Frequency Electronics Inc Reports Robust Revenue Growth in Q3 FY2024

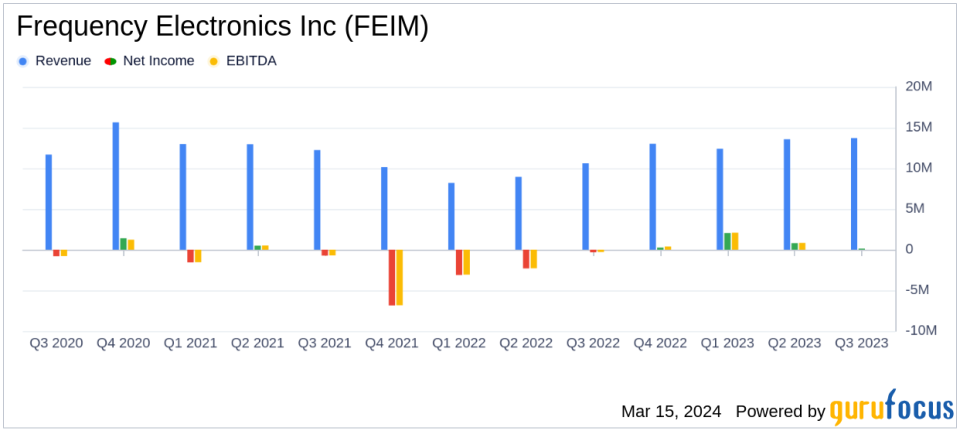

Revenue Growth: Q3 revenues increased to $13.7 million, up from $10.6 million in Q3 FY2023.

Net Income: Q3 net income was $0.1 million, a turnaround from a net loss of $0.3 million in the same period last year.

Operating Income: Nine-month operating income improved to $2.5 million, recovering from a $5.1 million loss in the prior year.

Backlog: Record high backlog of $67 million, indicating strong future revenue potential.

Gross Margin: Company aims to improve gross margins despite a decrease in the current quarter.

Free Cash Flow: Anticipated significant free cash flow generation in Q4.

Stockholders Equity: Increased to $36.7 million from $32.9 million at the end of the last fiscal year.

On March 14, 2024, Frequency Electronics Inc (NASDAQ:FEIM) released its 8-K filing, announcing financial results for the third quarter and nine-month periods of fiscal year 2024. The company, a leader in precision timing and frequency control products, reported a significant increase in revenues for both the three-month and nine-month periods, with revenues of approximately $13.7 million and $39.7 million, respectively. This marks a substantial improvement compared to the same periods in the previous fiscal year.

Financial Performance and Challenges

Despite the revenue growth, FEIM experienced an operating loss of $0.5 million for the quarter, attributed to technical challenges on a new development program. However, the company's President and CEO, Tom McClelland, remains confident that these setbacks are largely resolved and that the company will generate an operating profit for the year. The backlog, which reached an all-time high, and the anticipated significant free cash flow in the fourth quarter, suggest a positive outlook for the company's future financial health.

Strategic Focus on Gross Margin and Profitability

McClelland also emphasized the company's commitment to improving gross margins and achieving sustained profitability and cash generation. The gross margin performance for the quarter did not align with recent trends, but efforts are ongoing to enhance margins. The company's strategic initiatives are expected to position FEIM for growth, profitability, and improved cash flow.

Income Statement and Balance Sheet Highlights

Key details from the income statement show that the net income from operations for the three and nine months ended January 31, 2024, was $0.1 million or $0.01 per diluted share and $3.0 million or $0.32 per diluted share, respectively. This is a notable improvement from the net losses reported in the same periods of the previous fiscal year. The balance sheet reflects a solid financial position, with an increase in stockholders' equity to $36.7 million from $32.9 million at the end of the last fiscal year. Cash and cash equivalents remain strong at $11.7 million.

Analysis of Company's Performance

FEIM's performance in the third quarter of fiscal year 2024 demonstrates resilience in the face of technical challenges. The company's ability to pivot and manage setbacks, coupled with a record backlog and a focus on gross margin improvement, indicates a strategic approach to long-term financial stability. The anticipated free cash flow in the upcoming quarter is a critical factor that could further solidify the company's financial standing and support its growth initiatives.

Investors and analysts interested in discussing these results can join the conference call scheduled for March 14, 2024, at 4:30 PM Eastern Time. The call can be accessed by dialing 1-888-506-0062 (domestic) or 1-973-528-0011 (international), with participant access code: 835888.

For more detailed information on Frequency Electronics Inc's financials and strategic direction, interested parties can visit the company's website at www.frequencyelectronics.com or access the archived conference call for a week following the live discussion.

As a leader in its field, Frequency Electronics Inc continues to invest in research and development to expand its capabilities and markets, ensuring that it remains at the forefront of technological advancements in precision timing and frequency control systems.

Explore the complete 8-K earnings release (here) from Frequency Electronics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance