Freeport-McMoRan Inc. (FCX) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

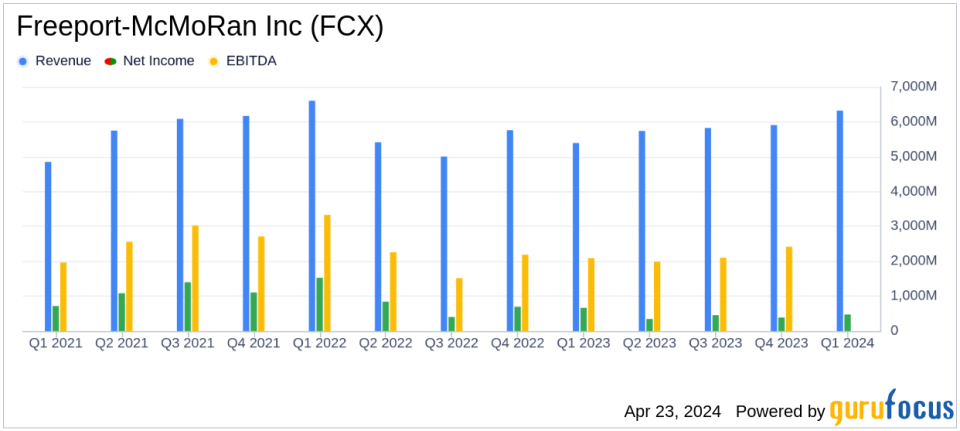

Net Income: Reported at $473 million for Q1 2024, with earnings per share of $0.32, surpassing the estimated earnings per share of $0.27 and net income estimate of $341.23 million.

Revenue: Reached $6,321 million in Q1 2024, exceeding the estimated revenue of $5,659.69 million.

Operating Income: Achieved $1,634 million in Q1 2024, showing strong operational performance and financial health.

Copper Sales Volumes: Totalled 1.1 billion pounds, an 11% increase over the January 2024 estimate and a 33% increase from Q1 2023.

Average Realized Prices: $3.94 per pound for copper, $2,145 per ounce for gold, and $20.38 per pound for molybdenum in Q1 2024.

Operating Cash Flows: Generated $1.9 billion in Q1 2024, indicating robust cash flow management and operational efficiency.

Capital Expenditures: Totalled $1.3 billion in Q1 2024, with significant investments in major mining projects and Indonesia smelter projects.

Freeport-McMoRan Inc. (NYSE:FCX), a leading international mining company, released its 8-K filing on April 23, 2024, detailing robust first-quarter results for the year. The company reported a net income of $473 million, translating to $0.32 per share, which aligns with analyst projections of $0.27 per share. This performance marks a significant achievement, particularly in light of the estimated net income of $341.23 million. FCX's revenue for the quarter stood impressively at $6,321 million, comfortably surpassing the expected $5,659.69 million.

Company Overview

Freeport-McMoRan Inc. operates on a global scale, focusing primarily on copper mining with additional operations in gold and molybdenum. Its major mining divisions include North America, South America, and Indonesia, with significant activities in the Morenci, Cerro Verde, and Grasberg mines. The company's revenue primarily stems from copper sales, making its performance in this sector crucial to overall success.

Operational Highlights and Financial Health

The first quarter saw FCX achieving copper sales volumes that not only exceeded the estimates set in January 2024 but also showed a significant increase from the first quarter of the previous year. This was largely due to enhanced mining and milling rates and improved ore grades, particularly at the PT-FI operations in Indonesia. Gold sales also saw a substantial increase, reflecting similar operational improvements.

FCX's strategic initiatives, including the nearing completion of the Indonesia smelter projects, are set to further bolster its operational capabilities. The company's solid financial position is underscored by a robust $1.9 billion in operating cash flows and a disciplined approach to capital expenditures, totaling $1.3 billion for the quarter.

Market Position and Future Outlook

The favorable market fundamentals for copper and the company's strong execution of operational plans provide a positive outlook for FCX. The anticipated completion of smelter projects in Indonesia and ongoing development activities across its operating regions are expected to sustain and enhance production capacities. With copper's role increasingly pivotal in global economic developments, particularly in green technologies, FCX is well-positioned to leverage its operational strengths for future growth.

Leadership and Strategic Directions

The impending transition in leadership, with Kathleen L. Quirk set to become CEO, marks a significant milestone for FCX. The company remains committed to its strategic focus on copper, aiming to capitalize on its extensive asset base and operational excellence to drive shareholder value and industry leadership.

Analysis and Investor Implications

Freeport-McMoRan's Q1 2024 performance reflects a robust operational and financial framework that supports its growth trajectory in the metals market. The company's ability to exceed revenue forecasts and align with earnings expectations underscores its resilience and strategic planning efficacy. Investors might view FCX's ongoing projects and market positioning as strong indicators of potential future returns, supported by favorable copper and gold market dynamics and strategic expansions.

Overall, Freeport-McMoRan Inc. (NYSE:FCX) demonstrates a compelling blend of operational success and strategic foresight, making it a noteworthy entity in the metals and mining sector for the forthcoming periods.

Explore the complete 8-K earnings release (here) from Freeport-McMoRan Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance