FTSE 100 Live 10 April: Index closes up 0.3% as US inflation reading dashes record hopes, S&P and Dow tumble

Another higher-than-expected US inflation reading sent London shares plunging, after a strong morning in which the FTSE 100 appeared to be to the verge of record territory.

London’s top flight still closed ahead for the day, but no longer close to the all-time highs seen in February 2023.

Meanwhile, Tesco boss Ken Murphy today hailed the supermarket’s strong performance after reporting a 12.8% rise in annual operating profits to £2.8 billion.

Other companies in the results spotlight today include the beauty and nutrition business THG and the advertising firm M&C Saatchi.

FTSE 100 Live Wednesday

Tesco grows profts and dividend

FTSE 100 near record high

Hut Group business still in red

ECB rates call highlights otherwise quiet day tomorrow

Wednesday 10 April 2024 17:29 , Daniel O'Boyle

Here’s what’s on the cards tomorrow, with little in the City, but a closely watched ECB rates meeting on the continent.

Trading updates

Norcros

Economics

China inflation

115pm – ECB rate decision

Opec monthly oil market report

FTSE 100 closes up 0.3% at 7,961.21

Wednesday 10 April 2024 16:37 , Daniel O'Boyle

The FTSE 100 closed modestly up at 7,961.21 today, after higher-than-expected US inflation figures poured cold water on the morning’s exuberance.

At one stage, London’s top flight was within a single point of the 8000 mark, and within 15 of a record close. But the March US CPI reading sent London shares tumbling.

It briefly fell into negative territory before a small rally late on.

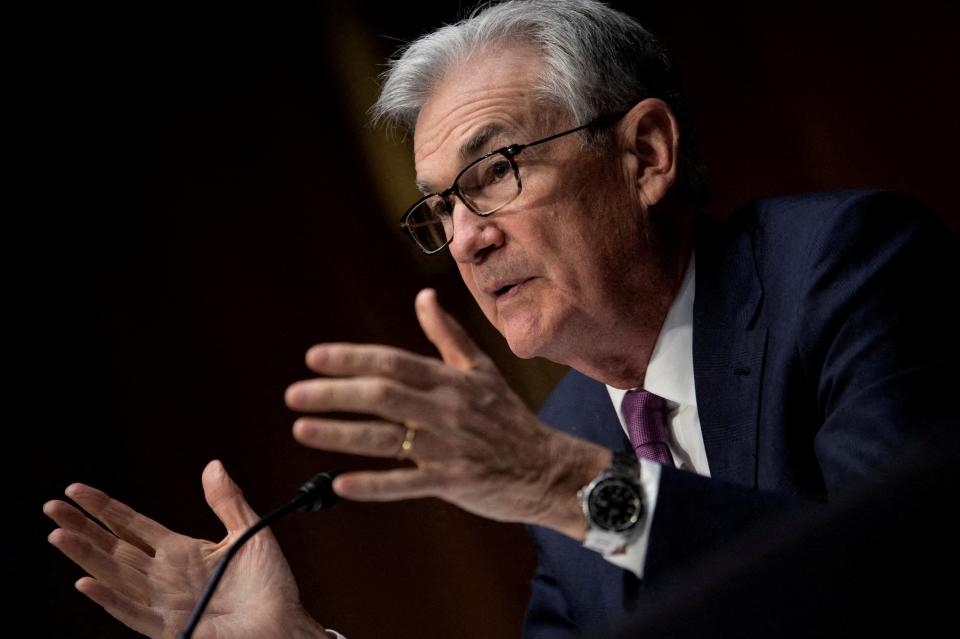

First US rate cut 'may not be until November'

Wednesday 10 April 2024 16:27 , Daniel O'Boyle

Kathleen Brooks, research director at XTB, says: “The immediate aftermath of the CPI report has been a bloodbath. The Dow is down by 440 points and the S&P 500 is lower by more than 1%. The 10-year Treasury yield, which had fallen by 10 basis points this week, reversed course and is higher by 12 basis points on the day. The market has once again recalibrated US rate cut expectations, and the verdict is that that first rate cut may not come until November. The market is now pricing in less than 2 rate cuts from the Fed for this year. What a turn around, only a few months ago the market was expecting 6 cuts.”

Will Bank of England be willing to cut before Fed?

Wednesday 10 April 2024 16:21 , Daniel O'Boyle

Market snapshot

Wednesday 10 April 2024 16:17 , Daniel O'Boyle

Take a look at the latest market data

Midwives working huge amount of unpaid extra hours – survey

Wednesday 10 April 2024 16:04 , Daniel O'Boyle

Many midwives are considering quitting as they work extra unpaid hours to keep services running, according to a new report.

The Royal College of Midwives (RCM) said a survey showed that during one week in March midwives and maternity support workers (MSWs) in England, Scotland and Wales worked 136,834 extra unpaid hours.

The situation was “unsustainable” and “grossly unfair”, said the RCM, adding that its members were now waiting for a pay announcement from the Government, which was due at the start of April.

City Comment: Think the UK economy has returned to growth? I wouldn’t be so sure

Wednesday 10 April 2024 15:15 , Daniel O'Boyle

Can Britain’s slow lane economy manage to eke out growth for two months on the trot for the first time since September?

That does not seem a very high bar to aspire to yet such are the grim realities of the UK’s parlous situation that it would be seized as major triumph by Downing Street after the autumn recession.

The consensus forecast among City scribes point to a 0.1% advance in GDP when the scores on the doors for February are revealed on Friday. Following the 0.2% mini-boom (by recent standards) in January that would represent something of a sustained spurt on recent performance.

But hang on to your hats.

US stocks plunge after hot inflation

Wednesday 10 April 2024 14:53 , Daniel O'Boyle

Wall Street stocks have fallen after the latest US inflation data came in hotter than expected.

The S&P 500 is down 1.1% at 5,153.79 while the Dow Jones has lost 500 points to 38,389.49. The Nasdaq is down 1.1% at 16,131.25.

Before the inflation reading, futures markets had suggested that markets were to open ahead of Tuesday’s close.

Big fallers included Royal Caribbean Cruises and Progressive.

'July or September for US rate cut'

Wednesday 10 April 2024 14:04 , Daniel O'Boyle

Neil Birrell, Chief Investment Officer and lead fund manager, Premier Miton Diversified Funds, says: “With rate cut expectations getting pushed further out over the last few weeks, today’s CPI data will give little hope for those looking for better news on that front. The US economy is running along at quite a pace and a June rate cut looks less and less likely – July or September is the call now.

“The Fed has got some head scratching to do and if other central banks were waiting for the Fed to move, they have got a conundrum on their hands now.”

US inflation 'dashed any hopes of May rate cut''

Wednesday 10 April 2024 13:44 , Daniel O'Boyle

Richard Carter, head of fixed interest research at Quilter Cheviot, says a May rate cut from the Federal Reserve is off the table after the latest CPI figures

He says: “These monthly readings will have dashed any remaining hopes of a Fed rate cut as early as May, as yearly CPI still sits firmly above the FOMC’s 2% target and has been heading in the wrong direction for the past few months. There had been hopes that today’s report would show the hot CPI figures from January and February were anomalous, but while that has not been the case, this recent uptick in inflation could just be a bump and we could see it begin to lower once more in the coming months.

“Central bank officials will be keeping a very close eye on these figures, and today’s print will have done little to quell fears that inflation is proving too stubborn. Markets are still hoping for a rate cut this summer, but the Fed will be looking for consistent signs of disinflation in the coming months before making the call.”

US inflation figures 'unlikely to cause a shift'

Wednesday 10 April 2024 13:38 , Daniel O'Boyle

Richard Flynn, Managing Director at Charles Schwab UK, said the latest US inflation figures shouldn’t mean a change in policy from the Fed, as it was already prepared for a bumpy path..

Flynn said: “Today’s figures show that the rate of inflation has increased compared to last month. Every piece of economic data is now being placed under the microscope as the market tries to predict when monetary policy will change, but these figures are unlikely to cause a shift.

“In recent months it has become clear that the journey to the Fed’s target of 2% inflation will be bumpy and Central Bankers are proceeding with caution when it comes to rate changes. It’s often said that the Fed takes the escalator up and the elevator down when setting rates, but for the path downwards in this cycle, it looks like they will opt for the stairs.”

London shares plunge on hot US inflation

Wednesday 10 April 2024 13:33 , Daniel O'Boyle

Shares in London are already repsonding poorly to that hot US inflation reading.

the FSTE 100 has lost 37 points in just three minutes. However it’s still up for the day at 7,953.64.

Another hot US inflation reading

Wednesday 10 April 2024 13:31 , Daniel O'Boyle

US inflation in March came in hotter than expected, with prices rising 3.5% year-on-year.

On a month-on-month basis, inflation was 0.4%. That compared to an expected 0.3%.

Core inflation was also a little ahead of expectations at 3.8%.

Direct Line rings the changes with new CFO brought in from Aviva after recent spate of setbacks

Wednesday 10 April 2024 13:16 , Daniel O'Boyle

Direct Line appointed a new chief financial officer today, as it seeks to move on from its recent rejection of a £3.1 billion takeover bid for the FTSE 250 insurer.

Jane Poole will join from Aviva, where she has been the CFO of the FTSE 100 firm’s UK and Ireland general insurance business since 2021.

She will take over from Neil Manser. He had been in post since January 2021 and worked for Direct Line for ten years before that, including a leading role in the company’s stock market floatation in 2012.

Best seats in the house help ticketing platform Seat Unique to soar

Wednesday 10 April 2024 13:02 , Lucy Tobin

Seat Unique is the luxury ticketing company Londoners call when money is no object. When all your partner wants in life is a Taylor Swift ticket that sold out months ago (Seat Unique still has a few left, albeit for at least £1800). When your team’s performance surpasses expectations and you want tickets to a particular Champion’s League fixture. Or when you want the plushest Formula 1 hospitality - but there’s only two of you and you’re not a corporate bank - Seat Unique will sell it to you.

The five-year-old company, set up by husband and wife Robin Sherry and Phillipa Hicks, has now sold £50 million of tickets to over 100 sports, music and theatre venues on its platform - £25 million of them in the last 12 months.

“We cannot understate the importance of today’s US inflation reading"

Wednesday 10 April 2024 12:50 , Daniel O'Boyle

Kathleen Brooks, research director at XTB, says today’s inflation reading will be crucial amid fears that price rises are becoming stickier.

Brooks said: “We cannot understate the importance of today’s US inflation reading. It comes as the market has pushed back its expectation for the first US interest rate cut to September, and investors seem to be positioned for bad news.

“Added to this, Fitch, the ratings agency, revised China’s outlook from stable to negative, saying that it expects China’s government to grow its debt pile to stimulate the economy.”

Market snapshot: FTSE edges ever-higher as US inflation approaches

Wednesday 10 April 2024 12:42 , Daniel O'Boyle

Take a look at our latest market snapshot as the FTSE 100 creeps closer to 8000. A low US inflation print could push it over that edge and to a new record.

'Neighbourhood' London bars group Darwin & Wallace sold to Portobello Pubs

Wednesday 10 April 2024 12:06 , Daniel O'Boyle

A London pub chain known for its Scandinavian-influenced interior design and gourmet breakfast menu is changing hands, as the “neighbourhood” bars group was bought by Portobello Pub Company today.

Darwin & Wallace operates seven pubs, mostly in South West London, at locations including Battersea Power Station and Chiswick Fire Station. It says all of its locations “take inspiration from their local areas”, and are designed in response to the “formulaic” style of many London watering holes.The chain is named after naturalists Charles Darwin and Alfred Russel Wallace.

The price was not disclosed, but the acquisition likely means a big payout for Darwin & Wallace founder Mel Marriott, who will step away from the day-to-day operation of the pubsas Portobello takes over.

Lloyds shakes up risk management team in bid to speed up transformation

Wednesday 10 April 2024 11:40 , Daniel O'Boyle

Lloyds Banking Group is shaking up its risk management team in a bid to speed up transformation, as a top executive said some processes are time-consuming and blocking the business’s progress, according to new reports.

The restructuring will put a number of roles under threat of redundancy, but will create jobs in other areas.

Lloyds told staff it is “resetting our approach to risk and controls”, according to an internal memo sent last month from chief risk officer Stephen Shelley, seen by the Financial Times.

Mr Shelley said two-thirds of executives think risk management is a blocker to its strategic transformation, while less than half of its workforce believe “intelligent risk-taking is encouraged”, according to the reports.

THG shares slide in late morning

Wednesday 10 April 2024 11:39 , Daniel O'Boyle

After an initially steady start to results-day trading, shares in THG have slid, down more than 8% at one point to 63p.

That leaves them down 16% for the year, and well over 90% below their IPO price.

It hoped to be able to reduce costs further this year as a result of the phased roll-out of more automation and use of robotics in its warehouses at Manchester Airport and New Jersey in the US

7.4m people struggling with bills and credit repayments in January 2024 – FCA

Wednesday 10 April 2024 11:04 , Daniel O'Boyle

More than seven million people across the UK were estimated to be struggling with bills and credit repayments in January, according to the City regulator.

Renters, single adults with children, adults from a minority ethnic background and people living in the north east of England were particularly likely to be in financial difficulty, the research indicates.

Unemployed adults and others not in work such as the long-term sick and full-time carers were also more likely to be struggling financially compared with the UK average.

FTSE 100 nears record, Lloyds higher after upgrade

Wednesday 10 April 2024 10:45 , Graeme Evans

The FTSE 100 index has taken a step towards record territory, with London’s top flight ahead by 0.6% or 47.82 points to 7982.61. That compares with the 8014 all-time closing high set in February 2023 and intra-day peak of 8047.

Alongside another strong session for commodity stocks, Legal & General rose 4.6p to 256.6p and BT Group lifted 1.45p to 108.65p. Lloyds Banking Group also lifted 0.6p to 53.5p after Barclays analysts improved their price target to 70p.

Tesco shares were 2.7p higher at 290.2p after operating profits rose 12.8% and the supermarket declared an 11% rise in the total dividend to 12.10p a share.

The improved market mood helped Ocado put back 4% as the best performing FTSE 100 stock, up 4% or 16.4p to 397p.

The FTSE 250 index rose 0.5% or 104.03 points to 19,867.38, with GKN Automotive business Dowlais up 3% and aerospace components firm Senior 4% higher.

FTSE 100 near record as BP run continues, Churchill China up 6%

Wednesday 10 April 2024 10:41 , Graeme Evans

Record territory for the FTSE 100 index was back in view today as investors circled some of London’s under-pressure blue-chip stocks.

Ocado rebounded by 3% or 13.2p to 393.8p, while advertising firm WPP and speciality chemicals business Croda International added 2%

The improved risk appetite helped the FTSE 100 index up by 0.5% or 41.28 points to 7976.07, not far from the 8014 record close of February 2023 and the intra-day peak of 8047.

BP’s strong run continued after adding 5.2p to 521.8p, while HSBC rose 9.2p to 653.9p and Standard Chartered lifted 9.8p to 682.6p.

On the fallers board, investors continued to reduce their exposure in defence and aerospace as Rolls-Royce fell another 2% or 8.4p to 403.8p after reversing 4% yesterday. BAE Systems also weakened 5.5p to 1271.5p.

The FTSE 250 index rose 0.75% or 148.15 points to 19,911.50, with GKN Automotive business Dowlais up 3% or 2.5p to 81.7p.

On AIM, Churchill China rallied after the tableware business posted a 12.4% rise in annual profits to £10.8 million. The increase came despite broadly flat revenues of £82.3 million in a challenging year for hospitality markets.

The company, which was founded in 1795 and employs 600 staff in Stoke-on-Trent, increased its dividend by 19% and said the new year had started in line with hopes.

Shares jumped 6% or 65p to 1075p, reducing the fall for this year to about 20%.

There was also progress by Cardiff-based semiconductor wafers firm IQE, which jumped 5.1p to 25.1p despite a bigger adjusted loss of £23.2 million for 2023.

IQE said the industry’s cyclical downturn had been unprecedented in its extent and duration but that it had seen improved trends in the first quarter of this year.

Labour reveals plans to ‘breathe new life’ into high streets with reformed rates

Wednesday 10 April 2024 10:05 , Daniel O'Boyle

Labour has pledged to “breathe new life” into high streets as the party unveils a five-point plan including reforming business rates and tougher laws on shoplifting.

During a visit to Tees Valley on Wednesday Labour’s deputy leader Angela Rayner, shadow chancellor Rachel Reeves, and shadow home secretary Yvette Cooper will unveil their party’s plan to “reverse the Tories’ 14 years of decline” on Britain’s high streets.

Analysis from the party claims that under the Conservatives there are 3,700 fewer fruit and veg shops, butchers and newsagents since 2010, adding that an additional 385 towns have seen their last bank branch close, or announce that they will be closing imminently.

"Much to do" at M&C chair admits

Wednesday 10 April 2024 09:23 , Simon English

M&C Saatchi chair Zillah Byng-Thorne today admitted the storied ad agency has “much more to do” before it can reclaim former glories.

The Soho agency, closely associated with the Conservative Party, has had a turbulent few years characterised by accounting scandals and management turmoil.

Byng-Thorne said 2023 was “a year of strategic progress”.

“We have begun to transform into a leaner and more agile business laying the groundwork for sustained growth and improved profitability ahead. There is much more to do on simplifying how we interact with our clients and evolving our go-to-market strategy,” she said.

The advertising market has been tough in general, with big tech players cutting their spending dramatically.

For the year to December sales fell 2% to £454 million. Profits fell 10% to £29 million.

CEO Moray MacLennan left last year. He will be replaced by Zaid Al-Qassab in May to build on a “simplified operating model”.

Byng-Thorne says the results reflect the “challenging market environment our businesses operate in”.

An election year ought to be good for agencies such as M&C. It has won new clients including Nike and McDonald’s. M&C shares today fell 5p to 170p.

TikTok owner surges ahead in 2023

Wednesday 10 April 2024 09:19 , Simon Hunt

TikTok owner ByteDance has emerged as one of the world’s fastest-growing tech companies after a near-50% jump in sales in 2023.

The firm delivered revenues of just under $120 billion in 2023, according to figures seen by Bloomberg, while profits rocketed by almost 60% to over $40 billion amid a surge in user activity on the video sharing app.

The figures have propelled ByteDance past its fiercest Chinese rival Tencent, which owns the popular social media app WeChat.

But uncertainty still hangs over the group’s future, with the US House of Representatives

passing a bill last month to ban TikTok in the US unless ByteDance divests TikTok, which has 170 million users in the country.

ByteDance founder Zhang Yiming is thought to have a net worth of as much as $40 billion, making him the third-richest person in China.

In the UK, TikTok has supplanted Instagram in popularity with more than one in four 16-24 year olds naming the app as their primary social media platform.

Market snapshot: FTSE 100 near record

Wednesday 10 April 2024 09:12 , Daniel O'Boyle

Take a look at our latest market snapshot after the FTSE 100’s strong start today.

US m/m inflation below 0.3% could lead to big market moves

Wednesday 10 April 2024 08:16 , Daniel O'Boyle

Ahead of this afternoon’s IUS inflation printout, Chris Turner of Dutch bank ING says a month-on-month figure cooler than the expected 0.3% could lead to a big reaction in the markets.

Turner said: “We see an asymmetric reaction from the dollar to today’s CPI data.

“A firm number has been expected and is consistent with the sticky inflation and firm activity data witnessed so far this year. We would expect a bigger dollar sell-off on, say, core CPI at 0.2% month-on-month than we would a dollar rally on a 0.3% or even 0.4% release. This because the Fed has said that it wants to cut rates probably three times, if only the data would allow it.”

THG posts another year of losses after sales slip

Wednesday 10 April 2024 07:44 , Simon Hunt

E-commerce firm THG posted another major loss today after it reported a fall in revenues.

The Manchester-based business made an operating loss of £185 million in 2023 -- that is only marginally smaller than the £496 million loss in 2022 after accounting for a one-off £275 million impairment recorded that year.

Revenues slipped 8.4% to just over £2 billion amid a fall in its beauty sales and an exit from a number of unprofitable business units.

Net debt jumped by a fifth to £218 million.

CEO Matt Moulding said the year “was certainly not without its headwinds, but the Group responded proactively, and emerged stronger.

“Following the challenging global environment in 2022, we repositioned our three businesses to focus our resources onto margin recovery and a return to sustainable revenue growth.”

Direct Line rings the changes with new CFO brought in from Aviva

Wednesday 10 April 2024 07:40 , Michael Hunter

Direct Line, the FTSE 250 insurer, appointed a new chief financial officer today, as it seeks to move on from its recent rejection of a £3.1 billion takeover bid.

Jane Poole joins from Aviva, where she has been the CFO of the FTSE 100 firm’s UK and Ireland general insurance business since 2021.

She will take over from Neil Manser, who has been in post since January 2021 and worked for Direct Line for ten years before that, including a leading role in the company’s stock market floatation in 2012.

The reshuffle comes weeks after the Bromley-based firm rebuffed the approach in February from Belgian rival Ageas, an offer it branded “opportunistic”. The bid last followed a turbulent 2023 for Direct Line, which issued a profit warning and axed its dividend in January that year. It led to the sudden departure of its chief executive, Penny James.

Her permanent replacement, Adam Winslow, took up the job last month after acting CEO Jon Greenwood ran the firm on an interim basis.

Jane Poole, said today: "I am delighted to be joining Direct Line Group as CFO at this important time and motivated to drive business performance to realise the significant potential ahead.

Tesco profit surge to reignite 'greedflation' debate

Wednesday 10 April 2024 07:39 , Simon English

Tesco saw profits soar by 160% in the last year, figures that are bound to reignite the debate about so-called “greed inflation”.

The UK’s biggest grocer saw profits jump to £2.29 billion on sales up 7.4% at £61.4 billion. Critics saw Tesco and other big firms have been selling smaller items at higher prices under the cover of inflation.

Chief executive Ken Murphy said: “Inflationary pressures have lessened substantially, however we are conscious that things are still difficult for many customers, so we have worked hard to reduce prices and have now been the cheapest full-line grocer for well over a year. We have continued to invest in helping customers where it matters most, cutting prices on more than 4,000 products and doubling down on our powerful combination of Aldi Price Match, Low Everyday Prices and Clubcard Prices.”

Shareholders will be pleased. The dividend is up 11% to 12.1p.

Murphy says consumer sentiment is “improving” and that Tesco is growing its market share.

Speedy Hire warns construction slowdown will hit profits

Wednesday 10 April 2024 07:39 , Daniel O'Boyle

Tools and equipment hire firm Speedy Hire is the latest company to warn its profits will be hit by the impact of surging interest rates, as it said its results will be on the lower end of guidance.

Revenue was down 5%, as the construction sector that makes up the main part of Speedy Hire’s customer base was hit by”cost inflation and softer demand”. Many housebuilders have warned that rising interest rates have hit their ability to deliver projects.

However, the business said it was well-positioned to benefit from a recovery this winter.

FTSE 100 higher ahead of US inflation reading, Hang Seng rallies

Wednesday 10 April 2024 07:21 , Graeme Evans

The prospect of US inflation figures later today has failed to dampen the mood after futures trading pointed to a positive start for London’s FTSE 100 index.

IG Index is reporting that the top flight benchmark will open about 0.5% or 42 points higher at 7977, having fallen by nine points in yesterday’s session.

Wall Street also saw robust trading on Tuesday after a late rally helped the S&P 500 index finish 0.1% higher while the Nasdaq Composite added 0.3%.

However, Deutsche Bank notes the S&P 500 has now gone seven sessions without a new record, the longest run without an all-time high since January.

The caution in the US reflects mounting interest rate cut uncertainty in the build up to today’s inflation reading for March.

Economists expect the year-on-year measure to pick up by two-tenths to 3.4% but for the core CPI measure to decline slightly to 3.7%.

Elsewhere today, the Hang Seng index rose 1.5% to its highest level in a month. Gold is near a record at $2357 an ounce and Brent Crude at $89.51 a barrel.

Recap: Yesterday's top headlines

Wednesday 10 April 2024 06:44 , Simon Hunt

Good morning from the Standard City desk.

Is Wael Sawan bluffing when he says he is prepared to move Shell’s main listing from London to New York if its shares stay as undervalued as they are currently?

I would not bet on it.

Although his Bloomberg interview is the first time the oil giant’s CEO has made the threat explicitly in public, he has been saying much the same thing privately for some time.

The 49-year-old has dual Lebanese and Canadian nationality and his career has taken him all over the world in a variety of roles often far away from head office. He feels that the antipathy for the oil and gas sector expressed through the Extinction Rebellion movement and other high profile campaigns is an indulgent “north west Europe” phenomenon not shared by the rest of the world, particularly in developing countries.

He is also deeply frustrated by what he sees as London investors’ under-appreciation of the financial performance of the company, and the British government’s over-taxation of its profits, a state of play unlikely to be eased by Keir Starmer’s arrival in Downing Street and Ed Miliband’s at the Department of Climate Change.

f that threat does not shake the Stock Exchange out of its complacency, it is difficult to know what will.

~

Here’s a summary of our other top headlines from yesterday:

HSBC takes $1 billion loss on sale of its Argentinian operation for $550 million

Losses at Talk TV widened to £54 million in year to July 2023 before decision was taken to take channel off air, latest accounts reveal

Unite Students wins planning consent for 41 storey student accommodation tower with almost 1,000 rooms next to Stratford Station

Gresham Technologies latest listed company to be taken out in £147 million deal

And...AI can be ‘sword and shield’ against misinformation, Sir Nick Clegg says

Yahoo Finance

Yahoo Finance