Food Stocks Queued Up for Earnings: MDLZ, K, SMPL & BGS

The quarterly reports of companies in the Zacks Food – Miscellaneous industry are likely to reflect the benefits from cost-saving plans, efficient pricing structures and innovation to cater to consumers’ changing preferences. Speaking of savings initiatives, the companies have been streamlining operational structures as well as optimizing manufacturing capacity and supply networks. Such upsides are likely to have contributed to aggregate revenues in this space.

However, food industry players are anticipated to have faced headwinds like rising input costs. In this context, inflationary trends for supplies like grains, edible oils, vegetables, dairy items, eggs as well as animal feed among others have been a drag. Moreover, increased logistics, warehouse and packaging expenses are expected to have increased cost burden.

Moreover, as these firms operate in a highly competitive arena, they are required to invest heavily in promotional activities. Unfavorable product mix and adverse currency fluctuations are other threats that cannot be counted out.

These aspects make us somewhat apprehensive regarding the performance of food companies, that are housed within the broader Zacks Consumer Staples sector. The sector (which is currently ranked among the bottom 25% out of the 16 Zacks sectors) has lagged the Zacks S&P 500 composite in the past year. The sector gained 9% over this period compared with the S&P 500’s rise of 16.3%.

The latest Zacks Earnings Preview suggests that the consumer staples sector’s third-quarter 2019 earnings are expected to decline 1.5% from the year-ago quarter’s levels. Nevertheless, revenues are likely to rise 4.9% year on year.

That said, we note that some food players are slated to release quarterly results this week. Let’s take a look at what’s in store for some of these companies.

Our research shows that for stocks with the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP, the chance of a positive earnings surprise is high. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

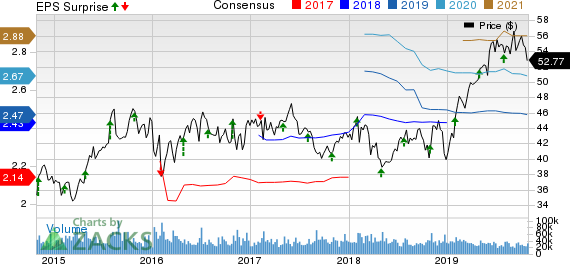

Mondelez International, Inc. MDLZ, is set to release third-quarter 2019 results on Oct 29, after market close. The Zacks Consensus Estimate for earnings has been stable in the past 30 days at 61 cents, which suggests a decline of 1.6% from the year-ago quarter’s reported figure. The consensus mark for revenues is at $6,312 million, which indicates a rise of 0.3% from the prior-year quarter’s figure.

The company’s top line is likely to have gained from innovations under the SnackFutures platform, efforts to broaden good-for-you offerings, brand building through promotions and strategic buyouts. However, adverse impacts from unfavorable commodity hedging, production delays and service delivery issues might have had a negative impact on the company’s bottom line.

Our proven model does not conclusively predict an earnings beat for Mondelez this season. Mondelez has a Zacks Rank #3 and an Earnings ESP of -0.99%. (Read More: Factors Setting the Tone for Mondelez's Q3 Earnings)

Mondelez International, Inc. Price, Consensus and EPS Surprise

Mondelez International, Inc. price-consensus-eps-surprise-chart | Mondelez International, Inc. Quote

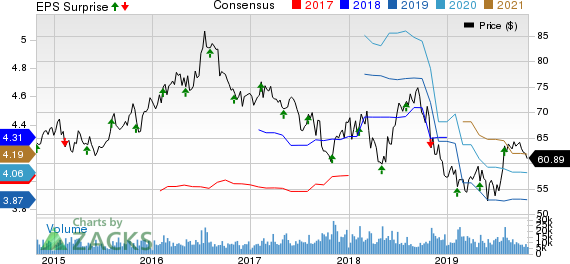

Kellogg Company K is scheduled to release third-quarter 2019 results on Oct 29. The Zacks Consensus Estimate for earnings has been stable in the past 30 days at 91 cents, which suggests a decline of 14.2% from the year-ago quarter’s reported figure. The consensus mark for revenues is at $3,368 million, which indicates a drop of 2.9% from the figure reported in the year-ago quarter.

Adversities stemming from divestitures and cost inflation are likely to have weighed on the company’s performance in the to-be-reported quarter. (Read More: Factors Setting the Stage for Kellogg's Q3 Earnings)

Our proven model does not conclusively predict an earnings beat for Kellogg this season. The company carries a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%. As it is, stocks with a Zacks Rank #4 or 5 (Strong Sell) are best avoided.

Kellogg Company Price, Consensus and EPS Surprise

Kellogg Company price-consensus-eps-surprise-chart | Kellogg Company Quote

B&G Foods, Inc. BGS is scheduled to release third-quarter 2019 results on Oct 31, after market close. The Zacks Consensus Estimate for earnings has declined by 3 cents in the past 30 days and is currently at 51 cents. The projected figure suggests a decline of 10.5% from the year-ago quarter’s levels. The consensus mark for revenues is pegged at $397.9 million, which indicates a fall of 5.8% from the figure reported in the year-ago quarter.

The sale of Pirate Brands along with headwinds emerging from inventory reductions and unfavorable mix is likely to have dented third-quarter performance. Moreover, higher input costs stemming from elevated freight, warehouse and procurement expenses are concerns.

Our proven model does not conclusively predict an earnings beat for B&G Foods this season. The company carries a Zacks Rank #5 and an Earnings ESP of 0.00%.

B&G Foods, Inc. Price, Consensus and EPS Surprise

B&G Foods, Inc. price-consensus-eps-surprise-chart | B&G Foods, Inc. Quote

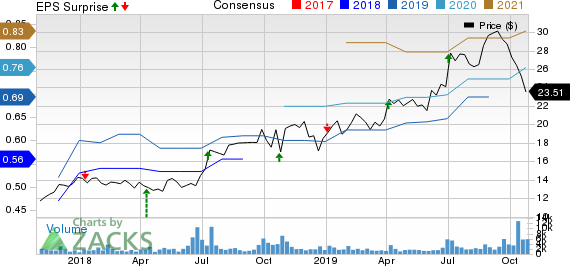

The Simply Good Foods Company SMPL is set to release fourth-quarter fiscal 2019 results on Oct 29, before market open. The Zacks Consensus Estimate for earnings has been stable in the past 30 days at 16 cents, which suggests a rise of 6.7% from the year-ago quarter’s figure. The consensus mark for revenues is at $138 million, which indicates a rally of 27.4% from the prior-year quarter’s figure. Growth across core brands and retail takeaway channel along with gains from savings initiatives, volume growth and net price realization is likely to have contributed to fiscal fourth-quarter performance.

Our proven model does not conclusively predict an earnings beat for Simply Good Foods this season. The company sports a Zacks Rank #1 and an Earnings ESP of -6.25%.

The Simply Good Foods Company Price, Consensus and EPS Surprise

The Simply Good Foods Company price-consensus-eps-surprise-chart | The Simply Good Foods Company Quote

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kellogg Company (K) : Free Stock Analysis Report

B&G Foods, Inc. (BGS) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

The Simply Good Foods Company (SMPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance