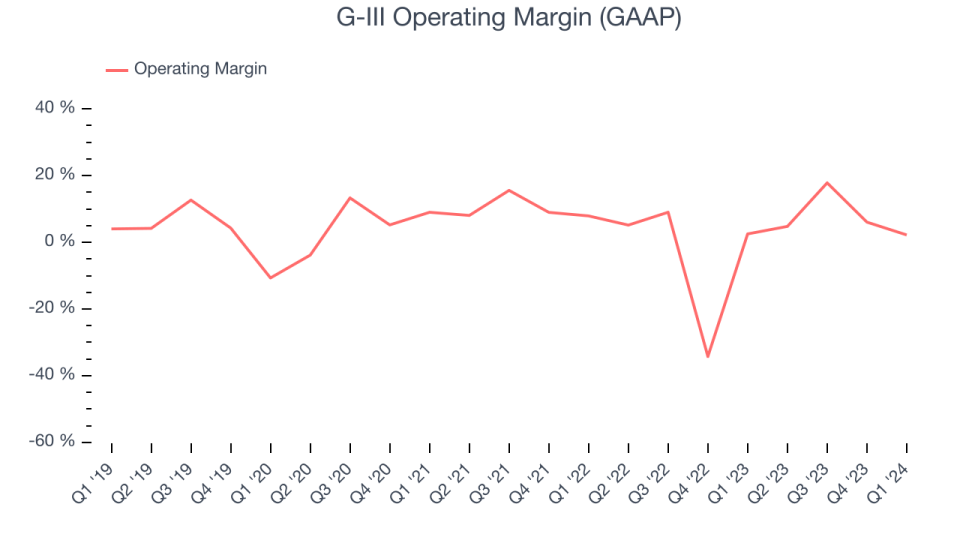

Operating Margin

G-III was profitable over the last two years but held back by its large expense base. It demonstrated weak profitability for a consumer discretionary business, producing an average operating margin of 2.1%.

In Q1, G-III generated an operating profit margin of 2.2%, in line with the same quarter last year. This indicates the company's overall cost structure has been relatively stable. Looking ahead, Wall Street expects G-III to become less profitable. Analysts are expecting the company’s trailing 12 month operating margin of 9.1% to decline to 7.9% in the coming year.

Key Takeaways from G-III's Q1 Results

We were impressed that G-III exceeded analysts' EPS expectations this quarter. We were also excited its operating margin outperformed Wall Street's estimates. On the other hand, its earnings forecast for next quarter missed and its revenue fell short of Wall Street's estimates. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is up 3.5% after reporting and currently trades at $32.33 per share.

So should you invest in G-III right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance