Forget Gold, Your Money Is Better Off in These 3 Stocks

Gold can be an attractive investment to consider. The problem with gold is that its limitations can make it a much worse investment than it seems. To start, its value is heavily tied to investor speculation, not its commercial or industrial value. This has caused gold to be volatile, but not necessarily a better long-term investment than stocks.

Furthermore, its function as an inflation hedge, or downside protector against a stock market drop, requires a pretty high degree of accuracy -- or luck -- to work out. The past decade has been excellent evidence that it's very hard to predict when gold will be a better investment than stocks.

We asked three Motley Fool investors their thoughts on stocks that are superior to gold, and they identified Berkshire Hathaway Inc. (NYSE: BRK-A)(NYSE: BRK-B), Royal Gold, Inc (USA) (NASDAQ: RGLD), and Brookfield Infrastructure Partners L.P. (NYSE: BIP). Keep reading to learn what makes these stock notable, and if they're the right fit for your money.

Image source: Getty Images.

An investment that does something

John Bromels (Berkshire Hathaway) Investing titan Warren Buffett has never been particularly bullish on gold, or really any commodities, for that matter. "The problem with commodities," he said, "is that you are betting on what someone else would pay for them in six months. The commodity itself isn't going to do anything for you."

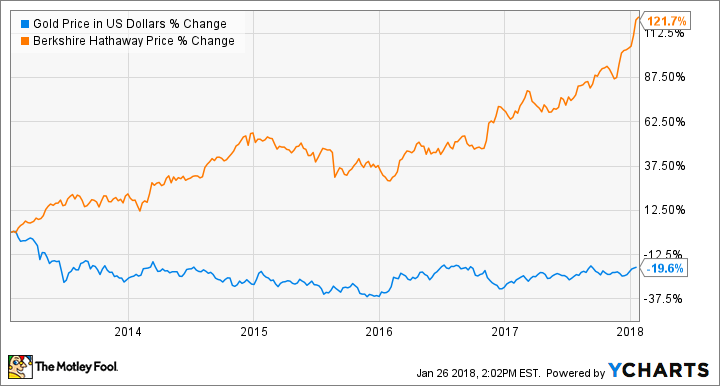

Indeed, over the past five years, Buffett's wisdom has paid off handsomely for his shareholders. Holders of gold? Not so much:

Gold Price in US Dollars data by YCharts.

I'm picking Berkshire Hathaway as a better investment than gold today because of the sheer variety of ways in which it makes money. While there's only one way to make money with gold -- wait for its value to go up -- Berkshire holds investments in a wide spectrum of industries. It fully owns railroad BNSF, insurer GEICO, battery-maker Duracell, and dozens more. It also has major stakes in companies as diverse as Coca-Cola, Wells Fargo, Phillips 66, and IBM.

That diversification makes Berkshire a safer place for your money than gold. If one -- or even two or three -- of Berkshire's companies or industries goes south, strength elsewhere in the portfolio is likely to offset it. Meanwhile, if the price of gold drops, like it has over the last five years, gold owners are out of luck.

Getting something productive out of an unproductive asset

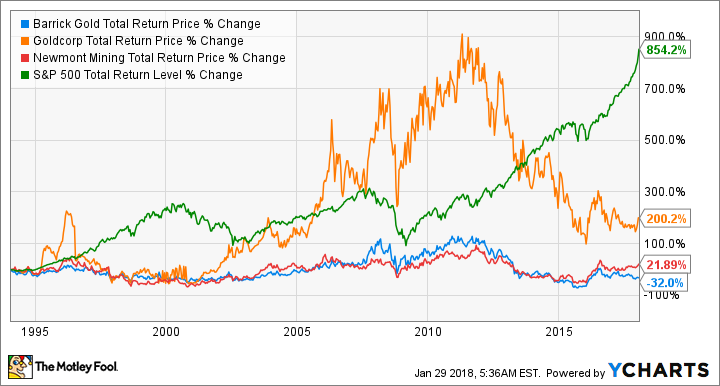

Tyler Crowe (Royal Gold): I'm not a big fan of lazy assets, and gold is a lazy asset. Sure, the price of gold will likely fluctuate over time, but there's no way for a physical ounce of gold to grow, or produce greater value. What's even worse is that gold miners are capital-intense businesses in a commodity industry where it's extremely hard to gauge supply and demand. Do you really want to buy and hold a gold miner when the S&P 500's total return has blown it out of the water over the past 25 years?

ABX Total Return Price data by YCharts.

If you want to make money in gold, you should think less like '49er prospectors and more like Sam Brannan, the richest man during the California gold rush, by looking at Royal Gold. Like Brannan, who sold the essentials to those prospectors, Royal Gold provides a valuable service to miners large and small: access to capital. Royal Gold is a royalty and streaming company that will provide upfront payments to miners in exchange for either an annual portion of the gold that comes from a mine, or the right to buy that gold at a deeply discounted price.

By buying gold at a significant discount to its price and not owning mines, Royal Gold is a high-margin business that doesn't require lots of capital investment. As a result, it can give back to its investors via a dividend that has grown steadily for more than a decade, and has actually beaten the S&P 500 on a total-return basis over the long haul.

There's gold, and there's investing in productive assets. Royal Gold is one of the few investments that falls in both categories, and anyone considering gold should look at this company.

The good things gold offers plus a lot more it doesn't

Jason Hall (Brookfield Infrastructure Partners): Gold is sometimes considered a nice defensive asset to own. Gold prices often go up when the stock market falls and can also act as a hedge against inflation. Unfortunately, for these upsides to pay off, you need to well time your purchase of gold for it to work out -- and it's almost impossible to accurately predict the next stock market crash, or inflationary period. Case in point: A lot of "experts" have spent much of the past decade predicting both, only to watch the stock market go on one of its best and longest bull runs ever.

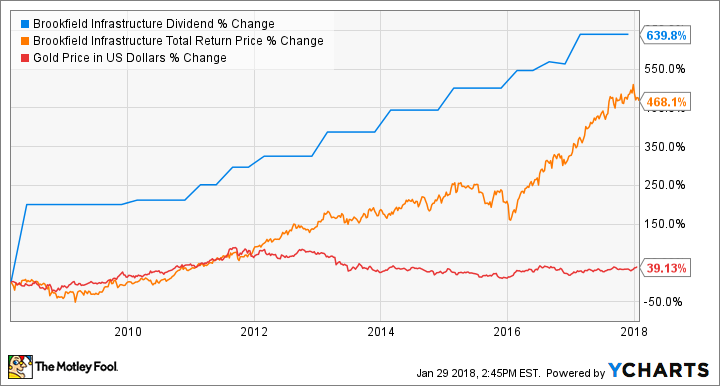

BIP Dividend data by YCharts.

Instead of trying to time the market -- which the experts fail to do all the time -- a better approach is to invest in a business with the characteristics to provide some of what makes gold attractive, but can also do well in almost any environment. Brookfield Infrastructure is exactly that kind of business, owning infrastructure assets around the world that provide transportation, telecommunications, water, power, and energy, to key markets.

The services Brookfield provides are largely recession resistant, which makes its cash flows very steady and predictable in any market environment, while a significant portion of its revenues are under contracts with inflation adjustments built in, further protecting its downside risks. This has made Brookfield Infrastructure an incredible dividend-growth investment since going public. The dividend has more than doubled since 2010, with increases at least every year.

If you're looking for downside protection across economic environments, Brookfield Infrastructure is a far better investment than gold. It'll also pay you a solid income -- 4% yield at recent prices -- that grows regularly. Gold can't match that.

More From The Motley Fool

Jason Hall owns shares of Berkshire Hathaway (B shares), Brookfield Infrastructure Partners, Phillips 66, and manages a family account with shares of Coca-Cola. John Bromels owns shares of Berkshire Hathaway (B shares) and Coca-Cola. Tyler Crowe owns shares of Berkshire Hathaway (B shares). The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares). The Motley Fool recommends Brookfield Infrastructure Partners. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance