Footwear execs push back against Peter Navarro on Chinese currency devaluation

Some footwear industry's executives are pushing back against White House Economic Advisor Peter Navarro over recent statements he made on China’s currency devaluation. Last week on CNN Navarro said the Chinese yuan drop against the U.S. dollar has already covered the cost of the additional 10% tariffs.

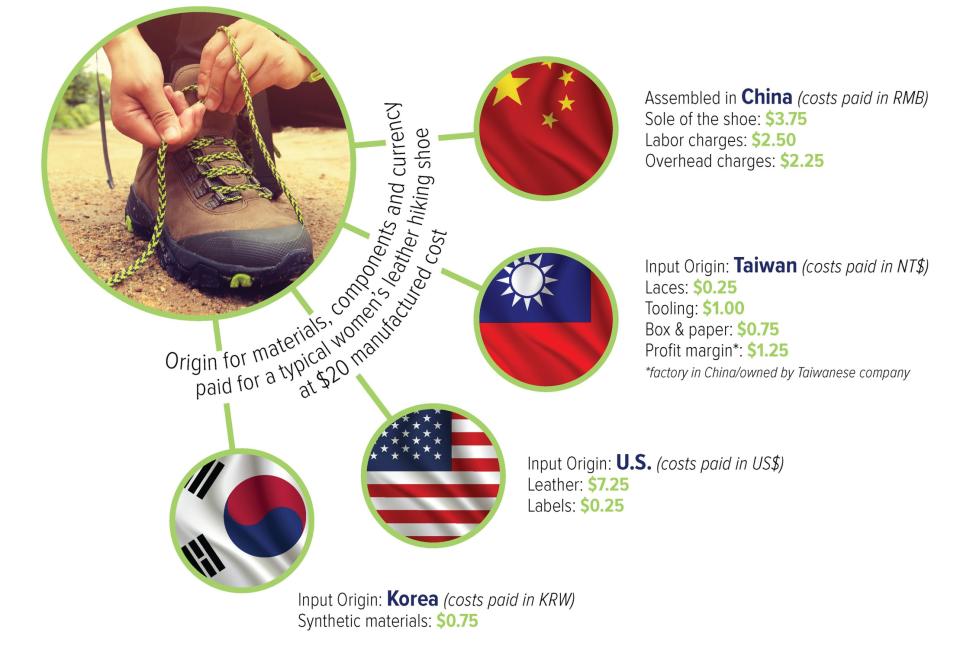

Footwear groups like the Footwear Distributors and Retailers of America (FDRA) said that Navarro's comments were unequivocally false based on trade and cost analysis the FDRA runs daily on its industry. According to the association, roughly 33% of the cost of shoes made in China and sold in the U.S. are sourced from regions outside of China. The group says it does not see the benefit of the devaluation on these components.

"I think it's just another challenge for the industry to push back on — these false narratives that [Trump administration officials] have. The White House has a 19th-century view of trade and tries to oversimplify what's actually happening." Andy Polk, FDRA senior vice president, told Yahoo Finance.

According to the FDRA, when it comes to duties on an item like footwear, things are more complicated than it might seem. Components that makeup as a shoe that is manufactured in China are often imported from more than one place, including Taiwan, South Korea, and the U.S.

"You have leather flowing from the U.S. into China to make leather footwear. And then when you’ve got multiple components and various raw materials loading into many locations, manufacturing, you have multiple currencies that you're paying in."

Some models of hiking boots only have one-third of their components actually made in China. The rest of the components are paid in the currencies of the countries of origin. According to FDRA analysis, a $20 pair of hiking boots would only see a $.55 reduction in cost due to currency drops. Meanwhile, the 10% tariff still increases the cost of the shoe by $2.38 with the $.55 savings included.

Polk also notes that factories cannot eat all of the costs of tariffs. "The depressed Yuan is actually making it harder for factories to absorb as much of the cost as the brands would like. Peter Navarro would have us believe the devalued currency is a help to factories to eat the costs, but in practice, it is a disruptor of trade calculus.”

Reggie Wade is a writer for Yahoo Finance. Follow him on Twitter at @ReggieWade.

Read more:

Nike unveils major sneaker innovation that was 10 years in the making

96% of teachers personally pay for students' supplies: Survey

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance