Forex Daily Recap – Fiber Drenched in Red over Downbeat Eurozone CPI

EUR/USD

After making a downside rebound price action on testing the center line of the Bollinger Bands on August 26, the pair continued to slip even today. Quite noticeably, the mouth of the south-side heading Bollinger Bands was getting wider over time, signifying high volatility. Fiber has fallen on Friday mainly on the back of adverse EUR-specific economic data releases.

Although the Eurozone July Unemployment rate remained in-line with the previous statistics, the Eurozone August YoY CPI – Core missed estimates. Meantime, the highly crucial Italian QoQ GDP Growth rate reported 0.1% lower than the previous data. Earlier today, German July MoM Retail Sales published -2.2% over -1.0% forecasts.

Nonetheless, the Average Directional Index (ADX) was indicating below 20 mark, revealing a lack of momentum in the downward price actions.

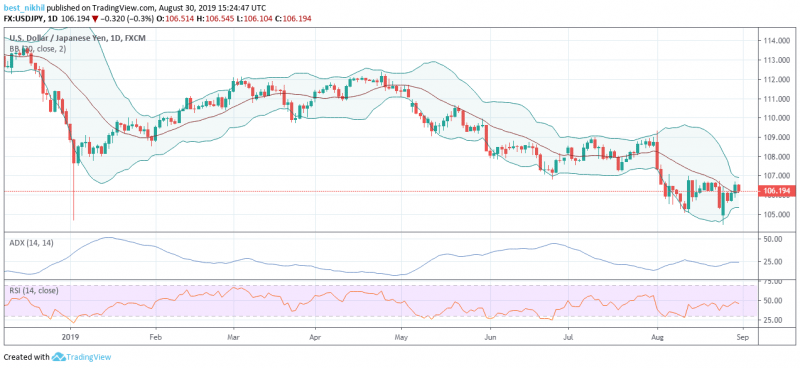

USD/JPY

Yesterday, the USD/JPY bulls had already crossed above the center line and entered into the upper vicinity of the Bollinger Bands. Anyhow, the pair appeared to shed significant accumulated gains today on the back of upbeat Japanese data releases. Despite losing ground, the USD/JPY pair continued to sustain above the center line, keeping intact uptrend possibilities.

At around 05:00 GMT, the Japanese Unemployment Rate recorded 0.1% lower this time over the previous 2.3%. Also, the Industrial Production data (both YoY and MoM) reported positive figures in comparison to the previously recorded negative statistics. Laterwards, the YoY Housing Starts came around -4.1% over the last -5.4%.

USD/KRW

South Korea’s central bank skipped a rate cut this time in order to save firepower for the next meeting. Notably, the Bank of Korea (BOK) had lowered the interest rates in the last July meeting. Anyhow, this time, the BOK policymakers voted to keep the interest rates unchanged near 1.5% the same as the previous rates.

“I expect a cut at the October meeting as domestic demand remains weak and as we need to confirm a sustained recovery in exports, especially semiconductor exports that kicked off the country’s economic downturn,” said Oh Suk-tae, an economist at Societe Generale in Seoul.

On the technical side, the USD/KRW pair has slightly moved out of the track, deviating below the 2:1 Gann line. And, the Relative Strength Index (RSI) was hovering near 50 mark, showing neutral buyer interest. However, even if the pair had made further downside moves, then the significant underlying SMAs would have got activated.

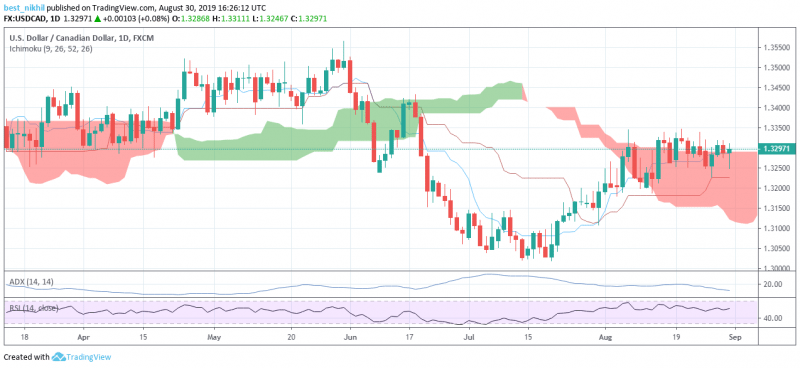

USD/CAD

As per the predictions in our USD/CAD Daily Forecast Article, the bulls continued to take control over the pair’s daily price actions. Today, the Canadian Q2 QoQ Annualized GDP recorded upbeat data, reporting 3.7% over 3.0% market hopes. However, the downbeat Canadian July MoM Industrial Product Price and Raw Material Price Index seemed to discourage the CAD bulls. While, on the USD-side, July PCE data stood in-line with the market expectations. In the interim, July Personal Spending rose by 0.3%, and Personal Income slumped by 0.4%, over the respective previous statistics.

Nevertheless, after a small dip inside the underlying red Ichimoku Clouds, the pair ensured to stay above the Clouds. Somehow, the ADX technical indicator was pointing below 20 mark, allowing the price actions to stay range-bound throughout the day.

The article was written by Bharat Gohri, Chief Market Analyst at easyMarkets

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas Weekly Price Forecast – Natural gas markets test major trendline

NZD/USD Forex Technical Analysis – Prolonged Price and Time Downtrend Since July 19

GBP/JPY Weekly Price Forecast – British pound continues to find resistance above

Crude Oil Price Update – Breaks Sharply on Hurricane-Caused Demand Concerns

Gold Price Futures (GC) Technical Analysis – Set-Up for $40 Break Under $1527.00

Yahoo Finance

Yahoo Finance