FMC's Earnings Surpass Estimates, Revenues Lag in Q1

FMC Corporation FMC reported a loss of 2 cents per share in first-quarter 2024. This compares to earnings of $1.55 in the year-ago quarter.

Barring one-time items, adjusted earnings per share were 36 cents, beating the Zacks Consensus Estimate of 35 cents.

Revenues were $918 million in the quarter, down around 32% from the year-ago quarter’s levels. The top line fell short of the Zacks Consensus Estimate of $1,025.2 million.

A 27% decline in volumes hurt FMC’s revenues in the reported quarter. Prices also fell 4% while currency was a headwind of 1%. Sales were impacted by inventory management actions by customers across all regions.

FMC Corporation Price, Consensus and EPS Surprise

FMC Corporation price-consensus-eps-surprise-chart | FMC Corporation Quote

Regional Sales Performance

In North America, sales tumbled 48% year over year to $259 million in the quarter on reduced volumes. It was below the consensus estimate of $318.1 million.

Latin American sales saw a 20% year-over-year decline to $188 million in the reported quarter, primarily due to reduced volumes and prices. It beat the consensus estimate of $174 million.

In Asia, revenues declined 29% compared to the previous year to $164 million, hurt by lower volumes in China due to poor weather conditions as well as reduced prices. It was below the consensus estimate of $219 million.

EMEA experienced a 20% year-over-year sales drop to $307 million in the reported quarter, driven by lower volumes partly mitigated by price increase by low-single digits. It missed the consensus estimate of $328 million.

Financials

The company had cash and cash equivalents of $417.8 million at the end of the quarter, up roughly 38% sequentially. Long-term debt was $3,024.6 million, flat sequentially.

Guidance

FMC forecasts full-year 2024 revenues between $4.50 billion and $4.70 billion, indicating a 2.5% increase at the midpoint compared to 2023. Adjusted EBITDA is expected in the range of $900 million to $1.05 billion, flat at the midpoint compared to the prior year. Adjusted earnings are forecast between $3.23 to $4.41 per share, up 1% year-over-year at the midpoint. Full-year free cash flow is anticipated to be $400-$600 million.

FMC also forecasts second-quarter revenues to be between $1 billion to $1.15 billion, reflecting a 6% increase at the midpoint compared to the second quarter of 2023. Adjusted EBITDA is forecast in the band of $170-$210 million, essentially flat versus the prior-year period’s levels. Adjusted earnings are expected in the range of 43-72 cents in the second quarter, calling for a 15% rise at the midpoint compared with second-quarter 2023 levels.

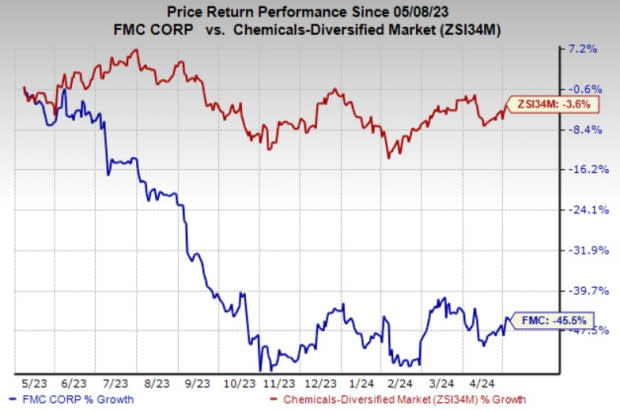

Price Performance

FMC’s shares have lost 45.5% in the past year against a 3.6% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

FMC currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include Gold Fields Limited GFI, sporting a Zacks Rank #1 (Strong Buy), and Valvoline Inc. VVV and American Vanguard Corporation AVD, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GFI’s first-quarter earnings is pegged at 22 cents per share. The consensus estimate for GFI’s first-quarter earnings has been stable in the past 60 days.

Valvoline is slated to report fiscal second quarter results on May 8. The consensus estimate for VVV’s second-quarter earnings is pegged at 36 cents per share. The company’s shares have rallied around 27% in the past year.

American Vanguard is expected to report first-quarter results on May 14. The consensus estimate for AVD’ first-quarter earnings is pegged at 8 cents per share, indicating a year-over-year rise of 14.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gold Fields Limited (GFI) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Valvoline (VVV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance