Flexible Solutions (FSI) Q1 Earnings and Sales Lag Estimates

Flexible Solutions International Inc. FSI reported earnings of 4 cents per share in first-quarter 2024, down from 7 cents in the year-ago quarter. It missed the Zacks Consensus Estimate of 6 cents.

The bottom line in the reported quarter was hurt by increased cost of goods, reduced sales and product mix as well as significantly higher depreciation and amortization expenses. The results were also impacted by higher stock-based compensation expenses and one-time costs associated with the closing of FSI’s Naperville R&D facility.

The company registered revenues of around $9.22 million for the quarter, down roughly 6% year over year. It missed the Zacks Consensus Estimate of $10 million.

Flexible Solutions International Inc. Price, Consensus and EPS Surprise

Flexible Solutions International Inc. price-consensus-eps-surprise-chart | Flexible Solutions International Inc. Quote

Segment Highlights

Sales from the company’s Energy and Water Conservation products for the reported quarter fell roughly 48% year over year to around $0.04 million, impacted by lower customer orders.

Sales of Biodegradable Polymers fell roughly 6% year over year to around $9.18 million in the quarter, hurt by lower customer orders.

Financials

Flexible Solutions ended the quarter with cash and cash equivalents of roughly $5.3 million, up around 6% on a sequential comparison basis. Long-term debt was roughly $6.3 million, down around 7% sequentially.

Outlook

Flexible Solutions said that it has identified several large new opportunities in the food/nutraceutical market, which are proceeding toward revenues in 2024. It also noted that new opportunities continue to unfold in applications such as detergent, food, nutraceuticals, oil field extraction, turf, ornamental and agricultural to further boost sales in the NanoChem division. Flexible Solutions also expects its cash resources to be adequate to meet its cash flow requirements and future commitments.

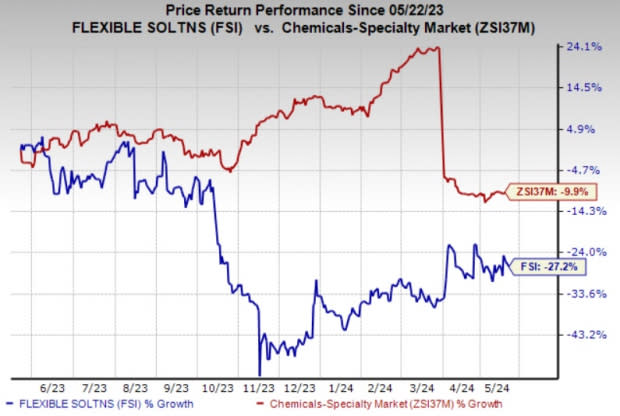

Price Performance

Shares of Flexible Solutions are down 27.2% over a year compared with the industry’s decline of 9.9%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

FSI currently has a Zacks Rank #4 (Sell).

Better-ranked stocks in the basic materials space include Axalta Coating Systems Ltd. AXTA, Carpenter Technology Corporation CRS and ATI Inc. ATI.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared roughly 128% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta Coating Systems, carrying a Zacks Rank #1, has a projected earnings growth rate of 26.8% for the current year. In the past 60 days, the consensus estimate for AXTA's current-year earnings has been revised upward by 5.9%. The company’s shares have gained roughly 15% in the past year.

ATI currently carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have rallied around 62% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Flexible Solutions International Inc. (FSI) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance