Flowserve (FLS) Expects Operational Disruption to Hurt Q3 EPS

Flowserve Corporation FLS provided an update on its third-quarter 2022 performance.

The company expects adverse impact from the implementation of enterprise resource planning ("ERP") system and an increase in corporate expenses to hurt reported and adjusted earnings per share by 18-22 cents in the third quarter.

Operational disruption during ERP implementation affected Flowserve’s volumes in the first two months of the third quarter. This is expected to reduce the company’s earnings by 10-12 cents in the third quarter. Additionally, FLS expects an increase in corporate expenses to hurt earnings by 8 to 10 cents per share in the third quarter.

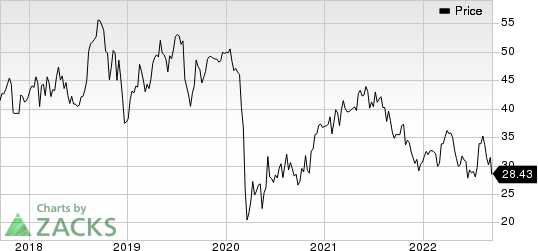

Flowserve Corporation Price

Flowserve Corporation price | Flowserve Corporation Quote

However, Flowserve expects these impacts to be limited to the third quarter only. The company has already taken initiatives to resolve the operational disruptions caused by ERP implementation and volumes are nearing normal levels.

Despite some adversities, Flowserve continues to experience robust bookings for the third quarter. The company expects its bookings to exceed $1 billion for the third consecutive quarter owing to strength in traditional and energy transition end markets. Its Diversify, Decarbonize and Digitize (3D) strategy has accelerated its bookings. With the gradual easing of supply chain disruptions, FLS expects a sequential improvement in the fourth quarter.

Zacks Rank & Key Picks

Flowserve presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Lindsay Corporation LNN currently sports a Zacks Rank #1 (Strong Buy). LNN pulled a trailing four-quarter earnings surprise of 25.6%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Lindsay has an estimated earnings growth rate of 45% for the current year. Shares of the company have rallied 3.6% in the past six months.

Greif, Inc. GEF presently carries a Zacks Rank #2 (Buy). GEF delivered a trailing four-quarter earnings surprise of 22.4%, on average.

Greif has an estimated earnings growth rate of 43% for the current year. Shares of the company have gained 10.4% in the past six months.

Valmont Industries VMI presently carries a Zacks Rank #2. VMI pulled off a trailing four-quarter earnings surprise of 13.7%, on average.

Valmont Industries has an estimated earnings growth rate of 26.9% for the current year. Shares of the company have gained 19% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance