Forget the soundbites: Here's what's really happening with all the EV delays

Pay less attention to today’s headlines, and more to the trend line.

That sums up what some of the smartest people studying the auto industry say about the transition to electric vehicles, and it’s a sharp contrast to the current obsessive focus on every change in automakers' production and sales plans.

EV sales are rising and will continue to do so.

In the first four months of 2024 – the latest period for which figures are available – customers bought 366,469 EVs, a 7.3% increase from 2023, according to S&P Global Mobility.

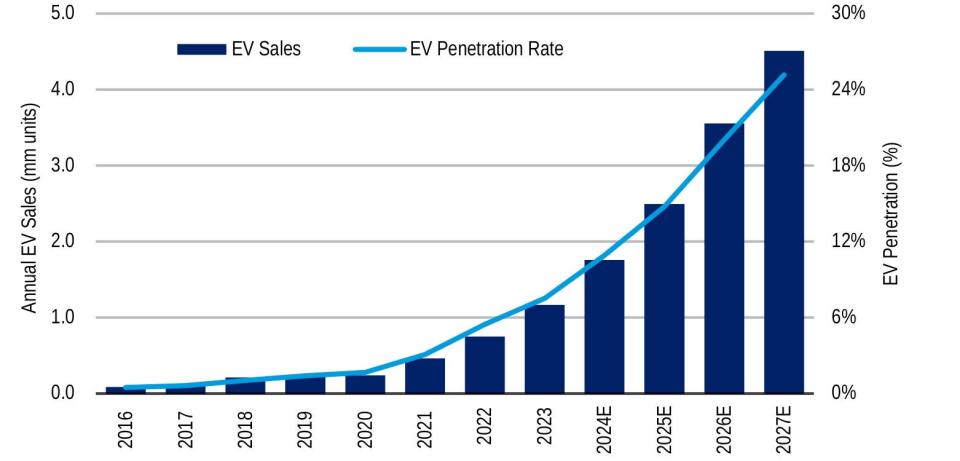

After reaching 5.9% of vehicle sales in 2022, EVs hit a record 7.6% in 2023. If 7.6% doesn’t butter your bread, consider that the popular Escape compact SUV accounted for 7.4% of the Ford brand’s sales in 2023. Looking forward, EVs should reach 11% of sales this year and rise steadily to 25% in 2027, Bank of America auto analyst John Murphy said in a presentation to the Automotive Press Association in Detroit this month.

So what's up with all the reports about automakers delaying plans for when, where and how many electric vehicles they’ll produce and sell?

They’re true, but they’re only part of the story.

Goofs and glitches happen

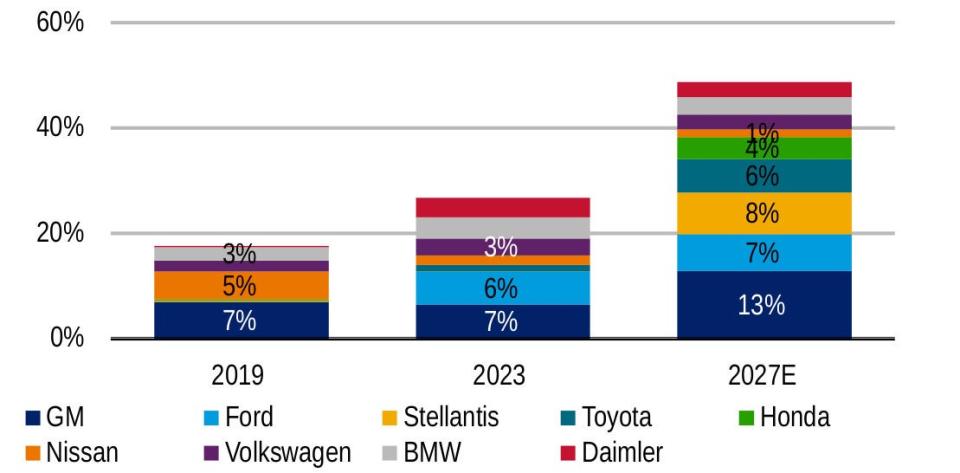

General Motors and Ford have repeatedly said they are delaying the production of EVs, batteries and motors. GM just trimmed its 2024 EV sales forecast by 50,000 vehicles. Fiat Chrysler (now part of Stellantis), a slow starter, has yet to sell any.

Those developments and more fueled claims that EVs are a sham, toys for the wealthy and woke, unfit for use by the rest of us.

Are EVs doomed? Have automakers wasted precious time and resources rushing them into cul-de-sacs?

Not a chance.

Remaking a 140-year-old industry is hard. In addition to the goofs and glitches that come with any new technology, virtually every major global automaker has either gotten out over its skis or has been lambasted for a slow and half-hearted strategy.

Hyundai Kia is the only exception, plotting and sticking to a smooth growth plan. Customers have rewarded them, but I’ll be surprised if the Korean pair doesn’t announce their own course corrections at some point.

'The next 18 months don’t matter much'

We all – whether you believe electric vehicles are a waste of time or destined to dominate – need to stop treating each announcement as if it's the answer to all our questions.

“This is still a new market,” S&P Global Mobility analyst Stephanie Brinley said. “There will be ebbs and flows. The next 18 months don’t matter much. All today’s investments are about 2030-35”

So why were some automakers’ investment announcements so bold?

I’ve got theories. How much time do you have?

◾ Maybe they wanted to win the press conference, outdoing the competition’s last big announcement. The news releases wrote checks the engineers, economy and infrastructure couldn’t cash.

◾ Maybe to win the biggest incentive packages from politicians who were equally eager to inflate the job impact they could claim.

◾ Maybe the bold goals boosted stock prices, if only for a moment.

“Product planning decisions are made years in advance,” Cox Automotive's Erin Keating said. “Some of the changes may be optics.

“Do those 50,000 vehicles disappear? No. It’s a three- or four-year cycle.”

En route vs. arrived

Automakers are responding to conditions ranging from evolving incentive and trade policies to an interest rate spike following a global pandemic.

Adjusting to changing conditions without abandoning core strategy is the essence of good management. It should be applauded.

Instead, it’s too often seen as proof of folly, most often by people emotionally, financially, or politically invested in the initiative’s failure.

GM CEO Mary Barra’s repeated goal to produce only electric light vehicles by 2035 gets thrown in her face by critics who ignore her ever-present cautionary coda that GM will listen and respond to its customers en route to an electric future.

There’s plenty to criticize about the auto industry’s move to EVs. Initial willingness to replace dependence on Mideast oil with critical minerals from equally distant places. The public charging infrastructure is a hot mess. The 40% of Americans who live in condos, apartments and townhouses don’t have enough chargers, either. Incompetent production of batteries. Ignoring affordable vehicles in a rush to build $80K-$100K behemoths. Forming new joint ventures to sidestep union contracts.

But we shouldn’t criticize companies for adapting to changing realities.

The auto industry is undergoing a profound transformation. It’s going to be lumpy. Production and demand will probably swing back and forth for the next decade.

Watch the trend line, not the headlines.

Contact Mark Phelan: 313-222-6731 or mmphelan@freepress.com. Follow him on Twitter @mark_phelan.

This article originally appeared on Detroit Free Press: Forget the soundbites: Here's what's really up with all the EV delays

Yahoo Finance

Yahoo Finance