Franklin Electric Q1 Earnings: Misses Revenue and EPS Estimates Amid Market Challenges

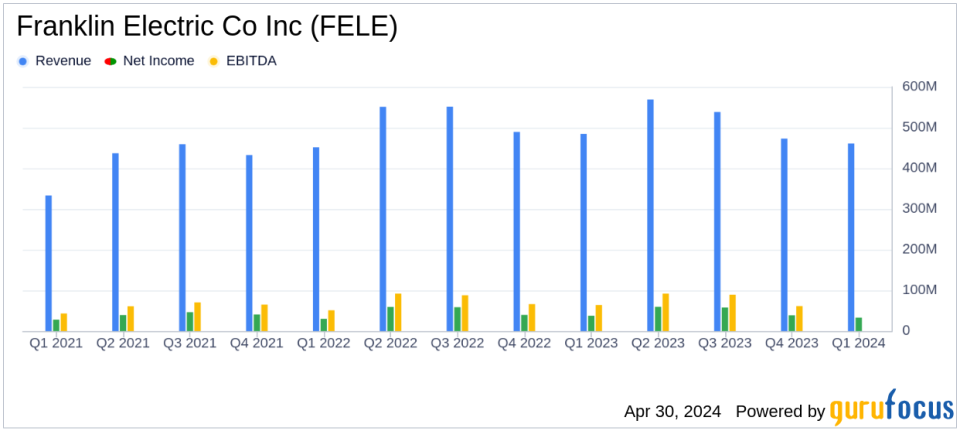

Revenue: Reported at $460.9 million, down 5% year-over-year, falling short of estimates of $477.68 million.

Net Income: Achieved $33.09 million, below the estimated $34.55 million.

Earnings Per Share (EPS): Recorded at $0.70, falling short of the estimated $0.74.

Operating Income: Totaled $47.9 million with an operating margin of 10.4%, compared to $52.6 million and a margin of 10.9% in the prior year.

Segment Performance: Water Systems sales decreased by 7%, while Fueling Systems sales saw a sharper decline of 15%. Distribution segment, however, increased by 3%.

Guidance: Maintained full-year 2024 sales guidance at $2.10 billion to $2.17 billion and EPS forecast between $4.22 and $4.40.

On April 30, 2024, Franklin Electric Co Inc (NASDAQ:FELE) disclosed its first-quarter financial results through an 8-K filing, revealing a mix of downturns in sales across most of its segments and a slight decrease in earnings per share (EPS). The company, a global leader in the manufacturing and distribution of water and fuel pumping systems, reported consolidated net sales of $460.9 million, a 5% decrease compared to the previous year, and below the analyst estimates of $477.68 million. The EPS also fell short of expectations, registering at $0.70 against an estimated $0.74.

Franklin Electric operates through three segments: Water Systems, Fueling Systems, and Distribution. The Water Systems and Fueling Systems segments experienced declines of 7% and 15% respectively in net sales, while the Distribution segment saw a modest increase of 3%. Despite lower sales, the company highlighted effective margin management and operational improvements.

Financial Highlights and Segment Performance

The Water Systems segment, usually a strong performer, saw a decrease in sales primarily due to reduced demand for large dewatering pumps, which had seen exceptional performance in the same quarter the previous year. However, this was slightly offset by increased sales in Water Treatment products. The Fueling Systems segment's decline was attributed to normalized demand and order patterns following unusually high sales in the previous year. The Distribution segment's growth was spurred by higher volumes and a recent acquisition, although this was somewhat negated by pricing pressures on commodity-based products.

Strategic Initiatives and Future Outlook

Despite the challenges faced in the first quarter, Franklin Electric's management remains optimistic about the future, maintaining its full-year guidance with expected sales ranging between $2.10 billion and $2.17 billion and EPS between $4.22 and $4.40. Gregg Sengstack, the Chairperson and CEO, emphasized the company's resilience and strategic adjustments in response to external pressures such as unfavorable weather patterns and commodity price headwinds.

"Our first quarter started slower than expected but improved as we moved through the quarter and demand seasonally increased. While results were slightly below our expectations due to the impact from unfavorable weather patterns and lingering commodity price headwinds in our Distribution business, underlying demand in our core markets remains healthy. Strong execution by our global teams drove improved margins on lower sales in our Water Systems and Fueling Systems segments," commented Gregg Sengstack.

Financial Stability and Investor Considerations

The company's balance sheet remains robust, with significant improvements in working capital management leading to enhanced cash flow from operations. This financial stability, coupled with a disciplined approach to capital allocation, positions Franklin Electric to capitalize on market opportunities and navigate through cyclical fluctuations in the industry.

For investors, these results highlight the importance of monitoring Franklin Electric's ability to adapt to market conditions and execute on its strategic initiatives. While the short-term results have shown some weaknesses, the company's strong market position and ongoing efforts to optimize its operations could provide a basis for future growth and profitability.

Investors and stakeholders are encouraged to review the detailed financial statements and listen to the earnings conference call to gain deeper insights into the company's strategies and market dynamics.

Explore the complete 8-K earnings release (here) from Franklin Electric Co Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance