Further weakness as Alvotech (NASDAQ:ALVO) drops 8.9% this week, taking one-year losses to 11%

Most people feel a little frustrated if a stock they own goes down in price. But sometimes a share price fall can have more to do with market conditions than the performance of the specific business. The Alvotech (NASDAQ:ALVO) share price is down 11% in the last year. However, that's better than the market's overall decline of 17%. Alvotech hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unfortunately the last month hasn't been any better, with the share price down 11%. We do note, however, that the broader market is down 5.4% in that period, and this may have weighed on the share price.

If the past week is anything to go by, investor sentiment for Alvotech isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Alvotech

Alvotech wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Alvotech's revenue didn't grow at all in the last year. In fact, it fell 43%. That looks pretty grim, at a glance. The stock is down just 11% over twelve months, which is not bad all things considered. So it seems that the market saw the weak revenue coming, and isn't worried. It could be interesting to study this stock more closely - when will it generate profits?

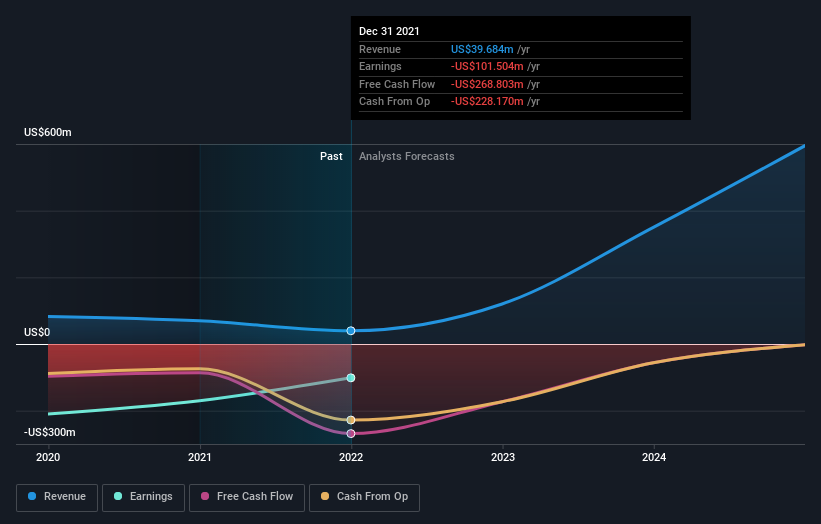

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Alvotech's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's not great that Alvotech shares failed to make money for shareholders in the last year, but the silver lining is that the loss of 11%, wasn't as bad as the broader market loss of about 17%. Things weren't so bad until the last three months, when the stock dropped 11%. The recent drop implies that investors are increasingly averse to the stock -- quite possibly due to a deterioration of the business. In times of uncertainty we usually try to focus on the long term fundamental business metrics. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for Alvotech (3 are potentially serious!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance