FTSE 100 Live: Meta rises despite £1bn fine; FTSE closes at 7771; Ryanair profits

Developments in US debt ceiling negotiations will be closely watched today as the 1 June deadline for a resolution looms into view.

The uncertainty has contributed to a pattern of steady and unspectacular trading, with the FTSE 100 index flat today despite modest early gains.

NatWest shares are in positive territory after a £1.26 billion disposal reduced the Government’s stake below 40%.

FTSE 100 Live Monday

Ryanair back in profit, warns fares will rise further

Treasury sells £1.3bn NatWest stake

Takeover target Dechra issues profit warning

Key data as FTSE closes at 7771

Monday 22 May 2023 16:56 , Daniel O'Boyle

The FTSE closed at 7771 today.

Click through the tables for key market data

The sour truth of Oxford Street’s candy shop curse

Monday 22 May 2023 15:54 , Daniel O'Boyle

It is Friday afternoon and Oxford Street is thronging with tourists walking down the world’s most famous shopping promenade as Londoners spill out of pubs.

Little did the tourists expect when they came here that so many of the stores would be weird American-style candy and souvenir shops. And little do they know that behind the gaudy exteriors, activities like the sale of illegal goods are taking place.

In today’s Standard...

Monday 22 May 2023 15:43 , Simon Hunt

...Ryanair rockets back into the black, more Libor scandal details emerge, the CFO of Wise steps aside and an interview with the entrepreneur founder of Sara Miller London.

Today’s paper is now on the streets -- pick it up from a tube station near you.

US shares close to flat as debt limit fears continue

Monday 22 May 2023 15:34 , Daniel O'Boyle

US shares are close to flat so far today as investors continue to weigh up the slim possibilities of the country defaulting on its debt against the catastrophic consequences that may bring.

Here’s a look at the key market data. Click on the buttons below to view the different charts.

Comment: The arrogant Bank of England has made our inflation crisis worse

Monday 22 May 2023 15:27 , Daniel O'Boyle

It is, perhaps, the nearest we’ve got so far to an admission from the Bank of England that things haven’t gone entirely to plan, Stephen King writes.

Andrew Bailey, the Bank’s Governor, acknowledged last week that “some of the strength in core inflation…reflects second-round effects... And as headline inflation falls, these second-round effects are unlikely to go away as quickly as they appeared”.

Headline inflation will fall this week, courtesy of an unwinding of earlier energy price increases. Yet “underlying” inflation will still be uncomfortably high, courtesy of Bailey’s “second-round effects”.

Meta among the big gainers in mixed start for US shares

Monday 22 May 2023 14:59 , Daniel O'Boyle

It’s been a mixed start for US shares so far today, with mega-cap firms down slightly, while the tech sector has performed well.

The S&P 500 is up 0.2% to 4,199.60, while the Nasdaq Index is up 0.6% to 12,729.91. However, the Dow Jones is down 0.2% to 33,366.33.

Meta is among the biggest gainers, despite reports of a £1 billion fine from EU data regulators.

Antony Constantinou: ‘Wolf of Wall Street’ City boss guilty of £70m investment fraud

Monday 22 May 2023 14:41 , Daniel O'Boyle

A former City boss who ran a “Wolf of Wall Street” style trading floor has been convicted of a £70 million investment fraud.

Anthony Constantinou, 41, lured victims into handing over tens of thousands of pounds to his firm, Capital World Markets (CWM), with the promise of risk-free investments and sizeable profits.

CWM was based in Heron Tower, in the City of London, and outwardly built up a reputation for respectability with sponsorship deals for Chelsea FC and boxing tournaments. He was even once pictured meeting Princess Anne.

The entrepreneurs behind warehouse studios

Monday 22 May 2023 14:19 , Daniel O'Boyle

Amin Hamzianpour and Nicholas Sonuga met “spending countless hours in dingy, expensive basement studios”. As music producers in neighbouring spaces, they’d complain about how most of the limited studio options were “barely soundproof units in basements in the middle of nowhere,” Hamzianpour says.

“No community, no flexibility and extortionate fixed rates. We were paying for space we only used part-time.” After failing to find a flexible studio “where we could also feel part of a valued community of talented, ambitious creators”, they decided to start their own.

Average UK household has lost £5,455 to inflation over past two years, research finds

Monday 22 May 2023 14:07 , Daniel O'Boyle

The average UK household has lost £5,455 to inflation over the past two years, according to new research.

Interactive Investor found that UK purchasing power has fallen by a combined £153 billion over the past two years, or £5,455 per household, because of price rises between March 2021 and March 2023.

Energy price rises have had the biggest impact, hitting each household by an average of £1,885, while food price rises have cost £1,147.

Morrisons launches new More Card loyalty scheme nationwide

Monday 22 May 2023 13:21 , Daniel O'Boyle

Morrisons has brought back its More Card loyalty scheme to replace its My Morrisons app following a successful trial.

The Morrisons More scheme, which replaces the My Morrisons scheme, can be used as a physical card or app and allows customers to earn points from selected products and counters in store and online as well as at Morrisons petrol stations.

Heathrow: Passengers ‘should not be concerned’ about half-term strike

Monday 22 May 2023 13:06 , Daniel O'Boyle

No flights will be cancelled during next week’s “completely unnecessary” half-term strike by Heathrow security officers, the airport said.

Members of union Unite working at Terminal 5 will walk out from May 25 to 27 in a dispute over pay.

Heathrow said its contingency plans, which include deploying extra staff, have delivered “excellent passenger service” throughout previous strike periods, with “almost all” travellers waiting less than 10 minutes to pass through security.

Early FTSE gains erased by noon

Monday 22 May 2023 12:19 , Daniel O'Boyle

The FTSE 100’s early gains today were erased as miners made up many of the day’s biggest losers.

Here’s a look at the key market data. Click on the buttons below to view the different charts.

City Voices: Will our needs be met by mathematical algorithms?

Monday 22 May 2023 12:00 , Daniel O'Boyle

The plot of the movie “Her”, released in 2013 and starring Joaquin Phoenix, raises forward-thinking questions for its time which today have surprising relevance.

Can we humanise a “machine” to the point of falling in love with it?

As technology advances, will we be tempted to anthropomorphise artificial intelligence more and more?

Will we reduce our human condition to a zombie state where all our needs are met by mathematical algorithms?

Ryanair flies back into profit and warns of higher prices ahead

Monday 22 May 2023 11:13 , Daniel O'Boyle

Soaring demand for flights after the end of pandemic travel restrictions sent Ryanair back into profit today, as the champion of low fares warned of rising prices into a busy summer getaway season.

The Irish carrier pointed out that capacity on European short-haul services was recovering more slowly than demand, meaning that travellers would be paying more for their getaways.

That boosted its shares, leaving Michael O’Leary, its chief executive on course for a €100 million (£87 million) performance-related payday, triggered by the stock, or headline profit.

Companies pick office locations for most ‘pain-free’ commute

Monday 22 May 2023 10:51 , Daniel O'Boyle

Firms seeking new large London offices in the City are taking space that is less than a four minute walk from a tube or train station, aiming to make post-pandemic commutes as ‘pain-free as possible’, research published on Monday shows.

Property consultancy Savills looked at office lettings of 100,000 square feet and above in the City of London in the last three years. It found that the average distance between an office and nearest station is a three and three quarter minute walk. Among the deals featured was law firm Linklaters signing for a new HQ at 20 Ropemaker.

Firms seeking new large London offices in the City are taking space that is less than a four minute walk from a tube or train station, aiming to make post-pandemic commutes as ‘pain-free as possible’, research published on Monday shows.

NatWest higher after £1.3bn stake sale, FTSE 100 makes headway

Monday 22 May 2023 09:57 , Graeme Evans

A £1.3 billion sale of NatWest shares today left the taxpayer stake below 40% as the government continues efforts to be rid of its exposure by 2026.

State ownership peaked at 84% during the financial crisis 15 years ago but is now at 38.6% after the Treasury sold shares back to the bank at a price of 268.4p on Friday.

The stock had been above 300p as recently as mid-February but valuations across the sector have been hit by the turmoil involving Credit Suisse and Silicon Valley Bank.

NatWest today lifted 2.3p to 270.7p, still 15% higher than a year ago amid recent strong trading under the leadership of chief executive Alison Rose.

The weekend move comes just over a month after the Treasury reiterated its intention to exit its shareholding by 2025/26, including through an ongoing trading plan.

Hargreaves Lansdown analyst Sophie Lund-Yates said: “Removing government stabilisers is a clear marker of the bank entering a new chapter.”

Alongside NatWest, Asia-focused pair Standard Chartered and Burberry rose after President Joe Biden suggested an imminent thawing of relations between the US and China. Their shares lifted 14.4p to 648.4p and 82p to 2372p respectively.

Progress in the London market was otherwise held back by caution over US debt ceiling negotiations, leaving the FTSE 100 index a modest 19.47 points higher at 7776.34.

Richard Hunter, head of markets at Interactive Investor, said: “While the likelihood of what would be a financially catastrophic default is considered low, investors remain on edge and will continue to be so the longer the talks progress.”

Other risers included BT Group, which recovered 3.1p to 148.05p after annual results triggered a sharp sell off for shares last Thursday.

The FTSE 250 index was 10.61 points higher at 19,299.71, with the newly-listed GKN automotive business Dowlais the best performing stock with a rise of 4% or 5.8p to 144.8p.

Meta to face £1 billion EU fine

Monday 22 May 2023 09:47 , Simon Hunt

Meta is to be fined a record-busting £1 billion by the European Union over the transfer of user data to the US, according to reports in the Wall Street Journal.

The EU’s privacy regulators, including Ireland’s Data Protection Commission (DPC), are set to impose the huge fine amid concerns the transfers expose EU citizens to weaker data privacy regulation in the US and adds futher pressure on the US government to strike a deal with the bloc over the management of personal data.

Last year, Facebook threatened to suspend its services in Europe if it was prohibited from moving data to the US. The previous record fine imposed by EU regulators over privacy standards was handed to Amazon last year and stood at €746m (£647m).

Dechra profit warning puts takeover at risk

Monday 22 May 2023 09:40 , Daniel O'Boyle

Pet medicine and vaccine maker Dechra put out a second profit warning in three months today, putting a potential buyout at risk, after a number of US wholesalers cut back on stocking its products.

The firm, which acquired Ivermectin maker Med-Pharmex last year, warned “widely reported destocking” in the US was hitting its profits in February, and now said this is lasting longer than expected.

It now expects profit of £186 million for the year — £2 million less than it said in February.

Dechra is in talks with private equity firm EQT over a 4,070p-per-share takeover. But with shares down 7.1% to 3,392p, markets believe EQT may not submit a firm bid by next week’s deadline.

City Comment

Monday 22 May 2023 09:33 , Simon English

In the public mind the traders jailed for rigging Libor are crooks and cheats. Those jailings were seen as a rare example of finance titans getting what they deserved for their role in the 2008 financial crash.

In the City, the feeling was rather different. The view was that these guys were probably just doing what they were told, and ending up in prison for that is harsh.

A new book* by the BBC’s Andy Verity, Rigged, rather makes it clear that this is the scandal that never was.

Libor was an obscure financial instrument before the crash. It is merely the price at which banks lend money to each other overnight to square off their liabilities. A matter of routine rather than skulduggery.

Post the crash, the authorities wanted Libor to be lower, to show that the banks had faith in each other.

The traders complied. So even if this manipulation affected the cost of your mortgage (it’s a hundred miles removed in truth), all it did was to send that cost down, not up. They did you a favour.

The book has strong evidence that central banks not only knew about this rigging, they encouraged it.

That’s both an important revelation and a statement of the obvious. Of course they knew.

In all, 37 traders and brokers were prosecuted by the US Justice Department and the UK’s Serious Fraud Office. Nineteen were convicted and nine jailed.

Some of those convictions have already been over-turned. It seems likely, and just, that most of the rest of them will be in time.

The desire to find the villains of the banking crash is understandable. These are not those guys. They never were.

*Rigged: The Incredible True Story of the Whistleblowers Jailed After Exposing the Rotten Heart of the Financial System.

William Hill owner sells Latvian arm

Monday 22 May 2023 09:30 , Daniel O'Boyle

William Hill owner 888 will sell its Latvian arm for £24.6 million, as it aims to cut down its debts.

Paf, owned by the government of Finnish region the Åland Islands, will buy the division which made £2.5 million in profit last year .

888 executive chair Lord Mendehlson said the Baltics were not a “core or growth market where we prioritise our investments”.

The betting giant said it would sell assets last month, having racked up almost £2 billion in debt to buy William Hill last year.

888 has been in the headlines for the wrong reasons this year. CEO Itai Pazner quit in January when the firm launched a probe into money-laundering checks for Middle Eastern high-rollers. William Hill then paid the biggest fine in UK gambling history, £19.2 million, in March for “alarming” failings in its safer gambling checks.

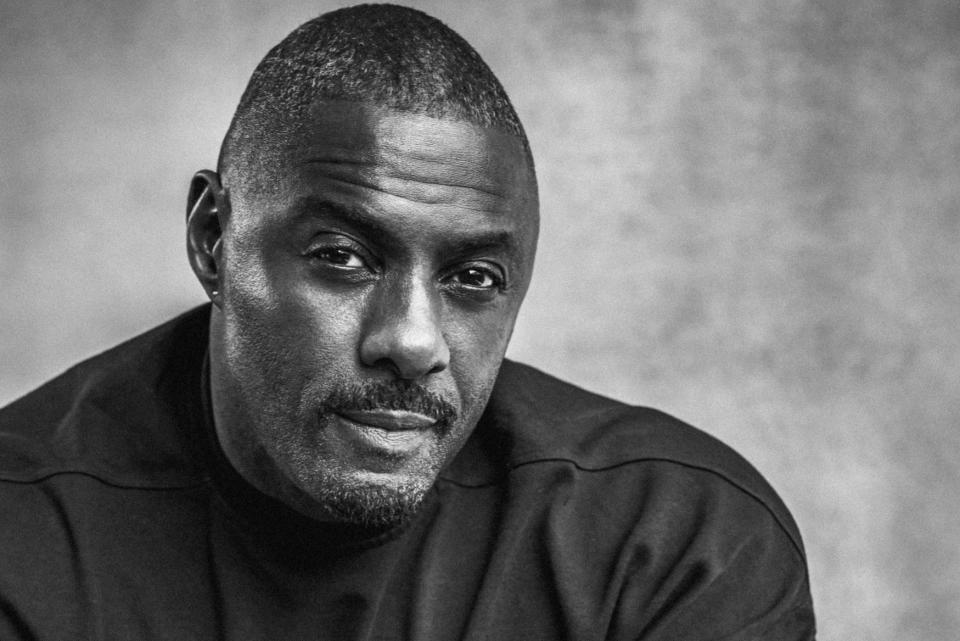

Zinc Media boosted by Idris Elba partnership

Monday 22 May 2023 08:38 , Simon Hunt

Shares in Zinc Media were boosted 8% to 114p today after the TV production group unveiled a new partnership with Idris Elba’s Green Door Pictures and wife Sabrina Elba’s Pink Towel to make documentary ‘Paid in full: The Battle for Payback.’

The multi-million-pound production, commissioned by the BBC and Canadian state broadcaster CBC, explores the extent of the historic injustice suffered by the music industry’s black artists, including the disparity of profits received by them, despite having created the records that have driven the fabric and culture of popular music.

Idris Elba said “This is a story that touches all of us. It’s about bringing the music industry to account for the injustice inflicted on generations of musical talents who have been deprived of their rightful rewards.”

Asia stocks lead FTSE 100, NatWest lifted by stake sale

Monday 22 May 2023 08:24 , Graeme Evans

The FTSE 100 index stands 18.33 points higher at 7775.20 as caution over US debt ceiling negotiations continues to hold back markets.

Richard Hunter, head of markets at Interactive Investor, said: “While the likelihood of what would be a financially catastrophic default is considered low, investors remain on edge and will continue to be so the longer the talks progress.”

Asia-focused stocks fared well in London after remarks from President Joe Biden over the weekend suggested an imminent thawing of relations between the US and China.

Standard Chartered shares rose 2% or 12.2p to 646.2p and Burberry rallied 38p to 2328p.

NatWest featured on the risers board, improving 1.9p to 270.3p after it emerged that the Government had reduced its stake below 40%.

The FTSE 250 index was 5.53 points higher at 19,294.63, led by a 5% gain for Auction Technology Group as sentiment continues to improve following last week’s half-year results. The shares lifted 39p to 768p.

Snapshot as London markets open

Monday 22 May 2023 08:20 , Simon Hunt

A few minutes into today’s trading session in London, here’s a look at the key market data.

Click on the buttons below to view the different charts.

Begbies Traynor beats expectations as insolvencies soar

Monday 22 May 2023 07:54 , Daniel O'Boyle

A growing number of insolvencies helped liquidator and administrator Begbies Traynor beat expectations for the year as profits grew to £20.7 million.

The business said liquidations are ahead of pre-pandemic levels, while administrations, which are usually for bigger companies, are not at that level yet but are up significantly from the lows of 2021.

Ric Traynor, executive chair of Begbies Traynor, said he saw further growth in 2023 as insolvencies continue to rise.

“We have started the new year confident in our outlook for a further year of growth. Our insolvency team will benefit from their recent insolvency appointments, together with anticipated further growth in the insolvency market.”

Ryanair returns to profit after Covid but warns that fares will rise further

Monday 22 May 2023 07:53 , Michael Hunter

Ireland’s budget airline Ryanair has returned to profit after the pandemic, but has warned travellers of further fare rises as European short-haul flights remaining under pre-Covid capacity as demand soars.

The company reported a near-record profit of €1.43 billion (£1.24 billion), up from a loss of €355 million, from revenue of almost €11 billion.

The company, run by chief executive Michael O’Leary, said forward bookings into the summer were “strong”, and that we continue to urge all customers to book early to avoid rising ‘close-in‘ prices.”

It added that capacity constraints were likely to continue “for at least 4 more years” and said it expects European airlines to continue to consolidate “over the next two years.”

NatWest stake raises £1.26bn for Government

Monday 22 May 2023 07:46 , Graeme Evans

The Government has raised £1.26 billion after selling more NatWest shares in a move that has reduced its stake from 41.4% to 38.6%.

The disposal, which was completed through an off-market purchase by NatWest, is part of an ongoing plan to wind down the Treasury shareholding taken during the financial crisis. It took place at Friday’s NatWest closing price of 268.4p.

The bank intends to cancel about three-quarters of the shares and will keep the rest in treasury, giving it the flexibility to cancel or reissue them at a later date.

Wise CFO to quit after CEO says he will be stepping away

Monday 22 May 2023 07:16 , Simon Hunt

The CFO of London fintech Wise said he plans to leave the firm just days after its CEO announced he would be taking a multiple-month leave of absence.

Matthew Briers, who has been in his role since 2015, said he will quit the board by March 2024 in order to aid his recuperation from an accident last year. A search for his replacement has begun.

“After almost eight years it’s time for me to think about my life after Wise. ,” he said.

“Wise will likely have many CFOs in its first century and this is simply me starting the process of handing over the reins to the next one. But some of you may know that a year ago I returned back to work at Wise after a quite horrible accident where I went under the wheels of a bus, and so, with this in mind, my focus will shift to making a full recovery.”

Earlier in May, Wise’s billionaire co-founder and CEO said he would be taking three months off work in order to spend more time with his family.

Markets steady as debt ceiling talks continue

Monday 22 May 2023 07:11 , Graeme Evans

The FTSE 100 index is poised for a positive start to the week, despite continued uncertainty over the state of US debt ceiling negotiations.

CMC Markets expects London’s top flight to open 25 points higher at 7782, having posted a modest rise in Friday’s session.

Today’s forecast improvement comes even though US futures are pointing to a slightly lower start to Monday’s session on Wall Street.

It follows a pullback for the major US benchmarks on Friday afternoon as it emerged that debt ceiling talks between Democrats and Republicans had broken down.

According to Treasury Secretary Janet Yellen, the US could default on its debt by 1 June if agreement is not reached.

Michael Hewson, chief market analyst at CMC Markets, said: “An avoidance of a default is still the markets base line view even accounting for Friday’s late drop in US markets.

“As we look ahead to a new and another important week, and the resumption of debt ceiling talks later today, there is a sense that we are likely to see a few more twists and turns.”

Yahoo Finance

Yahoo Finance