Forget Rate Hike, Bet on 3 REITs to Survive Market Volatility

As anticipated, the Federal Reserve has raised the benchmark interest rate by three-quarters of a percentage point to 3.00%-3.25%. Further to tame inflation, Fed has indicated more rate hikes ahead, with officials’ median projection for rates reaching 4.4% by the end of this year and a peak of 4.6% in 2023.

However, if you believe that this latest rate hike and the projections for this year and the next have put REITs on the back foot, then you need to reconsider and focus on Prologis, Inc. PLD, First Industrial Realty Trust, Inc. FR and Terreno Realty Corporation TRNO.

This is because this hybrid asset class not only provides protection against inflation but also benefits from the improving fundamentals of the underlying asset categories and the location of properties. A number of the asset categories are presently showing strength.

Particularly, the industrial real estate market is still firing on all cylinders with robust demand, rents and occupancy growth. In addition to the fast adoption of e-commerce, a rise in the inventory levels of companies as a precautionary measure for any supply-chain disruption is expected to lead to long-term growth momentum for this sector, offering scope to industrial landlords.

Despite economic headwinds in the second quarter, demand in the U.S. industrial market outpaced supply for the seventh straight quarter, per a report from Cushman & Wakefield (“CWK”). There was a net absorption of 120.4 million square feet (msf) of space in the June quarter and 236.3 msf through the first half of the year. Per the CWK report, this robust demand for industrial space is anticipated to continue, with net absorption projected to surpass 400 msf in 2022 and 250 msf in 2023.

Moreover, over the past decade, not only have the REITs made their balance sheets less leveraged, they have locked in the low rates by borrowing at a fixed rate and extending the average maturity of their debt outstanding.

In the second quarter of 2022, the weighted average term to maturity of REIT debt was more than seven years or 87 months. This is up from 85.5 months in the prior quarter, per a NAREIT media release. Net interest expense as a percent of net operating income (NOI) fell to a record low of 16.8% in the second quarter from 17.7% in the prior quarter. Also, leverage ratios remained low compared to the historical average.

After managing their balance sheets efficiently, REITs are now well prepared for a rising rate environment. Instead of looking for debt to finance the portfolios, these companies have strategically resorted to equity capital over the past decade.

Moreover, REITs provide natural protection against inflation. Particularly, rents and real estate values tend to move north with prices increasing, thereby aiding dividend growth. In fact, the majority of leases are tied with inflation, which leads to rent increases as inflation goes up. Therefore, even amid the inflationary period, investment in the REIT industry can offer a steady income stream.

Finally, with the roller coaster ride in the stock market this year — thanks to high inflation and a quick rise in interest rates that is weighing on asset prices — the focus has now shifted to investing in quality companies with a consistent track of paying dividends. Obviously, this brings us to the REITs because solid dividend payouts are arguably the biggest enticements for REIT investors as U.S. law requires REITs to distribute 90% of their annual taxable income in the form of dividends. This has enabled the industry to stand out and gain a footing over the last 15-20 years.

Stock Picks

San Francisco-based Prologis is a behemoth of the industrial REIT category. It focuses on logistics real estate in high-barrier, high-growth markets. Given its solid capacity to offer modern logistics facilities, the company is well-poised to bank on the favorable trend in the industrial real estate market.

In June, Prologis announced that it will acquire Duke Realty in an all-stock transaction valued at $26 billion, including the assumption of debt. The transaction is expected to be completed in the fourth quarter of 2022.

Prologis’ current cash flow growth is projected at 49.66%, well ahead of the 9.7% growth estimated for the industry. Moreover, this REIT’s trailing 12-month return on equity (ROE) highlights its growth potential. The company’s ROE of 9.85% compares favorably with the industry’s 3.76%, reflecting that PLD is more efficient in using shareholders’ funds than its peers. Given its balance sheet strength and prudent financial management, the company is well-poised to capitalize on growth opportunities and boost shareholders’ wealth.

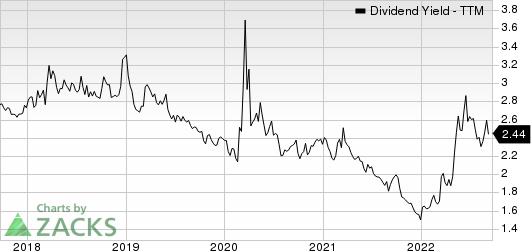

Based on the dividends paid over the trailing four quarters, PLD’s dividend yield is 2.44%. Also, Prologis has increased its dividend five times in the last five years, and the five-year annualized dividend growth rate is 11.29%. This is attractive to income investors and represents a steady income stream. Check Prologis’ dividend history here.

Prologis, Inc. Dividend Yield (TTM)

Prologis, Inc. dividend-yield-ttm | Prologis, Inc. Quote

Analysts seem bullish on this Zacks Rank #2 (Buy) stock. The estimate revision trend in the recent months for 2022 funds from operations (FFO) per share indicates a favorable outlook for the company as it has increased marginally to $5.17. It also suggests a jump of 24.6% year over year on 7.6% growth in revenues. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Industrial Realty Trust, a Chicago, IL-based industrial landlord, focuses on the ownership, operations and development of the industrial real estate, offering service to multinational corporations and regional customers. FR is engaged in the management, lease, acquisition, (re)development and selling of bulk and regional distribution centers, light industrial and other industrial facility types across major markets in the United States.

Analysts have a bullish view on First Industrial, with the Zacks Consensus Estimate for 2022 FFO per share moving up to $2.20 from $2.18 over the past two months. This indicates an 11.7% increase year over year on 9.4% revenue growth to $521.1 million. FR currently has a Zacks Rank #2.

First Industrial’s current cash flow growth is projected at 22.63% compared with the 9.70% growth projected for the industry. Moreover, this REIT’s trailing 12-month ROE highlights its growth potential. The company’s ROE of 13.84% compares favorably with the industry’s 3.76%, reflecting that FR is more efficient in using shareholders’ funds than its peers.

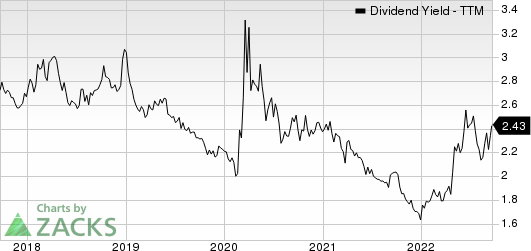

Based on the dividends paid over the trailing four quarters, the yield is 2.43%. FR has increased its dividend five times in the last five years, and the five-year annualized dividend growth rate is 7.47%. Check First Industrial’s dividend history here.

First Industrial Realty Trust, Inc. Dividend Yield (TTM)

First Industrial Realty Trust, Inc. dividend-yield-ttm | First Industrial Realty Trust, Inc. Quote

Terreno Realty, based in Bellevue, WA, is engaged in the acquisition, ownership and operation of industrial real estate in six major coastal U.S. markets — Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami and Washington, DC. This industrial REIT is witnessing solid property demand, as evident from its leasing activities. Also, it is banking on its expansion efforts to capitalize on the favorable fundamentals of the industrial real estate market.

The Zacks Consensus Estimate for 2022 FFO per share moved north marginally over the past two months to $1.93, signaling increased confidence of analysts in the company’s solid earnings outlook. It indicates a 12.9% increase year over year on 15.4% growth in revenues.

Currently, TRNO has a Zacks Rank of 2. The company’s ROE of 8.50% compares favorably with the industry’s 3.76%, reflecting that TRNO is more efficient in using shareholders’ funds than its peers.

Based on the dividends paid over the trailing four quarters, the yield is 2.38%. Also, TRNO has increased its dividend six times in the last five years, and the five-year annualized dividend growth rate is 11.66%. Check Terreno Realty’s dividend history here.

Terreno Realty Corporation Dividend Yield (TTM)

Terreno Realty Corporation dividend-yield-ttm | Terreno Realty Corporation Quote

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

First Industrial Realty Trust, Inc. (FR) : Free Stock Analysis Report

Terreno Realty Corporation (TRNO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance