Fox (FOXA) Q4 Earnings Miss Estimates, Revenues Increase Y/Y

Fox Corporation FOXA reported fourth-quarter fiscal 2022 adjusted earnings of 74 cents, which missed the Zacks Consensus Estimate by 6.3%. The figure increased 13.8% year over year.

Revenues were up 4.9% year over year to $3.03 billion. The figure missed the consensus mark by 0.8%.

Affiliate fees (56.9% of revenues) rose 3.7% to $1.72 billion. Meanwhile, advertising (34.8% of revenues) increased 7.4% to $1.05 billion. Other revenues (8.3% of revenues) increased 3.7% from the year-ago quarter’s levels to $252 million.

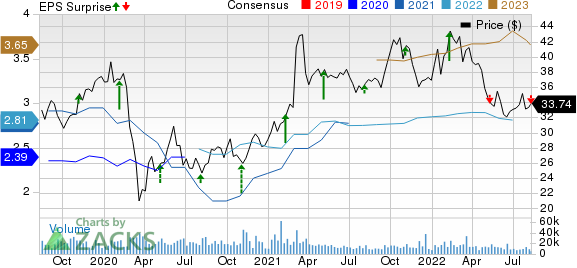

Fox Corporation Price, Consensus and EPS Surprise

Fox Corporation price-consensus-eps-surprise-chart | Fox Corporation Quote

Top-Line Details

Cable Network Programming (48.1% of revenues) revenues increased 4.4% year over year to $1.46 billion. Advertising revenues increased 14%, primarily due to continued strength in pricing and higher ratings, partially offset by the impact of higher preemptions associated with breaking news coverage at FOX News Media.

Revenues from Affiliate fees increased 1.7% year over year, driven by contractual price increases. Other revenues remained flat on a year-over-year basis, primarily due to higher FOX Nation subscription revenues being offset by the timing of sports sublicensing revenues, which were impacted by COVID-19 in the prior-year quarter.

Television (50.3% of revenues) revenues increased 5.4% from the year-ago quarter’s figure to $1.52 billion. Advertising revenues increased 4.5% year over year, primarily due to higher political advertising revenues at the FOX Television Stations, continued growth at TUBI and the addition of the USFL at FOX Sports, partially offset by lower ratings at FOX Entertainment.

Affiliate fees increased 6.9% year over year, driven by increases in fees from third-party FOX affiliates and higher average rates at the company’s owned and operated television stations. Other revenues increased 2.9% year over year, primarily due to the impact of the consolidation of MarVista Entertainment, TMZ and Studio Ramsay Global.

Operating Details

In fourth-quarter fiscal 2022, operating expenses increased 4.7% year over year to $1.71 billion. As a percentage of revenues, operating expenses contracted 100 basis points (bps) to 56.5%.

Selling, general & administrative (SG&A) expenses increased 2.2% year over year to $552 million. As a percentage of revenues, SG&A expenses expanded 500 bps to 18.2%.

Total adjusted EBITDA increased 7.4% year over year to $770 million. EBITDA margin expanded 60 bps to 25.4%.

Cable Network Programming EBITDA decreased 6.8% year over year to $628 million. EBITDA margin contracted 520 bps to 43%.

Television EBITDA jumped 52.7% to $226 million. EBITDA margin expanded 460 bps to 14.8%.

Balance Sheet

As of Jun 30, 2022, Fox had $5.2 billion in cash and cash equivalents compared with $4.63 billion as of Mar 31, 2022.

Long-term debt, as of Jun 30, 2022, was $7.20 billion, which remained flat sequentially.

Zacks Rank & Stocks to Consider

Fox currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Zacks Consumer Discretionary sector are DouYu International DOYU, Enthusiast Gaming EGLX and Genasys GNSS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

DouYu International is down 55.7% in the year-to-date period compared with the Zacks Gaming industry’s decline of 31.8% and the Consumer Discretionary sector’s fall of 30.1%.

Enthusiast Gaming shares are down 34% in the year-to-date period compared with the Zacks Gaming industry’s decline of 31.8% and the Consumer Discretionary sector’s fall of 30.1%.

Genasys shares are down 13.2% in the year-to-date period compared with the Zacks Consumer Services - Miscellaneous industry’s decline of 10.8% and the Consumer Discretionary sector’s fall of 30.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fox Corporation (FOXA) : Free Stock Analysis Report

DouYu International Holdings Limited Sponsored ADR (DOYU) : Free Stock Analysis Report

Genasys Inc. (GNSS) : Free Stock Analysis Report

Enthusiast Gaming Holdings Inc. (EGLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance