Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- Beef fat from Brazil is finding its way into American biofuels as US processors look abroad for cheaper raw materials. Often-overlooked manganese is outshining other commodities this year. And the world is awash with electric car batteries — a situation that threatens to undermine future demand.

Most Read from Bloomberg

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

S&P 500 Hits 30th Record of 2024 as Megacaps Rally: Markets Wrap

These Are the World’s Most Expensive Cities for Expats in 2024

How the US Mopped Up a Third of Global Capital Flows Since Covid

Here are five notable charts to consider in global commodity markets as the week gets underway.

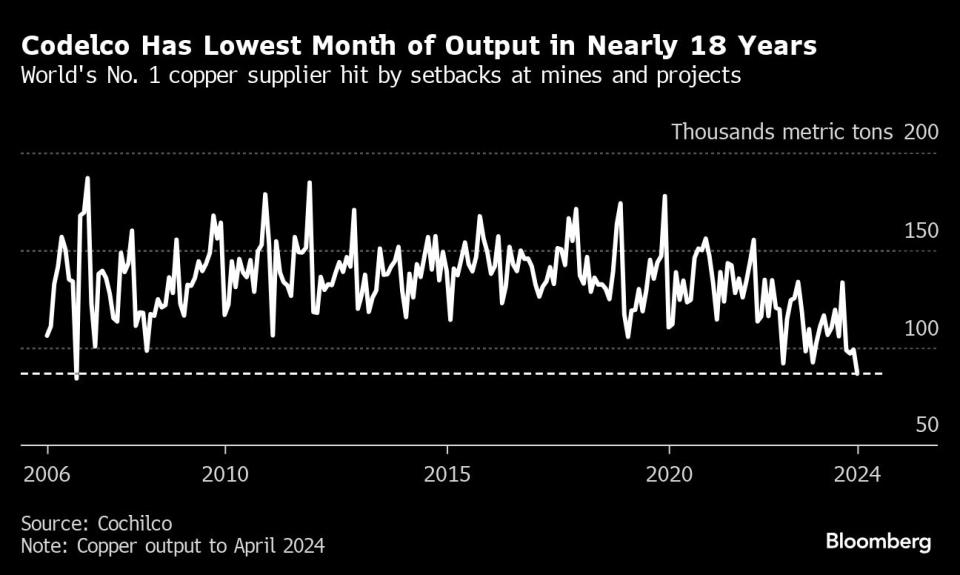

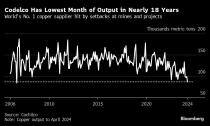

Copper

The price of copper — which has given back some ground after hitting record highs in May — is in a tug of war between supply struggles and signs of near-term demand weakness. Deteriorating output at top supplier Codelco is making a bullish case for the industrial metal. The Chilean state behemoth registered its worst month of production in almost 18 years in April after a series of setbacks at mines and projects, despite management saying that output is bottoming out. Copper futures on the London Metal Exchange fell as much as 1.5% on Monday.

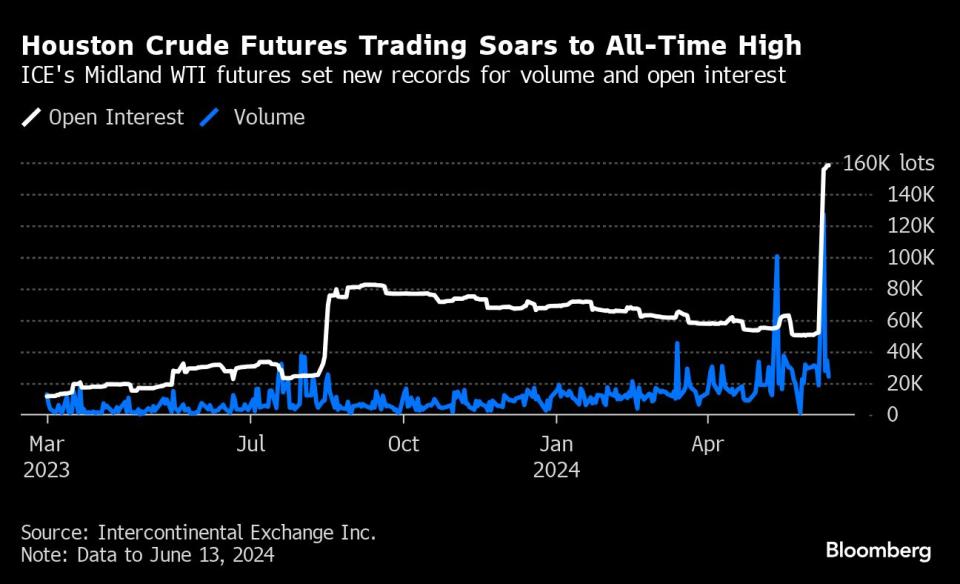

Oil

Booming US crude exports are helping shatter oil trading records in Houston. Intercontinental Exchange Inc.’s Houston crude futures contract set all-time highs last week for both daily trading volume and open interest as US oil supplies flooded into European markets. ICE’s Midland West Texas Intermediate futures contract — which is delivered in Houston — had almost five times May’s average daily volume on June 10, while open interest during the week was almost three times the average in May. Houston is rapidly evolving into one of the most active oil-trading hubs in the US as crude shipments out of the region soar. Oil edged higher on Monday.

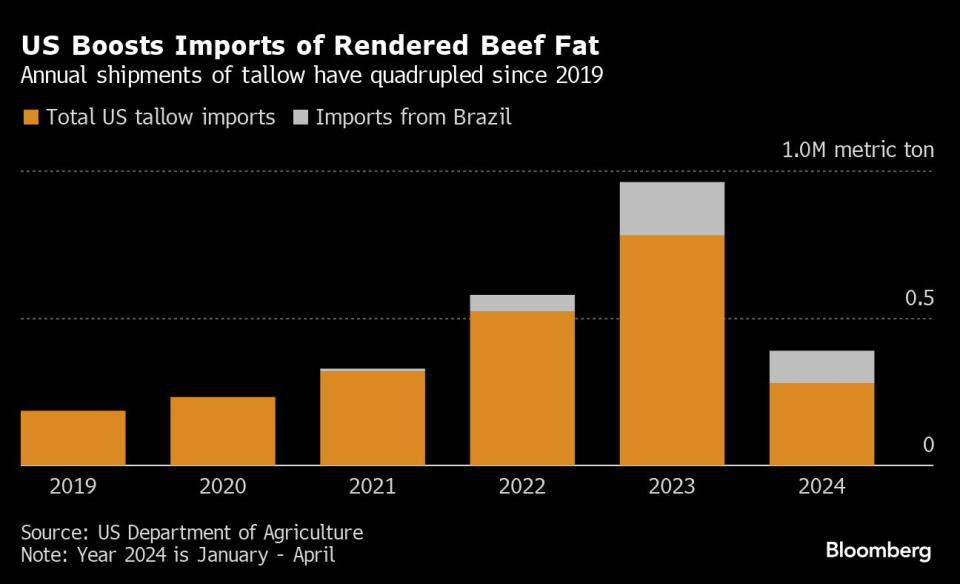

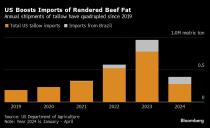

Biofuels

Brazil is reaping the benefits from a US biofuels boom, undercutting American farmers by flooding the market with a little-known commodity that can be used to make renewable fuels. US purchases of Brazilian cattle tallow — a form of waste fat — are soaring. Tallow, used in a variety of products from pet food to soap, is abundant in Brazil, which slaughters more cows than any country outside China.

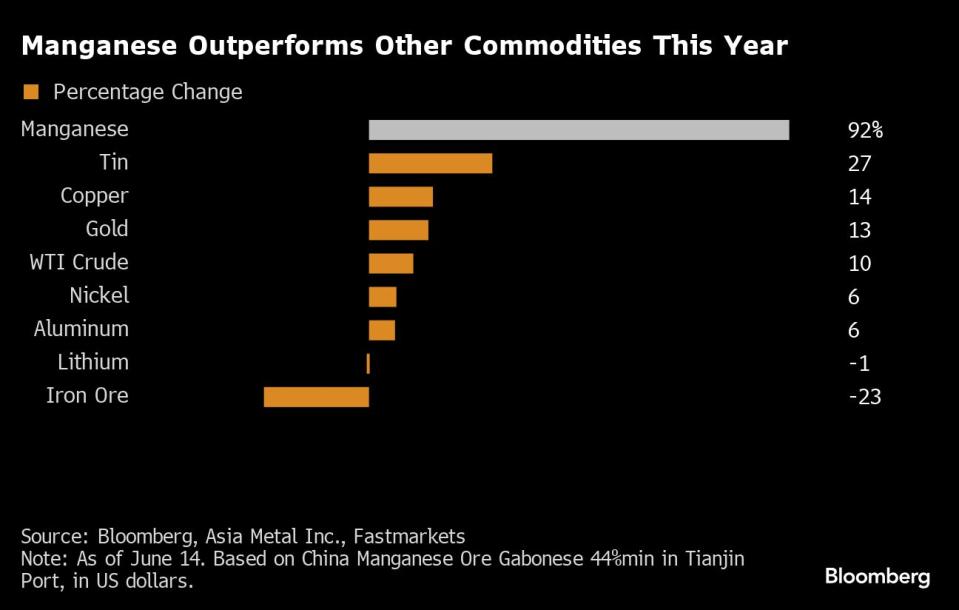

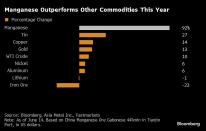

Manganese

Manganese — an essential steel-making ingredient — is outperforming copper, gold and many other commodities this year in the wake of disruptions to a key Australian mine. Prices of 44% grade manganese ore have almost doubled since the start of the year, and this month touched the highest level since 2018. Cyclone damage in March forced the world’s second-largest manganese mine to halt exports, with Groote Eylandt Mining Co. (GEMCO) shipments suspended until 2025. Manganese helps strengthen steel and is also used for aluminum alloys and electric-vehicle batteries.

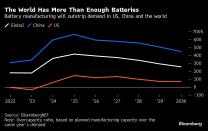

Batteries

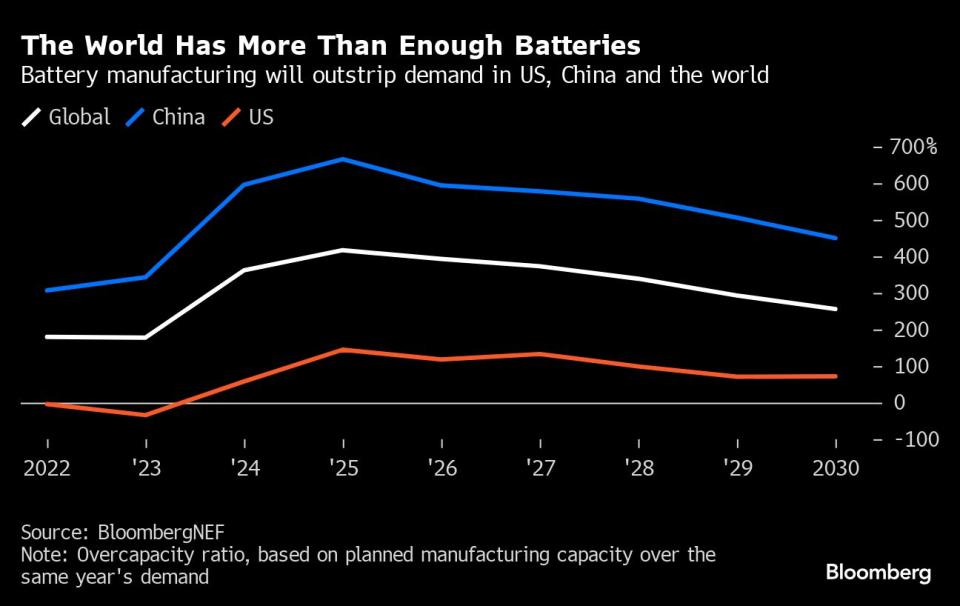

The switch to electric cars will need a lot of batteries. But so many manufacturers have announced plans for new battery plants worldwide that capacity will likely exceed demand for the rest of the decade, BloombergNEF warns in its latest Electric Vehicle Outlook. Oversupply is most acute in China, where manufacturing capacity will exceed annual battery demand by at least 400% for the rest of the decade. It’s also an issue in the US, where President Joe Biden has made building a domestic battery supply chain one of his top climate and economic goals.

--With assistance from James Attwood, Paul-Alain Hunt and Doug Alexander.

(Updates with copper and oil prices from third paragraph.)

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

It Will Take More Than US Bargaining Power to Cut Drug Costs

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance