Flowserve (FLS) Gains From Solid Bookings, Risks Persist

Flowserve Corporation FLS has been benefiting from strong bookings in both original equipment and aftermarket, solid backlog conversion capability and the multi-year Flowserve 2.0 strategy. The company’s solid backlog level, which was at $1.97 billion exiting third-quarter 2021, is likely to drive its performance in the quarters ahead. Its focus on cost management and operational executions also bode well.

The company’s healthy liquidity position allows it to tide over difficult operating conditions. At the end of the third quarter, its total available liquidity comprised $708.6 million of available capacity under its revolving credit facility and cash and cash equivalents of $1,457.3 million. Also, its free cash flow totaled $117 million in the first three quarters of 2021. Its focus on delivering free cash flow conversion of more than 100% of its net income bode well.

Flowserve remains focused on rewarding shareholders handsomely through dividend payments and share repurchases. In the first nine months of 2021, the company used $78.6 million for paying out dividends and $17.5 million for repurchasing shares.

However, its high-debt profile remains a concern. At the end of the third quarter, its long-term debt remained high at $1,272.2 million. In the quarter, interest expenses jumped 9.2% on a year-over-year basis to $14.7 million. For 2021 (results are awaited), it anticipates interest expenses to be in the range of $55-$60 million.

The company has also been experiencing the adverse impacts of labor shortage, logistics issues and supply-chain woes. Also, its realignment plan has been fuelling expenses and adversely impacting profitability. For instance, in the third quarter, its realignment expenses had an adverse impact of 2 cents per share on net income.

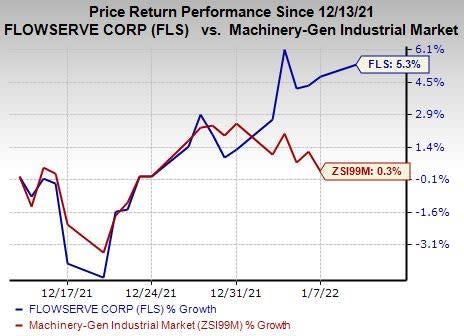

Image Source: Zacks Investment Research

In the past month, this Zacks Rank #3 (Hold) stock has gained 5.3% compared with the industry’s growth of 0.3%.

Key Picks

Some better-ranked companies from the Zacks Industrial Products sector are discussed below.

Casella Waste Systems, Inc. CWST presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Its earnings surprise in the last four quarters was 42.11%, on average.

In the past 60 days, Casella Waste’s earnings estimates have been stable for 2021 and increased 0.9% for 2022. Its shares have lost 2.4% in the past month.

Franklin Electric Co., Inc. FELE presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 16.27%, on average.

Franklin Electric’s earnings estimates have been stable for 2021 and increased 0.6% for 2022 in the past 60 days. Its shares have lost 0.7% in the past month.

Graco Inc. GGG presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 6.58%, on average.

Graco’s earnings estimates have been stable for 2021 and increased 1.9% for 2022 in the past 60 days. Its shares have lost 5.4% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Graco Inc. (GGG) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

Franklin Electric Co., Inc. (FELE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance