FTSE 100 Live: London blue-chips finish week up 1.8% amid big GDP revision, surprise jump in US unemployment

US jobs figures showed a surprise rise in the country’s unemployment rate, but also the addition of slightly more jobs than expected.

This afternoon’s non-farm payrolls follow a disappointing August for stock markets, with Wall Street ending a run of five monthly gains.

The focus of the London market is also on higher oil prices, Superdry’s £148 million loss and the latest drop in house prices.

FTSE 100 Live Friday

Superdry slumps to £148m loss

Next takes bigger Reiss stake

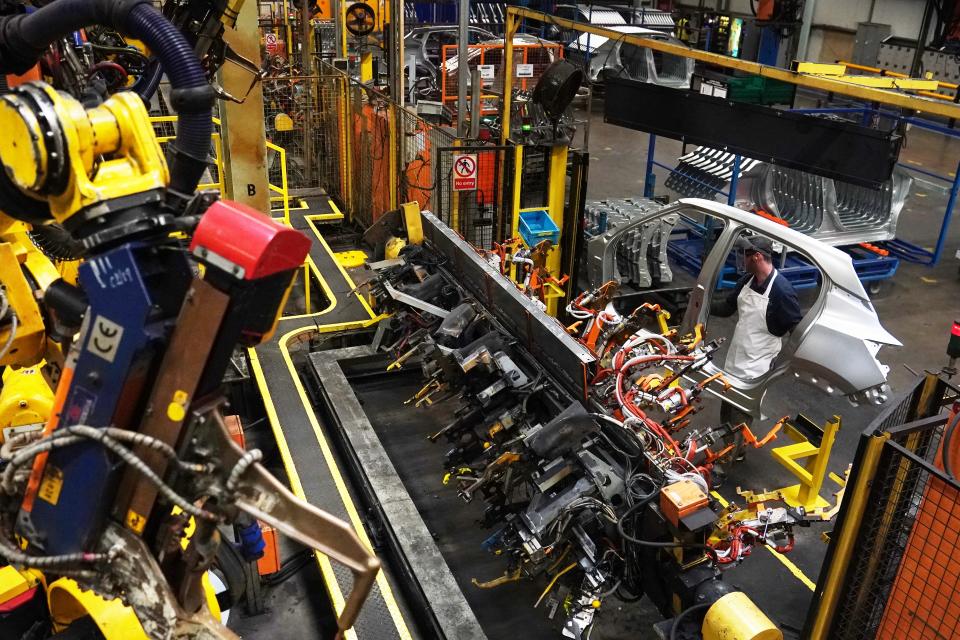

Manufacturing decline fastest in 3 years

FTSE ends week at 7,464.54

16:38 , Daniel O'Boyle

The FTSE 100 closed at 7,464.54, ending the shortened week up 1.8% after a 0.3% rise today.

Chemicals maker Johnson Matthey was the biggest riser with a huge 10% jump in its share price after a US investor upped its stake. Fallers included Adrmial and Landsec.

Pound buys $1.260 as dollar rallies

16:28 , Daniel O'Boyle

The dollar has risen sharply against all major currencies after an initial fall on the back of the latest non-farm payrolls data, meaning the pound has fallen to $1.260.

The pound first rose against the dollar when the data was released, but as investors took a closer look at the data, they piled back into the greenback. That sent the pound down by more than a cent.

City Comment: Retail titans are going on a canny shopping spree

16:22 , Jonathan Prynn

Some fascinating rustling in the retail undergrowth this week. While Mike Ashley’s Frasers continues to build its stake in online fast fashion retailer Boohoo — now above 10% — Next has also been doing some shopping.

This morning Lord Wolfson’s people snapped up a 34% stake in the respected Reiss fashion brand for £128 million from investor Warburg Pincus. That lifts Next’s holding to 72%.

Reiss has around 160 stores but do not expect them to be converted into Next outlets.

The management team under Christos Angelides will be allowed to get on doing what it does well — profits rose by half to £51.6 million last year — while Next takes care of all the boring bits, from IT to warehousing.

City regulator analysing savings providers’ ‘fair value’ assessments

16:12 , Daniel O'Boyle

The City regulator says it is analysing information provided by some banks and building societies on the value offered by their savings products.

It follows the introduction of the new Consumer Duty in July, which requires firms to ensure the products and services across their range deliver fair value to their customers and act if they do not.

As part of a 14-point action plan previously set out by the Financial Conduct Authority (FCA), the regulator said it would require firms offering the lowest rates to provide their fair value assessments under the consumer duty by August 31 2023 – and take robust action by the end of 2023 against those who cannot demonstrate fair value.

Housebuilders set to report amid soaring interest rates

15:47 , Daniel O'Boyle

After their shares soared on the Government’s decision to relax environmental rules, three housebuilders are preparing to update shareholders next week.

Vistry, Barratt Developments and Berkeley Group will all update shareholders during the week, as nervous investors will be looking for more indications of what is happening in the mortgage market.

Vistry has already said it expects underlying revenue to more than double to £930 million when it reports its first-half results on Thursday.

This is largely because of the company’s acquisition of Countryside, which is included in this data for the first time.

John Lewis under fire over affordable homes promise in mega Ealing development

15:33 , Daniel O'Boyle

John Lewis has come under renewed fire from residents over its £500 million plans to enter the rental property market amid concerns it will fail to deliver on affordable housing targets.

In December the partnership unveiled a multi-decade joint venture with investment firm Abrdn for about 1000 new rental homes across three local communities, of which two are in London.

But some 90% of the resident responses to a consultation over one of the developments in Ealing were negative by the deadline for comments yesterday, after John Lewis said its 35% affordable housing target would be scaled back unless it received local authority funding.

Residents also complain that at 20 storeys high, the tallest of the four tower blocks proposed by John Lewis is signficantly higher than guidance set out by Ealing Council under its local plan.

Pret prices almost double in three years as gross profits climb 83%

15:25 , Daniel O'Boyle

Prices at Pret a Manger have almost doubled since 2020 across a range of products as the sandwich chain saw its gross profits climb 83% in a year.

The price of an egg mayo sandwich is up 91% on August 2020 to £3.80, according to data obtained by the Financial Times, while the price of a pain au raisin has jumped 84% to £3.30 and a can of Coke Zero costs 95% more at £2.15.

Pret’s ham and greve baguette is up 65% to £5.70, while its humous & chipotle wrap has risen 61% to £4.80 and its tuna baguette is up 67% to £4.50. UK CPI inflation stood at 20% over the same period.

Pret turned a gross profit of £279 million in 2022, according to accounts filed in late July, against revenues of £648 million. That represents an 83% rise on gross profits made in 2021.

Stocks up after US markets open

14:54 , Simon Hunt

A few minutes into the day’s trading session on Wall Street, the S&P 500 index is up 0.74%.

Here’s a look at your key markets data:

US still on course for ‘soft landing'

14:34 , Daniel O'Boyle

Candice Tse, global head of strategic advisory solutions for Goldman Sachs Asset Management, said the latest non-farm payroll data shows that the US is continuing to move to a “soft landing”

“Above consensus job creation and slightly higher unemployment shows that the labor market rebalance continues.

“Broadly, the job market continues to show signs of moderation as the broader economy moves towards a soft landing, reinforcing market expectations that the Fed will keep interest rates steady at the September meeting. With US economic data remaining strong and the Fed providing greater clarity on the policy path forward, investors may find opportunities to generate alpha in both equities and fixed income.

“In equities, high index concentration and optimism about AI have benefited a handful of large-cap stocks, but investors may find broader investment opportunities as markets have become increasingly micro-driven. In fixed income, investors can benefit from attractive yields, still-robust fundamentals, and improved hedging capabilities by maintaining strategic allocations in rates and credit.”

US shares to rise

14:23 , Daniel O'Boyle

Wall Street stocks are set to rise today as the latest non-farms payroll data reinforced investors’ belief that the Federal Reserve will not raise interest rates further.

Dow Jones futures are up 0.5% to 34,970.00, while S&P 500 futures are up 0.6% to 4,544.75. Nasdaq futures, containing some of the most rate senstive stocks, were up 0.7% to 15,645.75.

Big risers include biotech firm Horizon Therapeutics, after the Federal Trade Commission okayed its acquisition by Amgen.

Jus-Rol merger unravels

13:41 , Daniel O'Boyle

A pastry manufacturer will be forced to sell off a rival business after an appeal to allow the merger was blocked by a judge, the UK’s competition watchdog has said.

Cerelia, the UK’s largest producer of bake-at-home products in the UK, agreed to buy rival pastry maker Jus-Rol for an undisclosed amount in 2021.

But the UK’s Competition and Markets Authority (CMA) moved to block the deal earlier this year after finding that it would put UK grocers at risk of higher prices and lower quality products, which could be passed on to shoppers.

Surprise rise in US unemployment

13:34 , Daniel O'Boyle

The US unemployment rate surprisingly rose to 3.8%, official statistics have revealed.

Latest figures from the Bureau of Labor Statistics showed that the country added 179,000 jobs, slightly more than expected.

However unemployment, which was expected to hold steady, rose to 3.8%.

The dollar fell against all major currencies, including the pound, on the back of the data.

The rise suggests that interest rate hikes from the Federal Reserve are starting to have an impact on the workforce, which had appeared to be incredibly resilient for most of the past year.

City Voices: Renewed Oxford Street has a secure future despite IKEA store delay

13:12 , Daniel O'Boyle

“It’s official: IKEA has bagged itself an iconic position on Oxford Street and marked the occasion with one of the most innovative, yet simple, brand hoardings you are likely to see: a 128 ft wide and 62 ft blue FRAKTA bag,” Dee Corsi of the New West End Company writes.

“The store’s delayed opening - now set for Autumn 2024 - isn’t the “blow” that some commentators are describing, but in fact quite the opposite. Brands investing in Oxford Street are committing to showcasing themselves on the global stage and therefore need to get it right. That requires painstaking precision and for IKEA it means renovating the Grade II listed building with a laser focus on sustainability. Being willing to spend that extra time underlines the importance of looking good on Oxford Street.

“IKEA will be in fantastic company when it opens next year, with a string of new additions in recent months further demonstrating a renewed confidence in the nation’s favourite high street. Global brands that have opened their doors include Carvella, Samsonite and Steve Madden.”

Octopus to buy Shell’s UK household energy business

12:47 , Daniel O'Boyle

Octopus will buy Shell’s UK and German household energy business, meaning the oil giant’s 1.4 million customers will change supplier.

Shell put the household energy arm of its business up for sale in June, opening the bidding process to acquire its operations.

The deal brings the number of Octopus Energy customers to 6.5 million. Octopus promised “a smooth transition and no disruption to customer energy supply”.

Greg Jackson, CEO and founder of Octopus Energy Group, said: “Following a stringent process, we are pleased to be acquiring Shell Energy Retail in the UK and Germany.

UK economy bounced back from pandemic much faster than previously thought, revised GDP figures show

11:45 , Daniel O'Boyle

The UK economy bounced back from the Covid-19 pandemic much more quickly than previously thought, official statistics revealed today, with new revised figures adding 1.7% to the country’s GDP for the fourth quarter of 2021.

However, what this means for the current size of the economy and its direction of travel is unclear, as revised statistics covering more recent quarters will not be published until 30 September.

Given that the new estimates of 2021’s GDP are higher, and that unrevised figures show that growth has been close to flat since then, the statistics could mean the economy today is bigger than previously thought. However, it could also be that existing estimates of GDP this year is accurate and the economy declined, possibly entering a recession, this year.

Lidl becomes UK’s joint-highest-paying supermarket as it gives London workers £12.85 an hour

11:07 , Daniel O'Boyle

Lidl has become the UK’s joint-highest-paying supermarket,with wages of £12.85 an hour in London, as it aims to recruit Wilko staff who are set to lose their jobs.

Those working inside the M25 will see their pay rise from £11.95 per hour to £12.85, while those elsewhere will be paid £11.40, up from £11.

With additional pay for length of service, Lidl employees in London can make up to £13.15, while those outside of London can make up to £12.30.

Based on the figures, a new Lidl employee in London working 225 eight-hour days would make £23,130 a year.

Johnson Matthey surges 13% in FTSE 100, Boohoo up 7%

10:29 , Graeme Evans

Johnson Matthey shares have surged 12% after a New York investor doubled its stake in the clean air firm.

The rise of 202p to 1832p came as filings revealed the investment arm of Standard Industries now had a 10% interest as the biggest shareholder.

The stake building reignited the takeover speculation seen after Standard made its initial 5.2% purchase of shares in April 2022.

Standard’s latest move took place with Johnson worth less than £3 billion and shares heading out of the FTSE 100 index following this week’s quarterly reshuffle.

The 200-year-old business, which is best known for helping car makers reduce harmful emissions, has failed to spark despite a new management team’s pivot towards green economy technologies including hydrogen.

Today’s rebound returned shares to where they were in mid July as Johnson pulled clear of BP and Shell at the top of the FTSE 100 index.

The oil giants rallied after Brent Crude topped $87 a barrel, a 4% rise over the week on expectations that Saudi Arabia will extend its voluntary production cut into October.

Shares in BP rose 2% or 11.25p to their highest level since late April at 498.75p, while Shell added 27.5p to 2430p. Their gains and the support of banking stocks Barclays and Standard Chartered meant the FTSE 100 rose 35.19 points to 7474.32.

Others on the front foot included Whitbread, which rallied 39p to 3479p after Jefferies sweetened its “buy” recommendation with a new 4400p target price.

Frasers Group added 7p to 813.5p after lifting its Boohoo stake for the second time in as many days to 10.4%. Interest in Boohoo shares, which lifted by 7% or 2.3p to 38p, was helped by broker Peel Hunt reiterating a 75p target price.

The FTSE 250 index weakened 13.22 points to 18,592.48, with holidays group TUI the biggest faller down 3% or 14.8p to 455.6p. WH Smith moved the other way, lifting 31p to 1498p.

Manufacturing declines at fastest rate since 2020

09:42 , Daniel O'Boyle

The UK manufacturing sector performed a little better in August than initial estimates, but still had its worst month in more than three years, according to the latest PMI data.

The closely watched S&P Global / CIPS UK Manufacturing PMI for August came to 43.0. While this was better than the 42.5 “flash” figure, it was still far below the 50 mark that separates growth from decline.

The figure was the lowest since the heights of the Covid-19 pandemic in the spring of 2020.

Rob Dobson, director at S&P Global Market Intelligence, said the decline was reminiscent of the pandemic and global financial crisis: “August saw a further deepening of the UK manufacturing downturn. The PMI sank to a 39-month low as output and new orders contracted at rates rarely seen outside of major periods of economic stress such as the global financial crisis of 2008/09 and the pandemic lockdowns.

“"Manufacturers reported a weakening economic backdrop as demand is hit by rising interest rates, the cost-of-living crisis, export losses and concerns about the market outlook. While this is being felt across the manufacturing industry, business-to-business companies are especially hard hit. Intermediate goods producers saw the steepest drops in output, new orders and employment as a result.”

Next buys out private equity firm’s stake in £376m Reiss

09:37 , Daniel O'Boyle

Next and the Reiss family have bought out private equity firm Warburg Pincus’ stake in fashion retailer Reiss, in a deal that values the brand at £376 million.

Next will acquire a further 21% stake in Reiss, upping its holding from 51% to 72%. The Reiss family's holding will increase to 22%, with the other 6% held by Reiss management.

Together, Next and Reiss will pay £128 million for just over a third of the business.

Simon Wolfson, NEXT Chief Executive said: “Reiss has performed exceptionally well since we first invested in March 2021. This success has been driven by the strength of its brand, first class management and the benefits of Total Platform; we look forward to continuing to develop the business with Christos and the Reiss team. Warburg Pincus has been an excellent partner throughout the term of our investment and we have enjoyed working with them during the last two years.”

Adarsh Sarma, Managing Director and Rianne Schipper, Principal, Warburg Pincus said: “Warburg Pincus is proud to have supported Reiss through its growth journey since 2016. We would like to thank Christos, Jonathan and the management team for their unrelenting hard work and commitment - they have done an outstanding job, consistently demonstrating category-leading performance. We have also been delighted by our partnership with Next and the way in which Next’s Total Platform has accelerated growth and enhanced the performance of the business.”

More bad news for blockchain industry as KR1’s portfolio sinks by nearly a third

09:03 , Simon Hunt

There were further signs of woes for the blockchain industry today after digital technology investor KR1 reported a near one-third drop in the value of its portfolio in just a few months.

The Aquis-listed business said the net asset value of its investments stood at £85.4 million at the end of July, well down from £121 million at the end of February.

Its share in Lido, a crypto staking technology company, was the worst performer, with its valuation slashed 45% to £18.8 million.

Bitcoin prices dropped 12% in August, in what became the digital currency’s biggest monthly fall of the year.

Johnson Matthey shares jump 12%, oil giants higher

08:42 , Graeme Evans

BP and Shell supported the FTSE 100 index today after Brent Crude futures rose above $87 a barrel to extend gains for this week to 4%.

Shares in BP rose 10.5p to their highest level since late April at 498p, while Shell added 35p to 2446.5p. The FTSE 100 index lifted 21.79 points to 7460.92.

Johnson Matthey jumped 12% at the top of the index, a rise of 197p to 1827p. The backing follows a poor stock market run for the 200-year-old business, which helps leading energy, chemicals and automotive companies reduce harmful emissions.

The FTSE 250 index weakened 49.66 points to 18,556.04, with holidays group TUI the biggest faller after a decline of 4% or 17p to 453.4p. WH Smith moved in the other direction, lifting 32p to 1499p.

Superdry future in doubt as it plunges to near £150m loss

08:40 , Simon English

Hopes that Superdry can ever return to former glories under founder CEO Julian Dunkerton were fading today after a disastrous set of results that leave investors worried for its future.

Dunkerton made a dramatic return to the business in 2019, furious at what management had done to a business he built and regards as one of his family.

Since then, shares have continued to plunge and his overhaul of the company ran into Covid and rough economic conditions.

Today’s results for the year to April had already been delayed by an auditor’s snafu, which hardly helped perceptions in the City. The shares were suspended while the books were completed.

FTSE opens higher

08:25 , Simon Hunt

A few minutes into today’s trading session in London, the FTSE 100 is up 0.25%.

Here’s a look at your key market data.

Shares plunge as NHS 111 provider Totally plans cost cutting

08:22 , Daniel O'Boyle

Shares in NHS outsourcer Totally Plc plunged by 11% this morning as it revealed it was cutting costs amid higher-than-expected expenses and slowdowns in the awarding of Government contracts.

The business, which operates the 111 service, said “the cost of agency staff required to deliver safe services for patients exceeds our anticipated forecasts and many decisions related to the awarding of new contracts are currently on hold”.

As a result, the business is “actively implementing strategies” to cut costs.

However, the business said it still expects to meet the financial targets it set out last month.

Shares are down 11% to 9.4p. They are down 80% since July of 2022.

Accsys Tech falls 18% after slump in demand amid construction slowdown

08:18 , Simon Hunt

Shares in Accsys technologies fell as much as 18% this morning after the firm said a slowdown in housebuilding had hurt demand.

The company, which develops wood for construction said: “Trading conditions in the building materials, construction and residential housing markets in the UK, Europe and North America have continued to soften, impacted by rising interest rates, the higher inflation environment and slowing residential activity.”

Shares fell 18% to 80p.

Weak August for stock markets, Bitcoin’s worst month of year

07:58 , Graeme Evans

The prospect of higher for longer interest rates and China’s softening economic data meant a rough month for financial markets in August.

Deutsche Bank reported today that just 12 out of 38 non-currency assets in its coverage were in positive territory, only slightly better than February’s 11 thanks to a recovery over the last week.

The gains since Federal Reserve chair Jerome Powell’s Jackson Hole speech last Friday meant the S&P 500 ended the month down 1.6% in total return terms compared with 4.7% on 18 August.

The overall monthly decline for the S&P 500 and Nasdaq ended a run of five monthly gains, although they have still delivered returns of 18.7% and 34.9% respectively this year.

The 8.2% slide for Hong Kong’s Hang Seng index leaves it in negative territory for the year, down 4.4%. The FTSE 100 index fell by close to 3% in the month.

Brent crude oil prices rose 1.5% for a third consecutive time, while European natural gas prices surged 23.5% as concern grew about a potential strike at LNG facilities in Australia.

Deutsche Bank reported a weak month for cryptocurrencies in August, with Bitcoin down 10.9% in its biggest monthly decline of 2023 so far.

Direct Line to pay back £30 million to overcharged customers

07:55 , Michael Hunter

Direct Line said today it will pay back any policy holders hit by a mistake it made in pricing some insurance policies after a change to the rules from regulators.

The FTSE 250 company overcharged some people renewing their car and home insurance after the Financial Conduct Authority banned the industry from charging more for renewals than they would pay if they were new customers.

At the time, the FCA said the rule change would save customers £4.2 billion over the next 10 years.

Direct Line said today that as a result of its error some “customers have paid a renewal price higher than they should have.”

It estimated that the cost of repaying customers would be around £30 million in total. About half of that was provided for on its 2022 results, it said.

Direct Line appointed a new CEO this week, poaching Adam Winslow from fellow insurer Aviva to fill the top job. The previous permanent cheif executive, Penny James, left in January after a profit warning led to it dropping its dividend payout and cancelling part of a share buyback.The warning came after a surge in the cost of motor insurance claims due to rising costs of second hand cars and longer repair times.

Markets focused on US jobs figures, Dell shares jump 8%

07:24 , Graeme Evans

Traders are looking to this afternoon’s non-farm payrolls figure for guidance on whether the Federal Reserve has room to pause interest rate rises later this month.

A forecast decline from July’s addition of 187,000 jobs to 170,000 in August will provide more evidence that rates are in restrictive territory and slowing the US economy.

The prospect of the closely-watched figures put pressure on Wall Street yesterday, with the Nasdaq Composite the only major benchmark in positive territory.

The performance rounded off a disappointing August for markets after the Dow Jones Industrial Average, S&P 500 index and Nasdaq all fell in the region of 2%.

In trading after the closing bell, Dell Technologies jumped 8% after it raised full-year revenues and profit guidance due to higher demand for AI-optimised servers.

Asia markets have continued the cautious pattern of trading, with the FTSE 100 index forecast by CMC Markets open 16 points higher at 7455 after a drop of 34 points yesterday.

Yesterday’s selling came after Europe’s headline inflation rate remained unchanged at 5.3%, fuelling expectations of another ECB rate rise later this month.

Frasers ups stake in Boohoo yet again

07:24 , Simon Hunt

Mike Ashley’s Frasers group has once again upped its stake in fashion retailer Boohoo.

The firm’s stake has gone up from 7.8% to 10.4%. That means Ashley is close to overtaking Boohoo founder Mahmud Kamani to become the biggest single shareholder of the business.

House prices fall 5.3% as interest rate hikes hit property

07:06 , Daniel O'Boyle

House prices fell 5.3% year-on-year in August, a much faster drop than expected, in a sign that interest rate hikes are clearly talking their toll on the property sector.

Princes were down 0.8% month-on-month, compared to a 0.4% expected drop.

House prices had proved surprisingly resilient even against the face of soaring interest rates, but today’s decline suggests that this may be starting to change.

Recap: Yesterday’s top stories

06:52 , Simon Hunt

FzilchGood morning. Here’s a summary of our top headlines from yesterday:

City traders launch new market to make it easier for big institutions to invest in unlisted “fast growth” companies

London fintech Zilch is mulling an IPO as Swedish rival Klarna smashes targets as it starts making monthly profit for first time

Payments firm Wise has been accused of ‘inappropriate’ controls over Russia sanctions

Wolseley restaurant group made record £6 million profit in year that founders Chris Corbin and Jeremy King were ousted

Pernod Ricard pushes up prices by average 11% as volumes stay flat

Park Plaza hotels UK profit doubles, with occupancy rocketing and room rates well above pre-pandemic levels - highlights “particularly strong London events calendar, even before the benefit of the coronation of King Charles III”

And...Whole Foods is paring back its luxury offering in favour of discount items as losses widen

Yahoo Finance

Yahoo Finance