FTI Consulting (FCN) Q1 Earnings Beat Estimates, Fall Y/Y

FTI Consulting, Inc. FCN delivered impressive first-quarter 2022 results, with both earnings and revenues beating the Zacks Consensus Estimate.

Adjusted earnings per share (excluding 6 cents from non-recurring items) of $1.66 surpassed the Zacks Consensus Estimate by 24.8% but decreased 12.2% on a year-over-year basis.

Total revenues of $723.6 million beat the consensus mark by 3% and rose 5.4% on a year-over-year basis. The uptick was driven by higher demand across all business segments, except Economic Consulting.

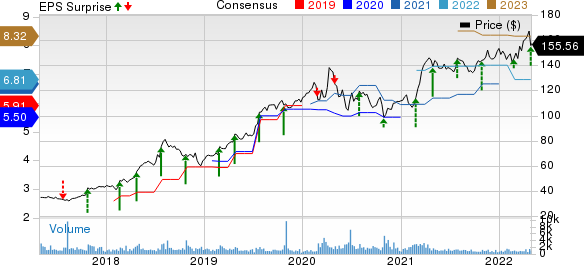

FTI Consulting, Inc. Price, Consensus and EPS Surprise

FTI Consulting, Inc. price-consensus-eps-surprise-chart | FTI Consulting, Inc. Quote

Revenues by Segment

Forensic and Litigation Consulting revenues increased 2% year over year to $153.9 million. The uptick was primarily driven by acquisition-related revenues, higher realized bill rates and demand for investigations services. The segment contributed 21.3% to total revenues.

Strategic Communications revenues increased 15.6% year over year to $69.9 million. The uptick can be attributed to higher demand for corporate reputation services. The segment contributed 9.66% to total revenues.

Technology revenues increased 1.3% year over year to $80.5 million. The upside resulted from higher demand for information governance, privacy and security, cross-border investigations and litigation services. The segment contributed 11% to total revenues.

Economic Consulting revenues were down 1.9% year over year to $166 million. The downside can be attributed to a decline in demand for M&A-related antitrust services. The segment contributed 22.9% to total revenues.

Corporate Finance & Restructuring revenues increased 12% year over year to $253.3 million. The uptick was primarily on higher demand for business transformation and transactions services, partially offset by lower demand for restructuring services. The segment contributed 35% to total revenues.

Operating Results

Adjusted EBITDA was $90.5 million, down 9% on a year-over-year basis. The decrease in Adjusted EBITDA was primarily caused by an increase in compensation. Adjusted EBITDA margin contracted 200 basis points year over year to 12.5%.

Balance Sheet and Cash Flow

FTI Consulting exited the first quarter with cash and cash equivalents of $271.1 million compared with the prior quarter’s level of $494.5 million. Long-term debt was $328.9 million compared with $297.2 million witnessed at the end of the previous quarter. FCN generated $203.8 million of net cash from operating activities, while CapEx was $12.6 million.

FTI Consulting currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots

Within the broader Business Services sector, ManpowerGroup Inc. MAN, Omnicom Group Inc. OMC and Equifax Inc. EFX recently reported first-quarter 2022 results.

ManpowerGroup reported impressive first-quarter 2022 results, with both earnings and revenues beating the Zacks Consensus Estimate. Quarterly adjusted earnings of $1.88 per share beat the consensus mark by 20.5% and improved 69.4% year over year. Revenues of $5.14 billion surpassed the consensus mark by 0.7% and inched up 4.5% year over year on a reported basis and 9.8% on a constant-currency (cc) basis.

Omnicom reported impressive first-quarter 2022 results as both earnings and revenues surpassed the Zacks Consensus Estimate. Earnings of $1.39 per share beat the consensus mark by 8.6% and increased 4.5% year over year, driven by a strong margin performance. Total revenues of $3.4 billion surpassed the consensus estimate by 5.4% but declined slightly year over year.

Equifax reported better-than-expected first-quarter 2022 results. Adjusted earnings of $2.22 per share beat the Zacks Consensus Estimate by 3.3% and improved 13% on a year-over-year basis. Revenues of $1.36 billion outpaced the consensus estimate by 2.4% and improved 12.4% year over year on a reported basis and 13% on a local-currency basis.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance