‘Your Fund Is Under Attack’: BlackRock Fights Boaz Weinstein

(Bloomberg) — A few days ago, BlackRock Inc. sent an unusual message to thousands of clients. It contained none of the formulaic language or inscrutable fine print typically packed into these sorts of statements. No, this was a call to arms.

Most Read from Bloomberg

Saudi Arabia Steps Up Arrests Of Those Attacking Israel Online

Everything Apple Plans to Show at May 7 ‘Let Loose’ iPad Event

Trump Auditions VP Picks Before Wealthy Donors in Palm Beach

Huawei Secretly Backs US Research, Awarding Millions in Prizes

“Your fund is under attack,” the headline screamed in bold print.

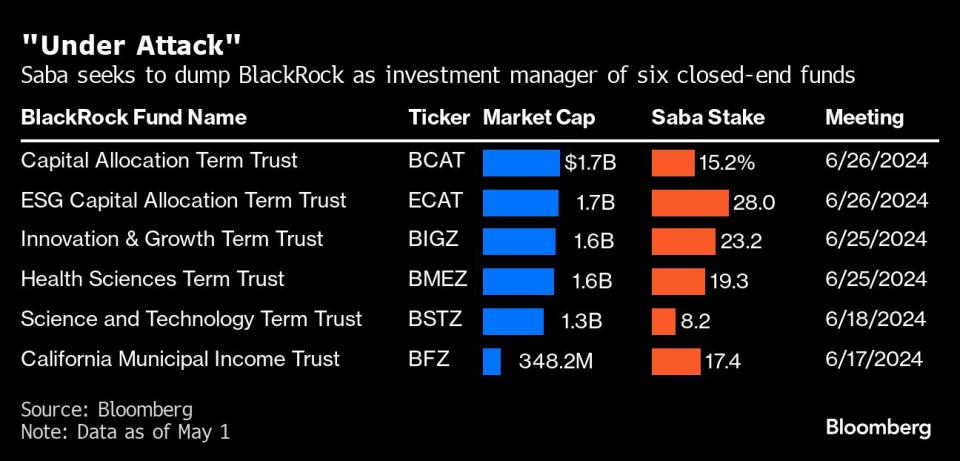

The attacker: Boaz Weinstein, the sharp-elbowed Wall Street money manager who says price distortions in funds run by BlackRock and others are cheating investors out of billions of dollars, and they need to be eliminated. This has turned into something of a crusade for Weinstein. Last month, his hedge fund, Saba Capital Management, launched a frenetic bid to have investors remove BlackRock as manager of six funds overseeing about $10 billion in assets.

Which is what triggered the note BlackRock sent to clients. “If Saba were to succeed, it may seek to appoint itself as investment advisor” and fundamentally disrupt the funds’ objectives and strategies, “all to enrich itself.”

The ongoing feud has turned the $250 billion closed-end fund industry, a normally sleepy Wall Street backwater, into the scene of one of the most dramatic power struggles in finance — one that’s coming to a head at shareholder meetings next month.

Weinstein says BlackRock is not only trapping shareholders in underperforming products, but also failing to meet basic governance standards by stymieing his efforts to elect new directors. BlackRock points to Weinstein’s own track record, where he took over a closed-end fund that had previously invested in floating-rate loans and put some of its money into crypto exposure and SPACs.

Both sides vow they have the moral high ground.

“We need to show there’s a cost to illegally entrenching themselves to protect their management fees while doing terrible things to shareholders,” Weinstein said in an interview, adding that many of BlackRock’s closed-end funds have track record of “horrible performance.”

Weinstein’s move — echoing some of the most audacious corporate raids of the 1980s — is the latest escalation in a multiyear campaign targeting closed-end funds trading well below the value of their underlying assets.

The 50-year-old hedge fund boss currently has about $6 billion invested in the products, using his stakes in dozens of funds to press money managers to buy back shares near their full market value (known as a tender) or turn their funds into open-ended vehicles, which would produce a similar result.

In recent years he’s taken on the likes of Eaton Vance, Franklin Templeton and Voya Financial, convincing managers to tender, winning board seats and even prompting them to resign from their role as fund adviser.

Weinstein notes that if Saba were to win the proxy battles, it wouldn’t necessarily mean the hedge fund would assume management of the funds. That would be up to the boards, but Saba has said it would “stand ready” to assist and may offer to do the job.

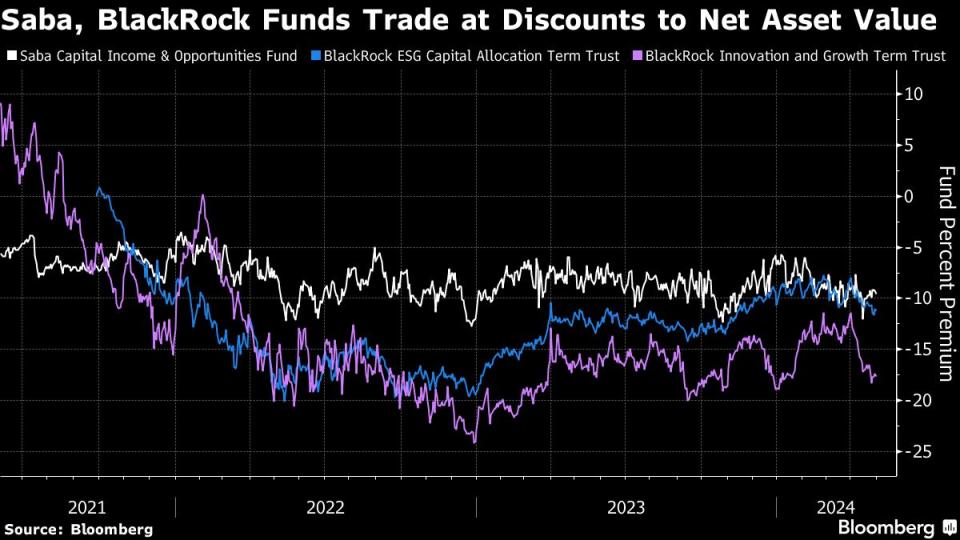

In mid-2021, Saba took over the $600 million Voya Prime Rate Trust, now known as the Saba Capital Income & Opportunities Fund (ticker BRW) and changed its investment mandate after getting shareholder approval. Following a pair of tender offers, the fund has returned an annualized 4.1%, more than triple its high-yield bond benchmark, according to data compiled by Bloomberg. It ranked third of 22 peer funds in 2022, 14th in 2023 and second-to-last this year through April, according to Morningstar Inc. data, which compares the product to US bank loan closed-end funds.

By comparison, the $1.6 billion BlackRock Innovation & Growth Term Trust (ticker BIGZ) has lost an annualized 23% over the same period, while the $1.7 billion BlackRock ESG Capital Allocation Term Trust (ticker ECAT) has gained an annualized 0.8% since its September 2021 inception. BIGZ ranked either first or second in its Morningstar category of only two funds over the period; ECAT ranked sixth in 2022, second in 2023 and eighth this year through April in its group of 11 funds.

BlackRock is quick to point out that BIGZ and ECAT returned 19% and 32%, respectively, last year as markets rebounded broadly, and that it manages closed-end funds in the same Morningstar peer group as BRW that have had higher returns than the Saba fund in recent years.

Still, BIGZ and ECAT continue to trade significantly below their so-called net asset value, or NAV. BIGZ is currently at a 17% discount, while ECAT trades at a 10% discount, according to data compiled by Bloomberg. Saba’s BRW is at an 8.3% discount.

BlackRock is warning investors that Saba could radically alter the composition of the funds should it win control, exposing shareholders to greater risk. After Saba took over BRW, it began adding everything from crypto exposure to SPACs to other closed-end funds Weinstein is campaigning against. BlackRock says Saba’s tactics have nothing to do with helping investors other than himself and his hedge fund clients.

“Saba’s true goal is a quick payout and, more recently, revenue in the form of management fees,” a BlackRock spokesperson said via email.

‘Hot Hand’

Last year, Weinstein launched three proxy campaigns for board seats against the money-management giant, failing to win a single one.

Instead of backing down, Weinstein is pushing even harder this year. In addition to efforts to terminate BlackRock’s fund management agreements, he’s also trying to shake up the boards of 10 BlackRock funds.

Saba has nominated a slate of directors, including a former Deutsche Bank AG derivatives-trading executive and Alexander Vindman, a retired US Army lieutenant colonel who testified against former President Donald Trump during impeachment proceedings.

“Saba has been growing assets and has the hot hand, successfully waging multitudes of successful activism campaigns in the closed-end fund space over the recent past,” said Erik Herzfeld, president at Thomas J. Herzfeld Advisors. Herzfeld manages investment products that buy closed-end funds. “BlackRock, given their depth and knowledge, has the ability to challenge Saba’s advancement.”

Weinstein says he’s redoubling his efforts in part because the asset-management giant, he alleges, has undermined the ability of shareholders to get a fair shake at annual meetings.

Last year he won a lawsuit against BlackRock — and other fund managers — for adopting so-called control share provisions that can deter proxy attacks.

BlackRock is appealing that ruling and now finds itself defending against another lawsuit from Saba. In March, Weinstein’s firm sued BlackRock in federal court in New York, arguing that an “entrenchment bylaw” in ECAT “strips away any realistic prospect” for a shareholder to elect trustees other than the incumbents. Lawyers for BlackRock said in court filings that “every share of ECAT has exactly the same right to vote.”

“BlackRock has behaved leaps and bounds worse than all the other managers, and so a tender for shares is not enough,” Weinstein said. “They put themselves in a spot where they need a strong response — to remedy the performance but also as a signal to the industry, that shareholders are not going to stand for this anymore.”

Stephen Minar, managing director focused on closed-end funds at BlackRock, said that “Saba uses the veil of governance to disrupt the investment objectives and strategies of closed-end funds by forcing changes that enrich itself at the expense of long-term shareholders.”

BlackRock notes that in recent years, it has sought to increase shareholder profits and lower costs. It’s repurchased $1.3 billion of shares in its closed-end funds since 2016, including about $180 million of BIGZ shares, and it has started new funds without load fees that were typically charged in the past.

On Friday, BlackRock said a series of its closed-end funds, including BIGZ and ECAT, plan to offer to buy back a portion of their shares at a slight discount to the value of the underlying assets, if the funds trade at more than a 7.5% discount for long enough.

“We believe the measures announced today will improve total returns while preserving the benefits of the closed-end fund structure and will help all fund shareholders reach their financial goals,” a spokesperson for BlackRock said in a statement.

Proxy Battle

As voting gets started ahead of June shareholder meetings, both BlackRock and Saba are actively seeking to corral investors to their cause.

BlackRock is sending out white proxy cards to individuals and paying about $1.7 million to advisory firm Georgeson to help solicit votes for the six funds, according to regulatory filings. Saba is sending out gold proxy cards.

The hedge fund has launched a website to keep shareholders updated on its campaigns. Splashed across the top is “Fink about it,” a reference to BlackRock Chief Executive Officer Larry Fink. Saba said it will be hosting a webinar on May 20 to discuss its plans “to hold BlackRock accountable.”

“I’m not only fighting for these funds, I’m fighting so that the next 30 funds don’t emulate these shady tactics,” Weinstein said. “I don’t need Larry Fink to apologize to shareholders for what BlackRock did, though they should be embarrassed.”

—With assistance from Dan Wilchins, Adam Kommel and Denise Cochran.

(Updates with BlackRock’s announcement on possible fund share buybacks in fifth and sixth paragraphs from end)

Most Read from Bloomberg Businessweek

AI Is Helping Automate One of the World’s Most Gruesome Jobs

China Launches Rockets From Sea in Bid to Win the Space Race

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance