Foot Locker (NYSE:FL) Reports Q1 In Line With Expectations, Stock Soars

Footwear and apparel retailer Foot Locker (NYSE:FL) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 2.7% year on year to $1.88 billion. It made a non-GAAP profit of $0.22 per share, down from its profit of $0.69 per share in the same quarter last year.

Is now the time to buy Foot Locker? Find out in our full research report.

Foot Locker (FL) Q1 CY2024 Highlights:

Revenue: $1.88 billion vs analyst estimates of $1.88 billion (small miss)

EPS (non-GAAP): $0.22 vs analyst estimates of $0.12 ($0.10 beat)

Maintains full year EPS guidance

Gross Margin (GAAP): 29%, down from 30.1% in the same quarter last year

Free Cash Flow was -$18 million compared to -$177 million in the same quarter last year

Locations: 2,490 at quarter end, down from 2,692 in the same quarter last year

Same-Store Sales fell 1.8% year on year

Market Capitalization: $2.13 billion

Mary Dillon, President and Chief Executive Officer, said, "We had a solid start to the year, which demonstrates that our Lace Up Plan is working. We delivered comparable sales results and gross margin in line with our expectations, while earnings per share outperformed due to disciplined expense management and some favorable shifts in expense timing. Importantly, we are well-positioned with fresh assortments as we approach the summer and Back-to-School seasons, and we are pleased to be reaffirming our full-year outlook."

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE:FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Sales Growth

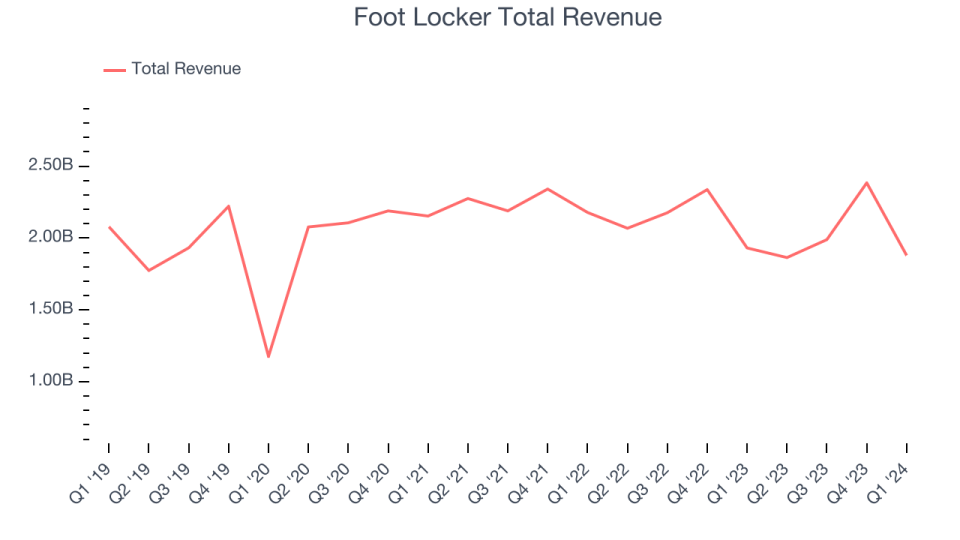

Foot Locker is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

As you can see below, the company's revenue was flat over the last five years as its store count dropped.

This quarter, Foot Locker missed Wall Street's estimates and reported a rather uninspiring 2.7% year-on-year revenue decline, generating $1.88 billion in revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

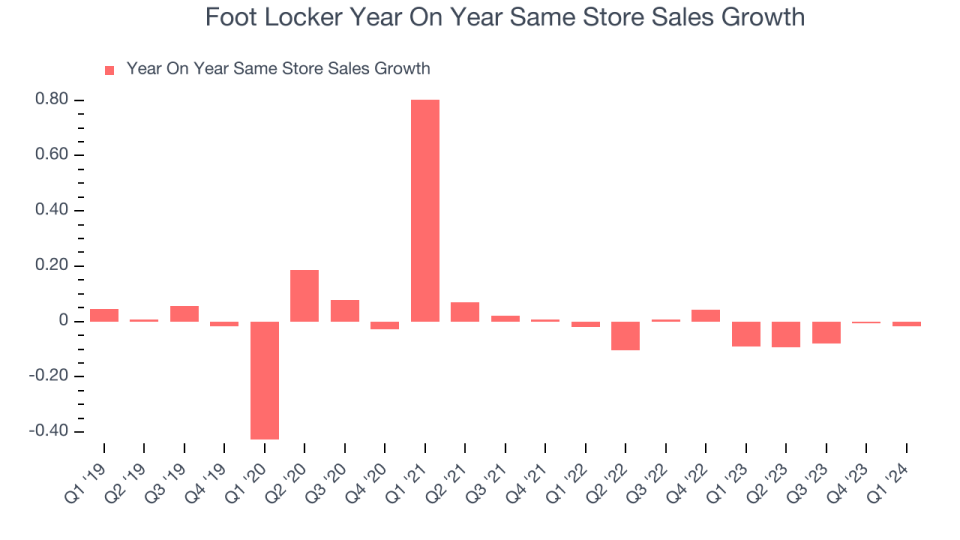

Foot Locker's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 4.3% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Foot Locker's same-store sales fell 1.8% year on year. This decrease was an improvement from the 9.1% year-on-year decline it posted 12 months ago. It's always great to see a business improve its prospects.

Key Takeaways from Foot Locker's Q1 Results

We were impressed by how significantly Foot Locker blew past analysts' EPS expectations this quarter. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 8.6% after reporting and currently trades at $24.47 per share.

Foot Locker may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance