Fraser Institute: New Brunswick's Blaine Higgs is Canada's most fiscally responsible premier

By Alex Whalen and Jake Fuss

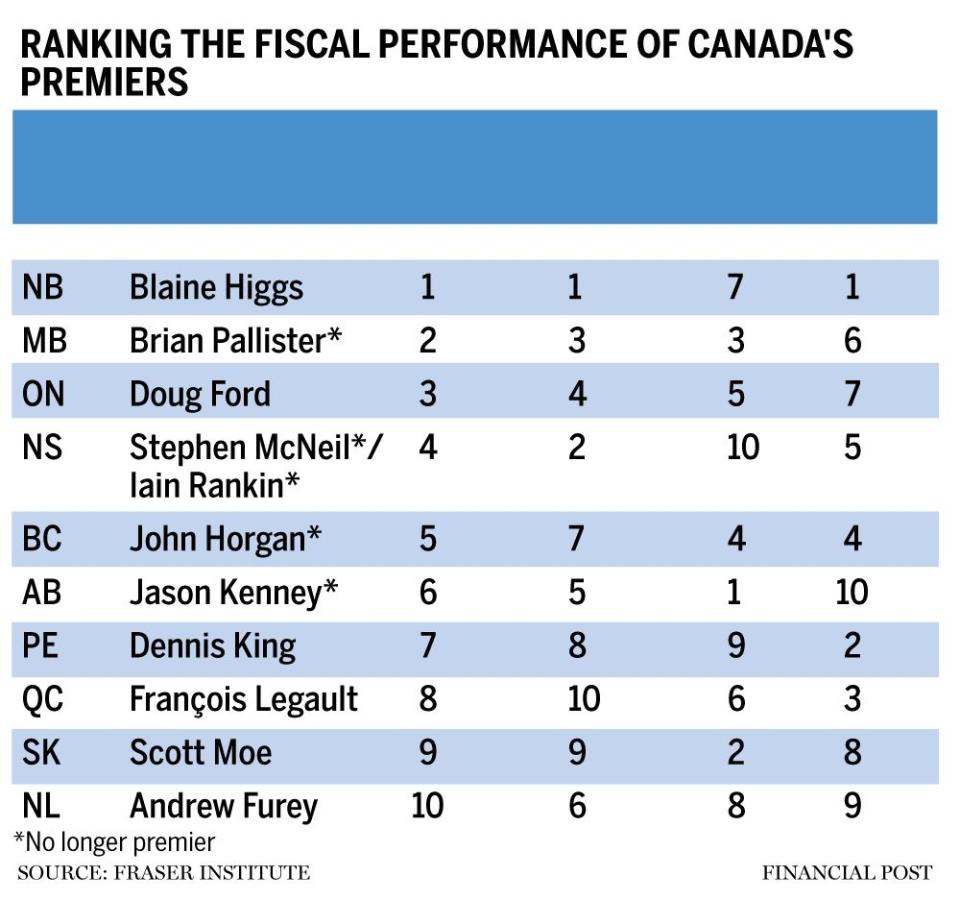

According to our new Fraser Institute study, New Brunswick Premier Blaine Higgs is the top-performing premier in Canada when it comes to fiscal issues. We ranked premiers in all 10 provinces based on their relative performance since coming to power on three core components of fiscal policy: government spending, taxes, and deficits and debt.

What has Higgs done right? He’s demonstrated the most spending restraint of any premier. In fact, since taking office in 2018 he is the only one to have kept the pace of growth in government spending (excluding debt interest costs) below the pace of his province’s economic growth.

In contrast, Premier François Legault of Quebec had the poorest score on government spending, followed by Scott Moe of Saskatchewan and Dennis King of Prince Edward Island. During Legault’s tenure, non-interest government spending has grown on average by more than 10 per cent a year, greatly outpacing Quebec’s average annual economic growth over the same period.

Because of the Higgs government’s restrained approach to spending, New Brunswick has had budget surpluses for four years running. Uniquely in Canada, it even managed to run surpluses during the pandemic. All other provinces chose to borrow money and dive deeper into debt.

The study also shows that New Brunswick’s debt as a share of its economy declined by the greatest percentage of any province between 2018 and 2022. Spending restraint is clearly paying off. With its surpluses and declining debt, the Higgs government has created fiscal room to tackle other pressing challenges, including New Brunswick’s high tax rates. The government reduced taxes in last year’s budget and promised further personal income tax and property tax reductions in its recent throne speech.

Terence Corcoran: Hey, everybody! How about a general strike?

Matthew Lau: Theresa Tam tests positive for creeping-government virus

Opinion: Why is Ottawa still rationing foreign landings at our airports?

Provinces that have taken a different approach to spending have less room for tax reductions. Alberta’s Jason Kenney, who recently stepped down as premier, placed last among his peers on deficits and debt as his government recorded relatively large deficits in 2019/20 and 2020/21 and an outsized increase in provincial debt during his time in office. To be fair, Alberta suffered a sharp loss of revenue during COVID, particularly when oil and gas prices were low, but Kenney failed to restrain spending both before and during the pandemic. He did record a budget surplus in 2021/22 but only after resource revenues, mainly from oil and gas, increased dramatically.

Economic success and responsible fiscal management go hand in hand. To adopt prudent fiscal policy, governments must prioritize and restrain spending, work hard to balance budgets and avoid heavy tax burdens that harm economic activity. These fiscal fundamentals lay the best foundation for an economy to grow and people to prosper.

The Higgs government’s approach to government finances stands out among the provinces. There are key lessons all premiers should learn from New Brunswick’s successful example.

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Yahoo Finance

Yahoo Finance