Ford (F) Q4 Earnings & Revenues Miss Estimates, Down Y/Y

Ford Motor Company F delivered fourth-quarter 2019 adjusted earnings per share (EPS) of 12 cents, missing the Zacks Consensus Estimate of 17 cents. In the prior-year quarter, adjusted earnings were 30 cents per share. This underperformance resulted from the lower automotive sales across all major markets served.

In the fourth quarter, the company reported adjusted earnings before interest and taxes (EBIT) of $485 million and adjusted EBIT margin of 1.2%, down from the $1,457 million and 3.5% witnessed in the year-earlier quarter, respectively.

During the reported quarter, Ford generated automotive revenues of $36,671 million. The figure narrowly missed the Zacks Consensus Estimate of $36,787 million. In the prior-year quarter, the figure had amounted to $38,717 million.

Ford registered overall revenue figures of $39.7 billion in fourth-quarter 2019, down from the year-ago quarter’s $41.8 billion.

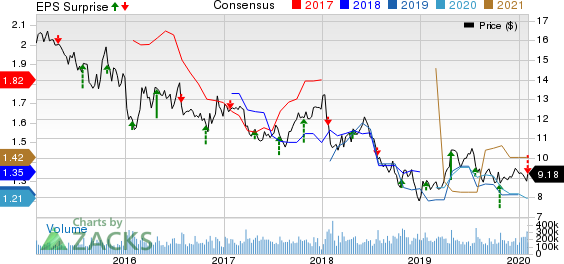

Ford Motor Company Price, Consensus and EPS Surprise

Ford Automotive

During the fourth quarter, wholesale volume in the Ford Automotive segment declined 8% to 1.35 million. EBIT declined 81% to $215 billion, mainly due to lower launch-related volumes, higher costs for new products, unfavorable currency exchange and UAW contract related costs in the quarter.

In North America, revenues declined 2% year over year to $25.3 billion during the December-end quarter. Wholesale volume edged down 8% to 681,000 units. Further, EBIT was $700 million, marking a decrease of $1,259 million from the year-ago quarter. This downside was mainly due to low volumes, discontinuation of sedan models and high costs related to product launches.

In South America, revenues declined 22% year over year to $1 billion. Wholesale volume slipped 17% to 74,000 units. The region reported a negative EBIT of $176 million, but the loss narrowed from the year-ago period because of a more favourable product mix.

In Europe, revenues fell 4% to $7.1 billion. Wholesale volume decreased 4% to around 346,000 units. The region registered EBIT of $21 million, as against a loss of $199 million reported in the year-ago quarter. The firm’s restructuring operations and cost-cut initiatives in the region seems to have yielded results. In the quarter, the business refocused its resources on commercial vehicles, selected passenger vehicles and iconic nameplates, such as Mustang and also announced plans to close or sell six manufacturing plants, and eliminate 12,000 positions across the region, which led to the decrease in losses.

In the Middle East & Africa segment (MEA), revenues declined 7% year on year to $0.6 billion. Further, wholesale volume declined 16% to 27,000 units. The region reported a negative EBIT of $83 million.

In the Asia-Pacific region, excluding China, revenues dropped 14% to $1.7 billion. Wholesale volume dipped 18% to 67,000 units. Further, the region reported a negative EBIT of $40 million.

In China, revenues plunged 38% year over year to $1 billion. Further, wholesale volume declined 7% to $159,000 units.The region reported a negative EBIT of $207 million, but the loss slumped 61% from the year-ago period due to lower structural costs in the quarter.

Financial Position

Ford had cash and cash equivalents of $17.5 billion as of Dec 31, 2019 compared with $16.7 billion as of Dec 31, 2018. Automotive long-term debt stood at $13.2 billion, reflecting a year-on-year increase from 11.2 billion.

Looking Forward

For full-year 2020, Ford anticipates adjusted free cash flow of $2.4-$3.4 billion and adjusted EBIT between $5.6 billion and $6.6 billion. Full-year adjusted EPS is forecasted to lie between 94 cents and $1.20. Capital expenditures are expected to lie between $6.8 billion and $7.3 billion.

Ford continues to expect extensive product introductions, featuring electric commercial and passenger vehicles, and investments in smart-vehicle capabilities throughout 2020.

Apart from Mustang Mach-E, the company plans to launch other refreshed or new vehicles in North America in 2020, which includes F-150 — featuring a first-ever hybrid-electric version, a small off-road utility vehicle, the first of 30 market-specific Ford and Lincoln vehicles in China, and Electrified versions of the Lincoln Corsair and Ford Escape/Kuga.

In first-quarter 2020, the company anticipates adjusted EBIT to fall by more than $1.1 billion compared to first quarter of 2019 due to higher warranty costs, lower vehicle volumes, lower results from Ford Credit, and higher investment in Mobility.

Zacks Rank & Stocks to Consider

Ford currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Auto-Tires-Trucks sector include Gentherm Inc THRM, Gentex Corporation GNTX and SPX Corporation SPXC, each carrying a Zacks Rank of 2 (Buy), at present. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Gentherm has a projected earnings growth rate of 20.60% for the ongoing year. Its shares have gained 11.4% over the past year.

Gentex Corporation has an estimated earnings growth rate of 7.32% for 2020. The company’s shares have appreciated 47.6% in a year’s time.

SPX has an expected earnings growth rate of 8.09% for the current year. The stock has rallied 62.5% in the past year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Click to get this free report Ford Motor Company (F) : Free Stock Analysis Report Gentherm Inc (THRM) : Free Stock Analysis Report Gentex Corporation (GNTX) : Free Stock Analysis Report SPX Corporation (SPXC) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance